US Pushes SEC to Unlock $12.5T 401k Market for Crypto Investments

Washington turns up the heat on regulators to open retirement funds to digital assets.

The Regulatory Push

Lawmakers and financial advocates mount fresh pressure on the Securities and Exchange Commission—demanding access to cryptocurrency options within America's massive retirement savings system. The move targets the $12.5 trillion 401k market, potentially flooding digital assets with mainstream capital.

Breaking Down Barriers

Proponents argue traditional retirement portfolios need exposure to emerging asset classes. They point to crypto's maturation and institutional adoption as proof it's ready for prime time. Critics counter with volatility concerns and regulatory uncertainty—the usual suspects in any finance debate.

Market Implications

Approval would represent crypto's ultimate mainstream endorsement. Suddenly every retirement planner becomes a potential crypto advisor, every 401k statement a potential balance sheet for digital assets. The infrastructure requirements alone could reshape custody and trading platforms overnight.

Because nothing says 'secure retirement' like betting your golden years on assets that can swing 20% before lunch—Wall Street's version of adding rocket fuel to your nest egg.

Source: The WHITE House

Source: The WHITE House

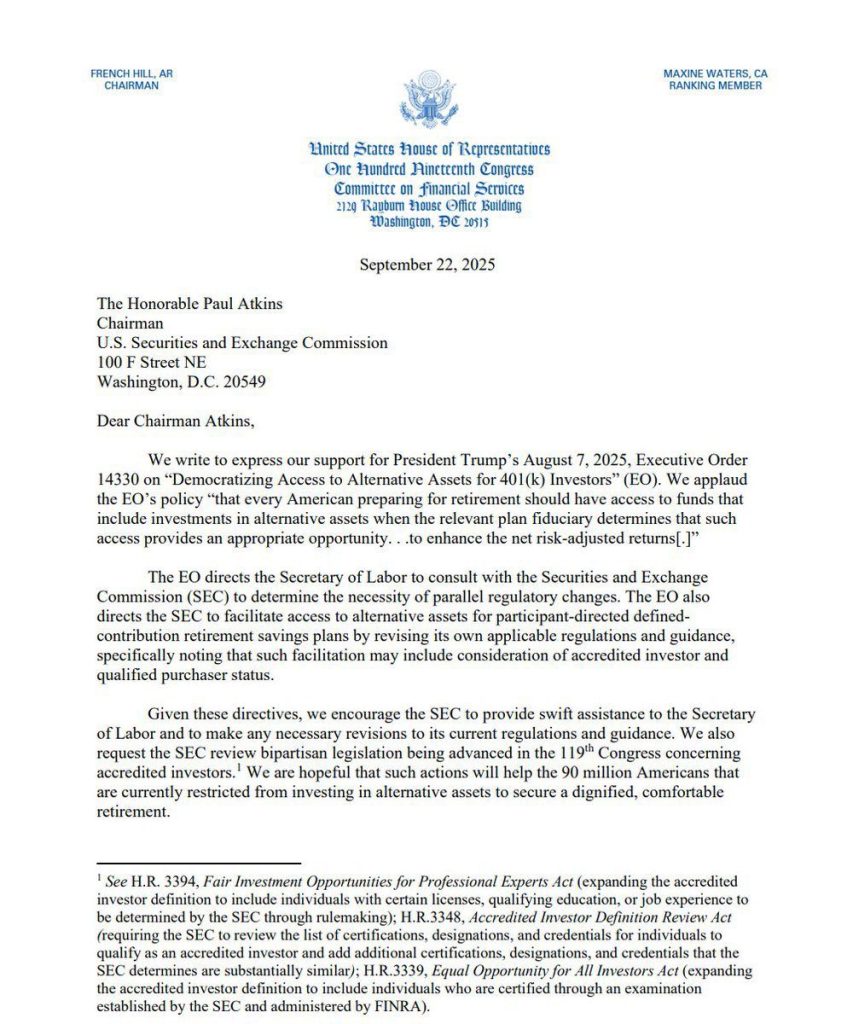

The letter calls on the agency to recognize FINRA-certified professionals as accredited investors and to expand the scope of who qualifies for access to alternative assets within retirement plans.

Trump’s 401(k) Executive Order Puts SEC at Center of Retirement Market Overhaul

The push follows Trump’s August 7 executive order, which directs the Department of Labor to reconsider guidance under the Employee Retirement Income Security Act (ERISA).

![]() White House to release a major crypto policy report today.#crypto #regulation https://t.co/j3tSVgmfUw

White House to release a major crypto policy report today.#crypto #regulation https://t.co/j3tSVgmfUw

The order specifically tasks the Labor Secretary, in coordination with the Treasury Department, the SEC, and other regulators, to clear the path for 401(k) participants to allocate part of their portfolios to private equity, real estate, digital assets, and other alternatives.

The policy is intended to broaden investment choices for the more than 90 million Americans who currently participate in employer-sponsored defined contribution plans.

According to a White House fact sheet, total U.S. retirement assets reached $43.4 trillion as of March 31, 2025, but most savers remain restricted from accessing alternatives.

Lawmakers argue that allowing measured allocations into these assets could enhance net risk-adjusted returns and modernize retirement investment strategies.

The SEC is expected to play a central role in revising regulations, particularly around the accredited investor definition. Several bipartisan bills already before Congress seek to expand the criteria, including measures to recognize professional licenses, education, or SEC-administered examinations as pathways to accreditation.

Hill and Waters urged Atkins to incorporate these legislative efforts into the agency’s rulemaking process.

The move revives initiatives first introduced during Trump’s earlier term but later rolled back under President Biden.

Industry groups have long lobbied for such reforms, arguing that retirement portfolios limited to stocks and bonds do not reflect the broader evolution of capital markets.

The order also clarifies fiduciary obligations for plan administrators who choose to include alternative assets. Regulators are expected to outline how retirement plan sponsors can provide such exposure while maintaining safeguards for investors.

For the cryptocurrency sector, the development marks a pivotal step toward mainstream adoption.

While administrative hurdles remain, the inclusion of digital assets in retirement plans could create a new channel for capital inflows into the market, bringing crypto exposure to tens of millions of Americans saving for retirement.

SEC Breaks With Gensler Era, Pledges Flexibility on Crypto and Corporate Disclosures

The SEC is signaling a major policy shift, moving away from the lawsuit-driven approach of its previous administration and toward a more collaborative stance with the crypto industry and public companies.

The SEC is preparing a sweeping shift in both corporate disclosure rules and its approach to crypto regulation, marking a break from years of rigid oversight.

Speaking on CNBC on September 19, SEC Chair Paul Atkins confirmed that the agency is prioritizing reforms that could loosen quarterly earnings requirements.

![]() SEC Chairman @secpaulsatkins says the agency is preparing reforms for corporate disclosure rules, which could end mandatory quarterly reporting#SEC #CryptoRegulation https://t.co/1AwEdIW1bj

SEC Chairman @secpaulsatkins says the agency is preparing reforms for corporate disclosure rules, which could end mandatory quarterly reporting#SEC #CryptoRegulation https://t.co/1AwEdIW1bj

The proposal WOULD allow companies, including those in the crypto sector, greater flexibility to set reporting cadences in consultation with investors and banks.

Atkins noted that semiannual reporting is already standard for foreign issuers trading in U.S. markets and called the adjustment “a good way forward.”

The move follows President Donald Trump’s revived call on September 15 to replace quarterly earnings with semiannual disclosures, a change he argued would cut costs and reduce short-term pressures on executives.

With Republicans holding a 3-1 advantage at the SEC, the proposal faces a favorable political landscape.

Atkins has also unveiled a new regulatory philosophy for crypto. In a report published September 15, he said the SEC would end its “regulation by enforcement” approach, a hallmark of his predecessor Gary Gensler’s tenure.

Instead, firms will receive preliminary notices of potential technical violations and up to six months to address issues before enforcement is considered.

Atkins rejected the broad classification of cryptocurrencies as securities, showing openness to tokenized stocks and bonds that mirror existing instruments.

Since taking office in April, he has dropped several high-profile cases inherited from the Gensler era and launched a Crypto Task Force.

That task force will hold a public hearing on October 17 to examine financial privacy and surveillance tools.