Bitcoin Breaches Critical Technical Levels – Bull Run Hitting a Wall?

Bitcoin's latest plunge sends shivers through crypto markets as key support levels crumble.

Technical Breakdown

The flagship cryptocurrency sliced through moving averages that traders have watched for months. This isn't just a dip—it's a violation of the chart patterns that fueled the rally.

Market Psychology Shift

Fear replaces greed as leveraged positions unwind. The 'buy the dip' mentality gets tested when technical foundations crack.

Institutional Reaction

Watch for whale movements around these levels. Traditional finance players might see this as either a bargain hunt opportunity or confirmation of their crypto skepticism—because nothing makes bankers happier than saying 'I told you so' while shorting volatility.

This correction either builds stronger foundations for the next leg up... or proves the bulls were just riding another bubble all along.

Bitcoin Price Slip Points to Bull Market Exhaustion

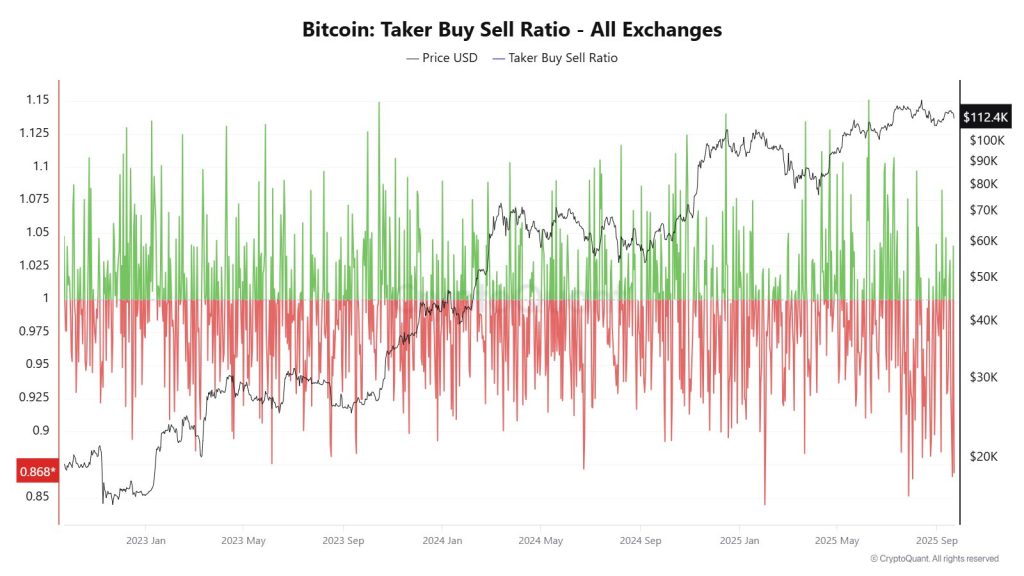

CryptoQuant data reveals Bitcoin’s taker buy/sell ratio has fallen to -0.86, a key sentiment indicator that signals bearish market conditions.

This metric serves as a barometer for market control – values below 1 suggest selling pressure dominates, while readings above 1 indicate buying strength prevails.

The current -0.86 reading demonstrates that sell orders are significantly outweighing buy orders, painting a picture of pessimistic market sentiment.

Historical context shows that this level last appeared during the January 20 market top, around $109,000, which preceded a three-month decline that erased 32% of Bitcoin’s value, with prices falling to $74,000 in April.

Joao Wedson, Founder & CEO of Alphractal, revealed that Bitcoin’s latest dip shows signs of cycle exhaustion that many market participants are not paying attention to.

According to his SOPR Trend Signal, which excels at showing when blockchain profitability is declining, never in Bitcoin’s history have investors accumulated BTC so late and at such high STH Realized prices of $111,400.

Similarly, Bitcoin’s Sharpe ratio is weaker than in 2024, meaning risk versus return is lower, reducing profit potential that won’t attract as many institutions as most people believe.

Social interest has dropped sharply, and according to Wedson, many market makers are partially selling their BTC and taking their stablecoin reserves to invest more in altcoins after a long accumulation period.

Bitcoin is already showing signs of cycle exhaustion — and very few are seeing it.

The SOPR Trend Signal is excellent at signaling when blockchain profitability is drying up.

Never in Bitcoin’s history have investors accumulated BTC so late and at such high prices.

Maybe only… pic.twitter.com/I1GBdEJH03

“So, even if BTC hits new all-time highs, and there’s nothing wrong with that, profitability will remain low, and the real focus will be on altcoins,” Wedson added.

Crypto trader Honey_xbt believes BTC is in a consolidation zone, with the next direction dependent on where Bitcoin closes.

According to her analysis, a 1-day close above $117,500 would be highly bullish and could send bitcoin to new highs above $124,000.

okay enough drama for the day, let's get back to business

BTC seems to be in our chop zone and our next direction WOULD be based on where we close 1D

above 117.5k = super bullish and we probably go for new highs

below 111.8k = bearish and we probably go for new lows around… pic.twitter.com/FugTVJRAeK

However, a close below $111,800 would be bearish and could see BTC target new lows around the 1-day EMA200 NEAR $106,000.

Historical Q4 Rally Could Overwrite Bitcoin Bearish Price Slip

Market observers show conflicting views regarding potential October gains following the recent bearish shift.

Despite current bearish indicators, several positive factors could send the Bitcoin price upward by next month.

The Federal Reserve’s recent pivot to monetary easing shows that market participants expect the rate-cutting cycle to continue with two additional reductions projected before the end of 2026.

Historical trends also support Optimism for the final quarter of the year.

Since 2013, Bitcoin has demonstrated particularly strong performance during Q4, delivering average returns of roughly 85% during this seasonal period.

Bearish Wedge Pattern Signals a BTC Dip to $108k

On the technical front, Bitcoin’s 4-hour chart shows a clear bearish wedge pattern breakdown from the recent uptrend channel.

After failing to sustain momentum near $117,836, the price broke down from the rising wedge, confirming weakness and shifting the short-term bias bearish.

The rejection has already taken BTC toward the first target zone around $112,967, with momentum signaling further downside pressure.

If selling continues, the next key support sits near $110,662, followed by a deeper retracement toward $108,073, which aligns with the final projected target of the wedge.

Overall, the technical setup suggests Bitcoin is likely to extend lower in the short term, with rallies more likely to face resistance unless buyers reclaim $115,000 levels to invalidate the bearish outlook.