Buterin Defends Ethereum’s 43-Day Unstaking Delay - Here’s Why It’s Actually a Feature, Not a Bug

Vitalik Buterin fires back at critics questioning Ethereum's lengthy unstaking process—turns out those 43 days aren't a design flaw but a deliberate security measure.

The Architecture Behind the Wait

Ethereum's proof-of-stake mechanism demands this cooling-off period to prevent malicious actors from rapidly withdrawing stakes after attempting network attacks. The 43-day window acts as a protective buffer—giving the community ample time to identify and slash suspicious validators before funds exit the system.

Market Realities vs. User Impatience

While traders chafe at the delay—especially during volatile markets—Buterin maintains that security can't be sacrificed for convenience. This stance highlights crypto's eternal tension between institutional-grade safeguards and user experience demands. After all, traditional finance settles trades in days too—they just hide it better behind layers of paperwork and intermediary fees.

Long-term security over short-term gratification—that's the Ethereum ethos. Whether users agree might depend on how much they value their assets not suddenly vanishing.

Ethereum Validator Queue (Source: ValidatorQueue)

Ethereum Validator Queue (Source: ValidatorQueue)

Developer Tensions Over User Experience

The exchange highlighted growing tensions between Ethereum’s technical design priorities and mainstream user expectations for digital asset liquidity.

Sags criticized the disconnect between wallet messaging that promotes “easy yield” and the reality of unpredictable withdrawal delays that can trap funds when users need them most.

“What about the average user who is suffering with the delay and needs to pay bills?” Sags questioned, arguing that clearer disclosure about redemption periods WOULD help users make informed decisions.

Sure, we all get that – but what about the average user who is suffering with the delay and needs to pay bills?

As remember what they were told by the wallet when they staked:![]() “Click here to stake your ETH and earn. Unstaking is not immediate and may take days.”

“Click here to stake your ETH and earn. Unstaking is not immediate and may take days.”

Sorry,…

Buterin acknowledged these UX concerns, admitting the Ethereum Foundation “needs to be more active at the UX layer” and has been working to address usability issues over recent months.

The Ethereum founder argued that reducing exit delays would make the chain “much less trustworthy from the PoV of any node that does not go online very frequently,” positioning the delays as essential for maintaining network stability.

Queue Dynamics Create Market Tension

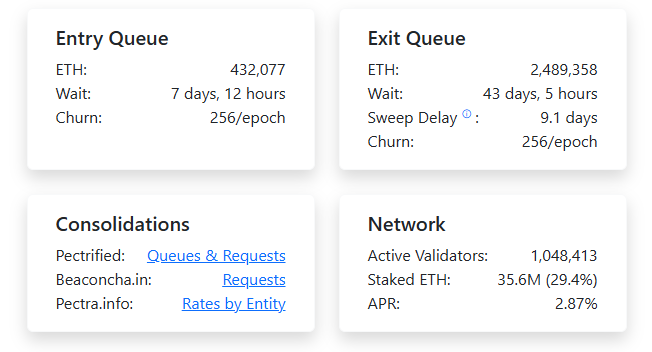

The current validator queue mechanics operate through strict churn limits of 256 validators per epoch, creating bottlenecks when exit demand surges beyond the network’s processing capacity.

Recent market data shows the exit queue peaked at over 1 million ETH worth approximately $5 billion in late August, before settling to current levels, still requiring 43 days to clear completely.

Meanwhile, the entry queue containing 432,077 ETH faces just a 7-day wait, creating an asymmetric dynamic that traps more supply than it releases in the short term.

This imbalance has created what analysts describe as artificial supply shortages, with previous Cryptonews reports highlighting how 833,000 ETH trapped in queues reduced available trading supply.

The 9.1-day sweep delay adds additional friction to the exit process, meaning validators face multiple layers of waiting even after initiating unstaking requests.

Exchange flow data reveals these queue dynamics are reducing sell pressure, with Bitcoin and Ethereum inflows hitting 1-year lows as larger holders avoid moving assets to trading platforms.

Staking demand has continued growing despite the exit delays, with the queue reaching $3.7 billion in early September, its highest level since the Shanghai upgrade enabled withdrawals in 2023.

Security Versus Liquidity Trade-offs Spark Broader Debate

Notably, the unstaking controversy is a fundamental tension between blockchain security models and modern financial expectations for asset liquidity.

Buterin’s military analogy reflects Ethereum’s proof-of-stake design philosophy, where validator commitments must be sticky enough to prevent coordinated attacks or mass exodus events that could destabilize consensus.

Critics argue this creates a dangerous precedent where large holders face material liquidity constraints, potentially amplifying sell pressure when exits do occur or forcing investors toward liquid staking derivatives.

The debate has sparked discussions about potential protocol modifications, including proposals for faster validator key switching that would allow repositioning without full exits.

One X user suggested implementing “a faster process to unstake and restake with different clients that’s not adding to the queue” to improve client diversity without compromising security guarantees.

Buterin responded favorably to a “switch your keys” function where validators would remain vulnerable to slashing from old keys temporarily while continuing to stake, describing it as something that “would only help, and would not hurt any guarantees.”

There should be a "switch your keys" function, where you continue to be vulnerable to slashing from your old key for some time but otherwise keep staking. That seems like something that would only help, and would not hurt any guarantees.

— vitalik.eth (@VitalikButerin) September 18, 2025However, any changes to the current queue system would require broad consensus among Ethereum developers and stakeholders, given the security implications of reducing validator commitment friction.