Bitcoin Price Prediction: Fed Cuts Rates After Nearly a Year – Could a 2020-Style Explosion Be Imminent?

Fed finally blinks—first rate cut in almost a year sends shockwaves through crypto markets.

Bitcoin's historical playbook suggests what comes next might defy traditional finance logic.

Remember 2020? Liquidity floodgates opened, Bitcoin ripped 300% in months. Same catalysts now lining up.

Institutional money's already positioning—blackrock, fidelity ETFs sucking up supply while retail sleeps.

Traditional finance still can't wrap its head around digital gold outperforming their precious metals portfolio.

Rate cuts don't fix structural inflation—they just make hard assets shine brighter while fiat devalues quietly.

Watch for the momentum break above key resistance—then brace for the kind of move that makes CNBC anchors stutter.

Wall Street's playing catch-up while Satoshi's creation keeps doing what it does best—ignoring their permission.

FOMC Statement – Source: Federal Reserve

FOMC Statement – Source: Federal Reserve

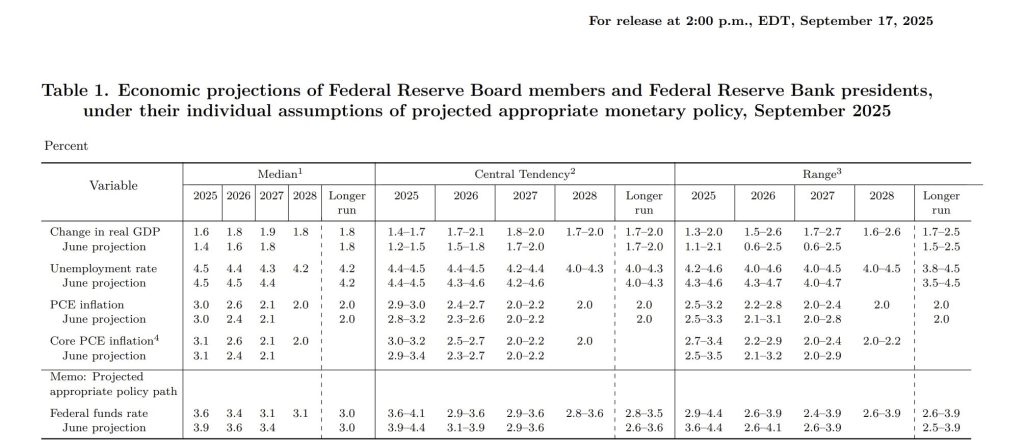

The new projections show US GDP 1.6% in 2025, unemployment 4.5% and inflation easing to 2% by 2028. Powell’s comments calmed some investors but markets got volatile as his press conference started, showing the tension between easing and uncertainty.

![]() BREAKING: FED cut rates by 25bps, bringing the target range to 4% – 4.25%.

BREAKING: FED cut rates by 25bps, bringing the target range to 4% – 4.25%.![]()

“F*ck your puts. F*ck your calls. J Powell has you by the balls. God bless my money printer.” – Jerome Powell, FOMC 17th Sept, LIVE. pic.twitter.com/6RH291atDS

![]()

![]()

For Bitcoin, which is both a risk asset and an inflation hedge, the path forward depends on how the Fed’s dovish tilt intersects with the chart.

Rising Wedge Signals Pressure on Bulls

On the technical front, Bitcoin has formed a rising wedge, a bearish continuation pattern that tends to appear when upside momentum begins to fade.

After failing to hold above the $117,300 resistance, BTC is now testing the $115,800 support area, reinforced by the 50-period SMA and the wedge’s lower boundary.

The RSI has slipped below 50, reflecting weakening momentum, while recent candles show signs of hesitation, with small-bodied formations hinting at indecision.

#Bitcoin is trading NEAR $115.9K after the Fed’s first 2025 rate cut.

On the 2H chart, a rising wedge is tightening.

$115.8K = key support.

Lose it → slide toward $114.4K / $113.2K. pic.twitter.com/5vjrmvKvCl

If sellers gain control, the TradingView path projection points to a drop toward $114,400, with a deeper slide possible to $113,200, where the 200-SMA aligns with a prior demand zone. A three black crows candlestick pattern beneath support WOULD confirm this bearish continuation.

Still, bulls are not out of the picture. Should bitcoin hold $115,800 and print a bullish engulfing candle or hammer at support, a rebound could follow. A breakout above $117,300 would invalidate near-term downside pressure, opening the way to $118,500 and $119,350.

Outlook: Can Bitcoin Break Higher?

For traders the $115,800 level is the line in the sand. Above it is accumulation and fresh longs to $118K-$119K. Below it is a deeper correction but the bigger picture of higher lows across the cycle still supports the long term bull case.

RSI — Arslan Ali (@forex_arslan) September 17, 2025

If the Fed’s rate-cut cycle unfolds in line with 2020, when looser monetary policy helped fuel one of Bitcoin’s strongest bull runs, a new wave of institutional demand could emerge.

In that scenario, BTC’s next breakout could extend beyond short-term resistance and build momentum toward the $130,000 region in the months ahead.

For investors, today’s volatility is less about short-term noise and more about positioning for Bitcoin’s potential role in the next expansion phase of global liquidity.

Presale Bitcoin Hyper ($HYPER) Combines BTC Security With Solana Speed

Bitcoin Hyper ($HYPER) is positioning itself as the first Bitcoin-native Layer 2 powered by the Solana VIRTUAL Machine (SVM). Its goal is to expand the BTC ecosystem by enabling lightning-fast, low-cost smart contracts, decentralized apps, and even meme coin creation.

By combining BTC’s unmatched security with Solana’s high-performance framework, the project opens the door to entirely new use cases, including seamless BTC bridging and scalable dApp development.

The team has put strong emphasis on trust and scalability, with the project audited by Consult to give investors confidence in its foundations.

Momentum is building quickly. The presale has already crossed $16.5 million, leaving only a limited allocation still available. At today’s stage, HYPER tokens are priced at just $0.012935—but that figure will increase as the presale progresses.

You can buy HYPER tokens on the official Bitcoin Hyper website using crypto or a bank card.

Click Here to Participate in the Presale