Toyota, BYD, and Yamaha Now Accept USDT Payments in Bolivia - Tether CEO Confirms Major Crypto Adoption Milestone

Corporate giants flip the script on traditional payment rails—Toyota, BYD, and Yamaha just opened their Bolivian operations to USDT transactions. Tether's CEO makes it official: dollar-pegged crypto goes mainstream in automotive and mobility sectors.

Why Bolivia? Look beyond the headlines. This isn’t just another market entry—it’s a strategic bypass of currency volatility and banking bottlenecks. Stablecoins cut settlement times from days to seconds. No middlemen, no forex headaches.

Think bigger: this isn’t a test. It’s a full-scale rollout. Toyota’s trucks, BYD’s EVs, Yamaha’s bikes—all available for crypto. The move signals a broader shift: corporations are ditching 'wait-and-see' for 'move-now.'

But let’s get cynical for a second. Traditional finance still thinks crypto is a niche. Meanwhile, real-world adoption is happening in emerging markets—where banking systems often fail to keep up. Sometimes disruption doesn’t ask for permission.

One thing’s clear: when household names embrace crypto payments, the old guard’s resistance starts looking less like caution and more like irrelevance.

The stablecoin adoption announcement comes as Bolivia’s Central Bank (BCB) recorded crypto payment transactions of $294 million during the first six months of 2025, a 630% jump from $46.5 million in 2024.

“Digital Dollar” Strategy, How USDT Payments in Bolivia Started

The expansion traces back to the Bolivian resolution to remove the crypto ban, enacted June 25, which gave official status to “virtual assets” and permitted financial institutions to direct client transactions to crypto exchanges.

Yvette Espinoza from the Autoridad de Supervisión del Sistema Financiero (ASFI), Bolivia’s financial regulator, noted the initiative has enabled the country to facilitate crypto transactions within a regulated framework.

Bolivia expanded the use of crypto in the public sector on March 13, when President Luis Arce’s cabinet authorized YPFB to conduct crude oil import transactions using either USD or cryptocurrency.

Beginning in October 2024, Bolivia’s Banco Bisa launched custodial services for Tether’s USDT to provide customers with trading capabilities.

Recently, Bolivia’s Central Bank signed a memorandum of understanding with El Salvador’s National Commission of Digital Assets to advance crypto development, viewing it as a “trusted alternative” to traditional currencies.

Moreover, Latin America continues to see a surge in crypto payment adoption.

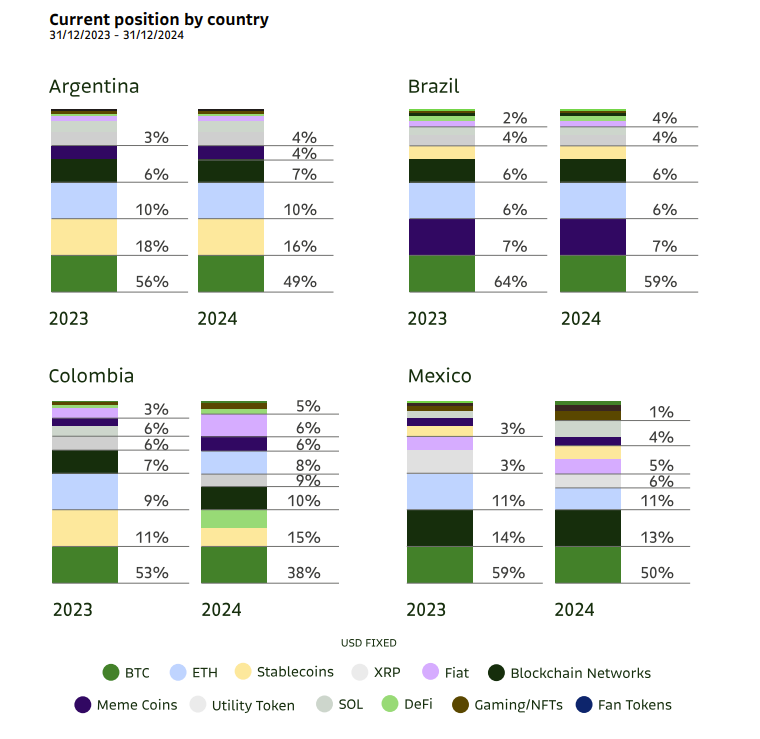

Bitso’s recent regional analysis reveals that economic instability and currency weakness across Latin America have transformed stablecoins like USDC and USDT into crucial wealth protection tools.

Inflation Crisis Fuels Stablecoin Adoption in Latin America

Argentina, which is battling inflation above 100%, has turned to stablecoins as a FORM of protection against financial volatility.

Brazil maintained consistent expansion through clear regulations and a dynamic technology sector.

Crypto adoption climbed 6% to 1.9 million users, with stablecoins comprising 26% of transactions.

Colombian investors have also embraced stablecoins after facing limitations on USD banking services.

Mexico holds its position as a leading regional crypto hub, where Bitcoin and USDT dominate international transfers amid the peso’s 23% decline.

Regional data confirms this upward trend.

The latest Chainalysis Global Crypto Adoption Index reveals Latin America’s crypto adoption climbed from 53% in 2024 to 63% year-over-year, cementing the region’s status as one of cryptocurrency’s fastest-expanding markets.

Latin America captured 9.1% of global cryptocurrency value between July 2023 and June 2024, with the region processing nearly $415 billion in digital assets during this period.

This growth is reflected in country rankings, with three Latin American nations securing spots among 2025’s top 20 crypto adopters, Brazil (5th), Venezuela (18th), and Argentina (20th).

Bolivian legislator Mariela Baldivieso of the Comunidad Ciudadana party stated that comprehensive cryptocurrency integration could strengthen the region’s economic foundation.

Baldivieso suggested that Bolivia’s crypto adoption is now positioning the country among the top five adopters in Latin America, supported by progressive policy reforms.

¡Un gran paso para la adopción de criptoactivos en Bolivia!![]()

A partir de este lunes 28 de octubre, estará disponible un nuevo servicio de custodia, compra y venta de USDT. Esto representa un avance significativo hacia la integración de criptomonedas en el país, acercándonos a… pic.twitter.com/a7zzhsn0c0

Notably, Bolivia’s USDT payment expansion is not the first time Toyota has pursued a blockchain and cryptocurrency payment project.

In July 2024, Toyota Blockchain Lab outlined plans for an ethereum ERC-4337-based MOA (Mobility-Oriented Account) system, creating vehicle-specific blockchain identities that could support complete autonomous operation.

Subsequently, the Toyota Group’s finance division announced its intention to launch blockchain-based security token bonds (ST bonds).

These Toyota Wallet ST bonds offer exclusive perks to holders who also maintain Toyota Wallet memberships.