Why Corporate Bitcoin Treasuries Demand Is Slowing in 2025: The Unspoken Market Shift

Corporate Bitcoin buying spree hits unexpected slowdown—here's what's really happening behind the boardroom doors.

Regulatory Headwinds Bite

Treasury teams face mounting compliance burdens that make Bitcoin allocations more headache than hedge. New reporting requirements add layers of complexity that traditional assets simply don't carry.

Yield Alternatives Emerge

High-interest cash equivalents and bond yields finally compete with Bitcoin's speculative returns. CFOs suddenly remember they get paid for stability—not volatility bragging rights.

Market Maturity Reality Check

Institutional adoption plateau reveals Bitcoin's stubborn correlation to risk assets. Turns out digital gold still dances to the Fed's tune—just like everything else.

Corporate treasury strategies pivot toward predictable returns over crypto cowboy antics. The smart money always follows the path of least resistance—and right now, that path bypasses Bitcoin's volatility minefield. Maybe next cycle, folks.

Slowing Corporate Demand: Outlier or Trend?

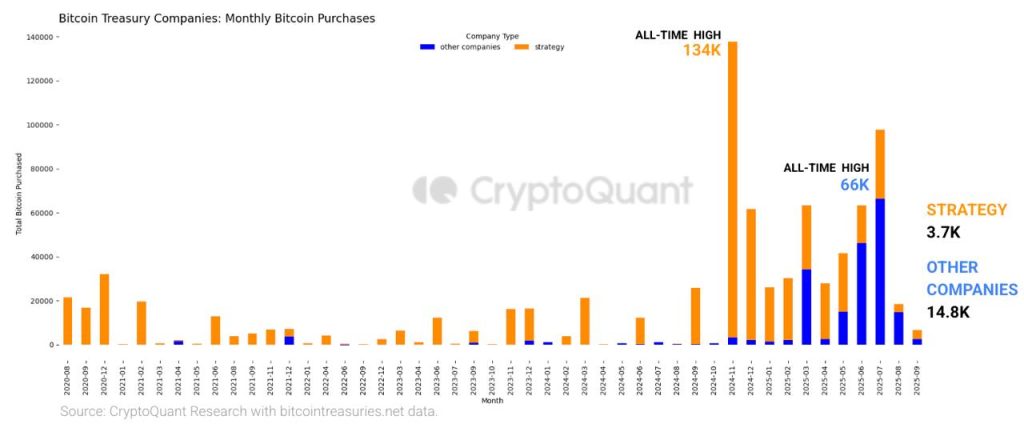

Speaking to Cryptonews, Illia Otychenko, lead analyst at crypto exchange CEX.io, warned against reading the CryptoQuant data at face value.

“November 2024 was by far the largest month of bitcoin accumulation for Strategy, making it an outlier,” he explains. “In less than 10 days of September 2025, the company has already added 6,000 BTC — more than the entire August figure highlighted by CryptoQuant.”

Otychenko says the context is important because the headline slowdown risks overstating the case. While Strategy’s accumulation has declined, other corporate buyers have stepped up, at some point cutting the firm’s dominance in corporate Bitcoin treasuries from 76% in January to 64%.

The analyst said public companies added a combined 415,000 BTC to their treasuries so far in 2025, already surpassing the 325,000 BTC acquired throughout the whole of last year.

“The appetite is still there,” Otychenko stated. “It’s just that Strategy has been hit harder, which makes the overall picture look weaker than it actually is.”

Part of the reason Strategy’s activity looks muted lies in how the market now values its Bitcoin strategy.

Since November 2024, says Otychenko, the firm’s modified Net Asset Value (mNAV) — essentially the premium investors were willing to pay for its Bitcoin exposure — collapsed from 3.89x to 1.44x.

“At 3.89x, the market was valuing the company almost like a Leveraged Bitcoin ETF,” Otychenko tells Cryptonews. “With 1.44x, investors are now treating it much closer to the actual value of its Bitcoin holdings.”

The premium disappeared with the launch of IBIT ETF options earlier this year, which offered investors a simpler way to gain Bitcoin exposure. As a result, enthusiasm for Strategy’s aggressive Bitcoin buying model cooled.

“The market is no longer rewarding the company for outsized accumulation in the same way it once did,” Otychenko says. “This might have contributed to Strategy’s weaker BTC accumulation.”

Macro Headwinds

Since CryptoQuant’s report earlier this month, the total number of Bitcoin held by publicly traded Bitcoin treasury firms alone has risen to 1,011,387 BTC valued at over $118 billion, according to data from Bitcoin Treasuries Net.

That’s about 5% of all the Bitcoin in circulation. Led by Strategy, other key holders include Mara Holdings, Metaplanet, and Riot Platforms. Private companies own 299,207 BTC worth $35 billion at existing prices, the website says.

“The concentration of BTC in corporate treasuries and institutional funds can cut both ways,” says Otychenko. “On one hand, it reflects long-term conviction and removes supply from circulation, which supports price stability.”

“On the other, it makes the market more sensitive to shifts in institutional sentiment. If these players slow accumulation or decide to sell, the impact on liquidity and price can be outsized.”

Shawn Young, chief analyst at MEXC crypto exchange, described the record corporate Bitcoin treasuries as “a great structural milestone for the maturity of Bitcoin.” He believes it could be healthy for other public companies to buy Bitcoin.

Young noted that 28 new Bitcoin treasury firms were created in July and August alone, boosting aggregate corporate holdings by 140,000 BTC.

However, if the structural trend is intact, what explains the slower pace in corporate accumulation over the last few months? Analysts who spoke to Cryptonews blamed the decline on poor macroeconomic conditions.

“Institutions and corporations are now constrained by higher global interest rates, stricter regulatory oversight, and the need to show shareholders financial discipline and risk management,” Young said.

Uncertainty around U.S. jobs and inflation data, and changing expectations for Federal Reserve policy, have also dampened risk appetite. “The market is leaning toward caution, favoring smaller, more measured purchases,” added Otychenko.

Farzam Ehsani, CEO of VALR crypto exchange, put it more bluntly, saying uncertain macroeconomic conditions are “known to be very unkind to risk assets” like BTC and other crypto assets, including ETH, SOL, and XRP.

“Institutions are simply being limited by corporate policies, capital reserve requirements, and shareholder expectations. This does not imply that there is anything fundamentally wrong with Bitcoin itself.”

Is Corporate Bitcoin Concentration Risky?

As companies stack more Bitcoin, questions about market dynamics are also starting to pop up. Analysts are worried that concentrating too much BTC in corporate hands could lead to centralization and even fragility.

MEXC analyst Young thinks institutional adoption has a “double-edged effect”. While anchored supply strengthens the scarcity narrative, heavy treasury control can dampen liquidity and worsen volatility. He explains:

“Whilst concentration provides stability against market selloffs, it can also raise systemic risk and impact if corporations decide to pursue a different path and change their investment strategies.”

Ehsani, the VALR cofounder and CEO, is more critical:

“Bitcoin concentration in a few corporate wallets may look impressive on a balance sheet, but it doesn’t strengthen the health of the network. It makes it brittle and susceptible to declining when key players decide to unwind their positions…”

Despite institutional dominance, retail interest has remained strong, according to Otychenko, the CEX.io analyst. Around 75% of Bitcoin ETF shares are held by non-13F filers, which is mostly retail, he says.

Investment advisers, who buy Bitcoin on behalf of individual clients, add another LAYER of indirect retail participation. It means that the share of retail investors is likely higher than what is publicly reported.

“Retail includes both speculative traders and those seeing it [Bitcoin] as a store of value,” said Otychenko, adding:

“During periods of macro uncertainty, the speculative cohort may temporarily act like weak hands, making overall activity increasingly resemble institutional patterns.”

In 2025, retail investors have stepped in at critical moments. As institutional demand softened mid-year and whales sold more BTC, retail flows helped defend key support levels, preventing a broader collapse.

“These complementary market dynamics … are healthy,” Young said, noting that as corporate inflows provided the hard floor for BTC prices earlier in the year, retail inflows provided resilience.