Upbit Unleashes Coin Listing Frenzy as Bithumb Fights Back for Market Dominance

South Korea's crypto giants are locked in an all-out exchange war—and traders are reaping the benefits.

The Listing Arms Race

Upbit just dropped seven new altcoins in a single week—their most aggressive expansion since 2023. Meanwhile, Bithumb countered with four exclusive listings and slashed trading fees by 40%. This isn't just competition—it's a bloodsport for market share.

Trading Volume Tsunami

Daily volumes surged 217% across both platforms as retail investors flooded back into altcoins. Bithumb clawed back 12% market share in Q3—their first gain since the 2022 crash. The Korean won trading pairs now account for 35% of global crypto-fiat volume.

Regulatory Gambit

Both exchanges are racing to list coins before the FSA's new compliance deadlines hit in December. Because nothing says 'financial innovation' like scrambling to beat regulatory deadlines—classic crypto maturity.

The winner? Traders getting more options than a derivatives desk on margin call day.

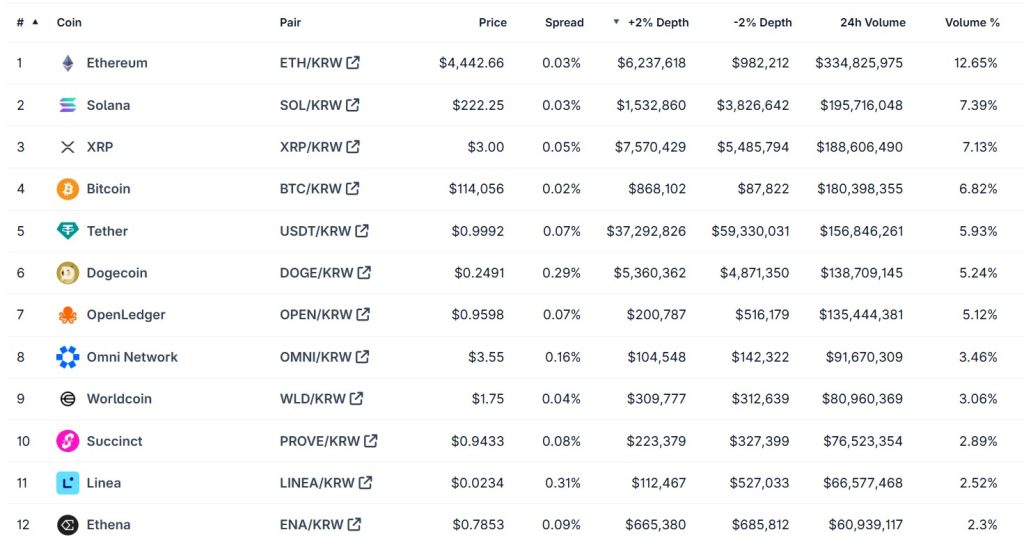

The top 12 most-traded coins on the Upbit crypto exchange on September 11, 2025. (Source: CoinGecko)

The top 12 most-traded coins on the Upbit crypto exchange on September 11, 2025. (Source: CoinGecko)

Upbit Listing Spree: Will It Stop Bithumb’s Surge?

The outlet wrote that on September 9, Bithumb’s domestic market share climbed to 46%, with Upbit’s share standing at 50.6%.

Upbit has dominated the South Korean market since around 2022, enjoying market share dominance above the 80% mark in some months.

This has led some lawmakers to complain that its operator, Dunmau, has become the crypto exchange sector’s de facto monopoly.

But Bithumb has been chipping away at Upbit’s market share in recent months. It has struck a partnership deal with Kookmin Bank, South Korea’s biggest financial player.

And it has also launched a spinoff firm as it looks to become the first domestic exchange to debut on the NASDAQ stock exchange.

Upbit appears to have responded to Bithumb’s resurgence by launching new altcoin pairings and listing a wider range of coins.

An unnamed South Korean exchange official told the media outlet that Upbit is concerned that Bithumb has narrowed the market share gap to less than 5% without resorting to novel promotions. The official opined:

“Upbit cannot help but feel a sense of crisis.”

WLD Listing

The media outlet wrote that Upbit’s response to Worldcoin (WLD) trade volume growth in South Korea has been telling.

When WLD transaction volumes pushed Bithumb’s market share to 46% on September 9, Upbit responded rapidly.

Upbit announced it WOULD be listing WLD at 7 pm KST the same day and completed its listing just two hours later, at 9 pm KST.

Upbit’s latest listing, at 1:30 am KST on September 11, was the Linea (LINEA). The exchange’s September listings tally has already surpassed its total number of listings for the whole of August.

Customers May Suffer, Experts Warn

The market leader has traditionally taken a much more conservative attitude to coin listing than Bithumb, which also continues to add coins to its platform.

Should the two firms become embroiled in a listings war, critics warn, customers could suffer in the long run.

Experts said they were “concerned” that the “fierce competition between exchanges” could lead platform managers to make “hasty decisions” that “compromise the review process.”

The experts noted that while listing frenzies continue, South Korean delisting events are becoming more common.

A combined total of 25 altcoins have been delisted by Bithumb, Upbit, and their closest rivals, Korbit, Coinone, and GOPAX, since July this year.

Several of these coins had only recently been listed on the platforms. An unnamed crypto industry executive suggested that Seoul’s efforts to police the sector may be at fault.

The source said:

“Regulators only allow domestic exchanges to provide spot trading. That means that the only way they can compete with one another is by expanding their listings. It is ironic that regulators’ attempts to police the industry are actually spurring listing competition and weakening investor protection.”