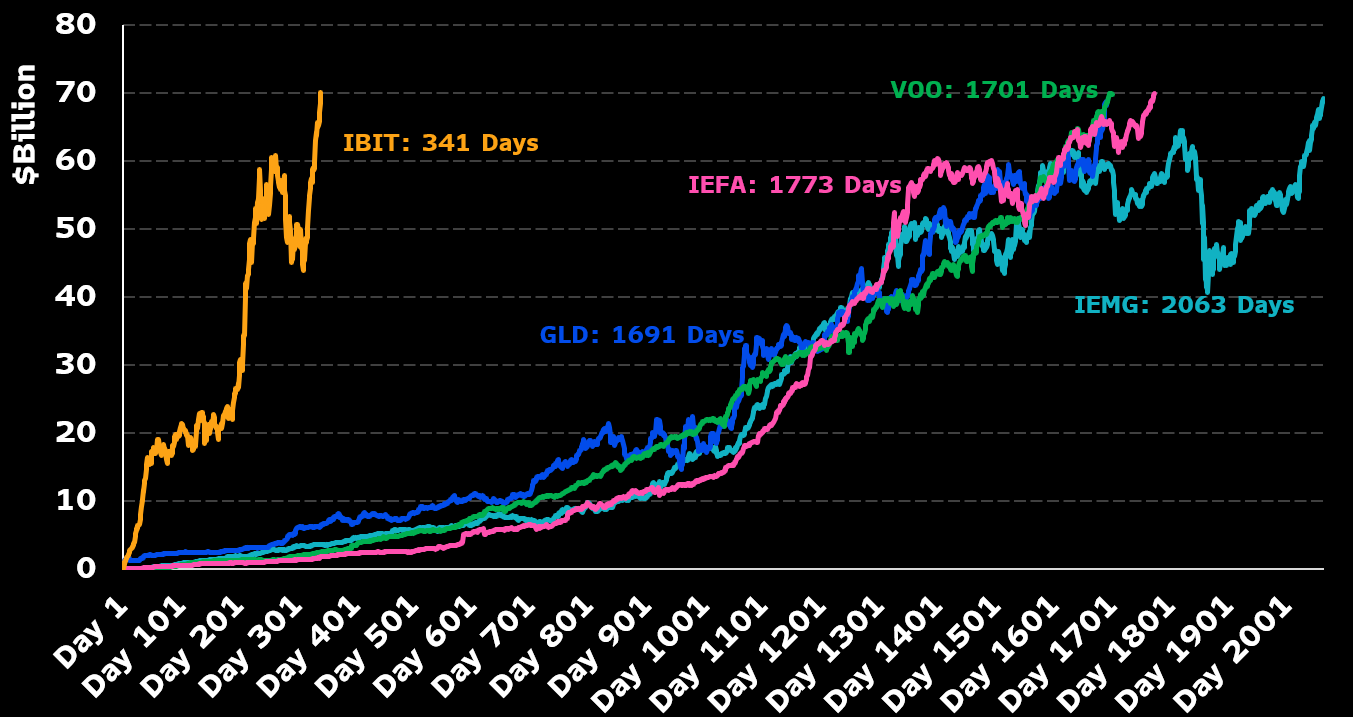

BlackRock’s Bitcoin ETF Smashes Records—$70B in Assets Under Management in Just 341 Days

Wall Street’s crypto love affair hits new heights as BlackRock’s IBIT ETF crosses the $70 billion mark—faster than most startups burn through seed funding.

The big guns are playing for keeps. When the world’s largest asset manager pivots to crypto, the market listens. Now, with institutional money flooding in, the ‘digital gold’ narrative gets harder to ignore—even for the suits who dismissed Bitcoin as a ‘fraud’ five years ago.

Funny how zeros on a balance sheet change minds.

This is all happening during a time when both bitcoin and gold are seeing solid performance. One of the major factors driving this movement is economic uncertainty caused by trade policies under President Donald Trump.

BlackRock launched IBIT in January and now holds 2.8% of Bitcoin supply

BlackRock introduced the IBIT fund in January 2024, and it didn’t take long for it to start eating up a serious portion of the Bitcoin market. By April, the fund held 2.8% of the total circulating Bitcoin, according to data from Arkham Intelligence.

That means nearly 3 out of every 100 BTC in existence are sitting in this one fund. But the firm isn’t buying Bitcoin for itself — it’s holding it on behalf of its clients.

The previous ETF record-holder was SPDR Gold Shares, better known as GLD. That fund lets people invest in gold without buying physical bars or coins, and it’s been around since November 2004.

GLD is still the largest physically backed gold ETF globally and manages around $100 billion in total assets. But while it still holds more money overall, it took nearly five years to hit the $70 billion mark — way slower than IBIT’s less-than-a-year sprint.

Market signals suggest traders should slow down as risk climbs

While IBIT continues growing, signs in the broader Bitcoin market suggest that it might not be the best time to make new aggressive moves.

The 60-day Realized Cap Variance (RCV), which tracks market volatility and momentum, has officially left the “buy” zone. That window usually opens when conditions are low-risk and momentum is improving. But now, those yellow buy signals have disappeared.

Even though the RCV hasn’t hit red yet — which WOULD mean it’s time to sell — it’s creeping into the neutral-to-high risk range, going over 0.3. That means prices are heating up, and the odds of getting in at a good value are shrinking. One thing keeping this from being a clear sell is the 30-day momentum, which is still positive. That’s the only reason we haven’t seen a red sell flag yet.

A full-on sell signal would need three things: RCV above +1, negative 30-day momentum, and a falling trend. So far, none of those have lined up. But traders are still being cautious. Smart investors aren’t jumping in like it’s January anymore. Instead, they’re watching for changes in the chart and thinking about locking in profits if the data starts flashing red.

The current phase is being described as risk-elevated but not overheated. The earlier accumulation zone — when Bitcoin was relatively cheap and the momentum was building — is over. Anyone still thinking about buying in should know they missed the low-risk opportunity. Right now, the data says to hold back, not go all in.

Your crypto news deserves attention - KEY Difference Wire puts you on 250+ top sites