Coinbase Unveils Public Guide to Digital Asset Listing Process in Major Transparency Move

Coinbase just ripped the curtains off its listing playbook—and the crypto world is watching.

Transparency Unleashed

The exchange dropped its digital asset listing criteria publicly for the first time, detailing everything from security reviews to compliance checks. No more guessing games about what gets a token through the door.

Market Impact

This move pressures rivals to match their openness—or risk looking shady by comparison. Suddenly, 'trust us' doesn't cut it anymore in an industry where opacity often masquerades as sophistication.

Investor Takeaway

Clear rules mean fewer surprises. Projects now know exactly how to prepare, while traders gain insight into which assets meet rigorous standards. Finally, some daylight in a market that sometimes feels like a black box—run by math geniuses who still can’t explain their fees.

Source: Coinbase

Source: Coinbase

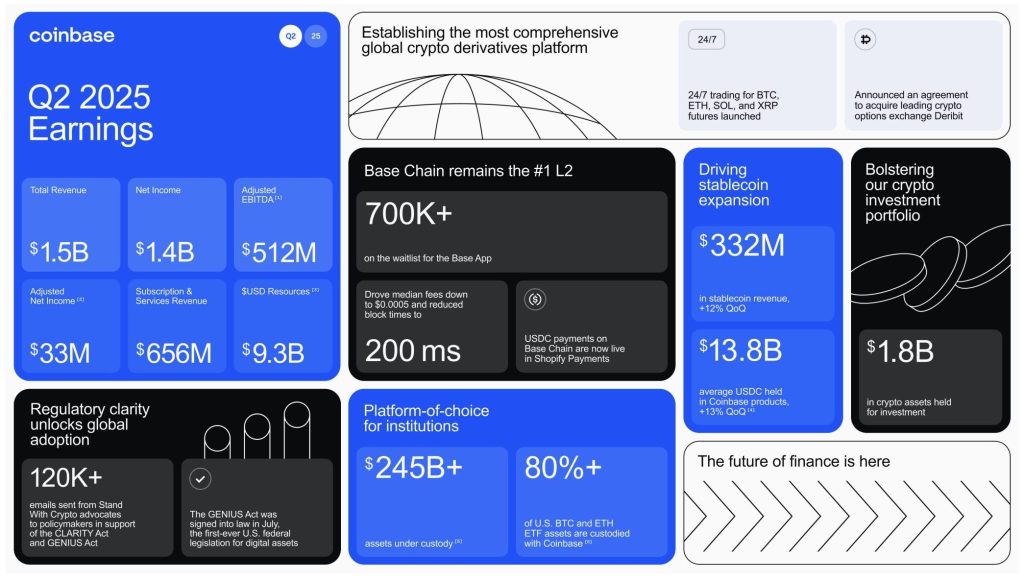

Coinbase stock dropped 9.2% in after-hours trading following Q2 results, but has gained nearly 50% year-to-date.

XRP emerged as an unexpected revenue bright spot, generating 13% of consumer transaction revenue compared to Ethereum’s 12% for the second consecutive quarter.

Detailed Process Addresses Fee Controversy

The listing guide outlines a five-step evaluation process, including application submission, business assessment, and Core reviews covering legal, compliance, and technical security factors.

Coinbase emphasizes that listings connect projects to DEEP liquidity and a global customer base within a trusted regulatory framework.

The exchange addresses common roadblocks, including securities risk assessments based on public statements and marketing materials.

According to the guideline, projects highlighting token utility and governance rights face smoother reviews than those promising speculative returns or “moon” scenarios.

Average due diligence takes one week, with trading enabled within two weeks of approval, though timelines vary significantly based on asset complexity.

Tokens on supported networks, including Ethereum, Base, Solana, Arbitrum, Optimism, Polygon, and Avalanche, receive expedited processing compared to new blockchain integrations.

We get a TON of questions about how and why assets get listed on Coinbase. To be more transparent we wrote a guide on how it all works.

TL;DR: listings are free and merit-based. Every asset is evaluated against the same standards.

Link in replies. pic.twitter.com/HmqQDt6085

The guide coincides with Coinbase’s strategic pivot toward becoming an “everything exchange” supporting millions of tokens through decentralized exchange integration.

Since then, Armstrong has announced plans to eliminate intensive listing barriers that have limited asset additions.

As part of the guideline, the exchange’s phased market launch process includes transfer-only periods, limit order auctions, and full trading states designed to protect market integrity during new asset introductions.

Notably, this new transparency guideline follows multiple allegations of misconduct.

Earlier in November 2024, TRON founder Justin Sun disputed Armstrong’s free listing claims, alleging that Coinbase requested 500 million TRX worth $80 million plus a $250 million Bitcoin deposit in Coinbase Custody.

Sun noted that Binance listed TRON without fees, while Sonic Labs co-founder Andre Cronje also reported similar experiences with Coinbase demanding $30-300 million.

Revenue Pressures Drive New Monetization Strategies Amid Market Challenges

Last month, Coinbase introduced a 0.1% fee on USDC-to-USD conversions exceeding $5 million within 30-day periods starting August 13. This was the first monetization of previously free stablecoin off-ramping services.

The change addresses competitive disadvantages from Tether’s existing redemption fees that made USDC the cheapest route for large-scale fiat conversions.

The fee implementation triggered user backlash, comparing Coinbase to traditional banking institutions.

CEO Armstrong defended the decision as necessary to address arbitrage opportunities where users swapped USDT to USDC before converting to USD, reducing USDC supply while maintaining USDT circulation.

![]() @Coinbase is turning to the bond market for support after a disappointing second-quarter earnings report triggered a sell-off in its stock. #Coinbase #Coinhttps://t.co/QAMu3x06KO

@Coinbase is turning to the bond market for support after a disappointing second-quarter earnings report triggered a sell-off in its stock. #Coinbase #Coinhttps://t.co/QAMu3x06KO

Following disappointing Q2 results, Coinbase also announced a $2 billion convertible senior notes offering split between 2029 and 2032 maturities.

Proceeds will fund capped call transactions to limit share dilution and support corporate needs, including working capital, acquisitions, and debt repurchases.

The company purchased 2,509 bitcoin worth $222 million during Q2, bringing total holdings to 11,776 BTC and placing it among the top 10 public holders ahead of Tesla.

However, Bitcoin accumulation couldn’t offset broader revenue declines affecting overall performance.

Coinbase continues expanding revenue streams through prediction markets, tokenized stocks, and derivatives for U.S. users.

The exchange secured a European MiCA license through Luxembourg’s financial regulator while pursuing partnerships, including Chase Ultimate Rewards point transfers to crypto wallets.

Despite financial challenges, TIME also recognized Coinbase as one of 2025’s 100 Most Influential Companies, labeling it a “disruptor” for shaping U.S. digital asset policies and predicting it could become the central hub for American crypto trading.

The regulatory landscape supporting Coinbase’s transparency push includes the SEC’s Project Crypto initiative, which aims to enable on-chain financial markets, and the GENIUS Act, which creates frameworks for payment stablecoins.