Aster Token Skyrockets 1,650% in Debut 24 Hours as Platform TVL Blasts Past $1B – The Hyperliquid Challenger Arrives

Aster Token detonates across crypto markets with an unprecedented 1,650% surge right out the gate—platform total value locked smashes through the $1 billion barrier in record time.

The Anatomy of a Meteoric Rise

This isn't just another token launch—it's a full-scale market upheaval. The protocol's architecture apparently solves liquidity fragmentation that's plagued legacy DeFi setups, pulling capital like a magnet while traditional finance still debates whether blockchain is 'a fad.'

Beyond the Hype Cycle

Sure, plenty of projects promise the moon and deliver crater dust. But crossing $1B TVL in under a day signals something fundamentally different—either revolutionary tech or the greatest yield farm ponzi scheme since that guy on Twitter promised 'risk-free arbitrage.'

What Traders Aren't Saying Out Loud

Every portfolio manager now faces the FOMO vs. due diligence dilemma—chase the 16x returns or wait for the inevitable pullback? Meanwhile, Wall Street analysts are probably still trying to explain to their bosses what 'TVL' even means.

The Verdict: Aster either redefines liquidity infrastructure or becomes the most spectacular cautionary tale of 2025—no middle ground.

Aster Rapidly Growing with Infrastructure Expansion and Users

Aster’s post-launch momentum accelerated through immediate feature rollouts, including ASTER/USDT perpetual trading with 4x leverage and hourly funding rate settlements.

The platform has also enabled spot withdrawals, previously scheduled for October, via BNB Chain with 30-second processing times.

It has also implemented multi-dimensional scoring in its Genesis Stage 2 program to reward smart traders beyond volume metrics.

Current metrics position Aster as a serious Hyperliquid competitor, with total users reaching 1.848 million and 7-day new user additions hitting 617,379.

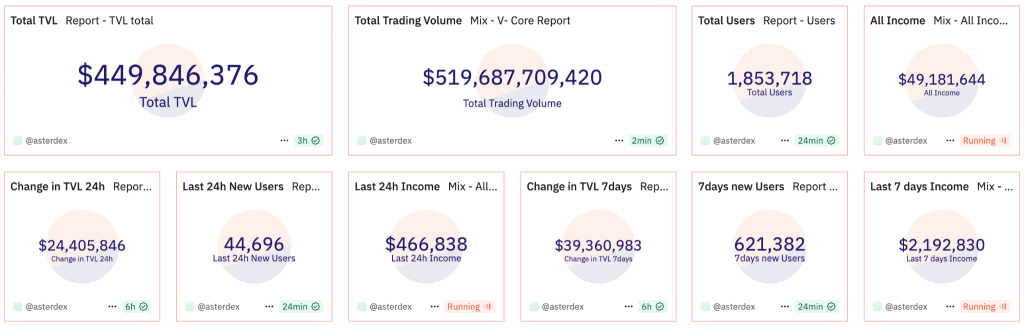

At the time of writing, platform data reveals $449.8 million in total TVL, $517.2 trillion in cumulative trading volume, and 695,559 total traders.

Daily metrics show 53,332 new users, $1.53 billion in 24-hour trading volume, and $466,838 in daily income.

The platform’s liquidity pools maintain substantial holdings, including $275.7 million in asBNB TVL and $41.2 million in USDF TVL.

Open interest also reached $255.3 million while maintaining competitive APY rates of 25.79% on BSC and 21.28% on Arbitrum.

Platform income metrics show $49.2 million in total earnings with consistent growth patterns across weekly and monthly timeframes.

Technical Architecture Positions Aster as Hyperliquid Challenger

Aster’s multi-chain approach differentiates it from Hyperliquid’s single Layer 1 strategy. The protocol offers native support across BNB Chain, Ethereum, Solana, and Arbitrum without requiring bridging or asset conversions.

The platform combines Simple Mode for MEV-free one-click trades with Pro Mode featuring advanced tools, including hidden orders, grid trading, and professional order books.

It also introduces unique stock perpetual contracts enabling 24/7 trading of major US equities like Tesla and Nvidia, fully settled in crypto.

This feature particularly makes it powerful, as it expands beyond traditional crypto derivatives, potentially attracting traditional finance users.

10 reasons $ASTER will flip Hyperliquid:

1) The only DEX with 24/7 US stock perps

2) Yield Bearing margin: $USDF is native and functions similar to USDe, with additional yield based on activity

3) CZ doesn't tolerate competitors and historically has neutralized all competition…

Additionally, it has a hidden order functionality that addresses concerns CZ previously raised about trader manipulation on transparent order books.

Aster also leverages zero-knowledge proofs on its dedicated Aster Chain for confidential trade validation, while integrating Pyth Network oracles for tamper-resistant pricing data.

The platform’s capital efficiency features include liquid staking through collateral tokens like asBNB and USDF, enabling users to generate yields while trading.

Community ownership also exceeds 50% of the token supply through rewards, governance participation, and buyback programs.

Current trading data reveals sophisticated user behavior with top traders already achieving realized profits exceeding.

The platform maintains DEEP liquidity across trading pairs while processing substantial daily volumes comparable to established centralized exchanges.

Market Position Against Hyperliquid’s Dominance

Hyperliquid’s August performance established incredible benchmarks with $106 million in revenue, $383 billion monthly trading volume, and $1.25 billion annualized revenue while capturing 70% of the DeFi perpetuals market share.

The platform operates with just 11 employees, processing $330.8 billion annually, creating efficiency ratios surpassing traditional payment giants like PayPal and Visa.

![]() Hyperliquid smashes revenue record with $106M in August, dominating 70% of the DeFi perps market as lean 11-employee team outperforms financial giants.#HyperLiquid #DeFihttps://t.co/EsYDUloLz8

Hyperliquid smashes revenue record with $106M in August, dominating 70% of the DeFi perps market as lean 11-employee team outperforms financial giants.#HyperLiquid #DeFihttps://t.co/EsYDUloLz8

However, Aster’s current trajectory suggests potential for rapid market share capture, particularly given CZ’s track record with previously backed projects.

MYX Finance, another CZ-supported DEX, delivered 1000% returns in three days, while BNB surged from $0.09 to a new ATH of over $1000 under his leadership.

Analysts project potential 10x rallies for ASTER, citing the current $1.5 billion FDV compared to Hyperliquid’s $55 billion valuation.

The competitive landscape is further intensifying as both platforms target institutional adoption.

Hyperliquid secured Anchorage Digital Bank custody services and Circle’s native USDC deployment. It has also recently closed Native Markets for its USDH stablecoin.

However, Aster’s multi-chain strategy and traditional asset integration could capture market segments unavailable to Hyperliquid’s specialized approach.

The platform’s community-driven token distribution and governance model also greatly differentiates it from Hyperliquid’s more centralized structure.