Nemo Protocol Points Finger at Developer for $2.6M Exploit from Unaudited Code Deployment

Another day, another crypto heist—only this time, the blame lands squarely on human error.

Nemo Protocol got rocked by a $2.6 million exploit, and the team isn’t mincing words: a developer deployed unaudited code. No backup, no review, just straight into production. Classic.

How It Went Down

The exploit wasn’t some sophisticated zero-day—it was a basic oversight. A single misconfigured contract function gave the attacker full access to drain funds. No fancy bridge hack, no oracle manipulation. Just pure, avoidable sloppiness.

Who’s Really at Fault?

Sure, the developer clicked deploy. But let’s be real—protocols that skip audits to save a buck deserve what they get. In traditional finance, this would’ve been a lawsuit. In crypto? It’s a learning experience. Or a very expensive tweet.

Lessons Unlearned

This isn’t the first time unaudited code has led to disaster. It won’t be the last. But while Wall Street spends millions on compliance, crypto’s still out here crowdsourcing its security—and wondering why things keep going wrong.

Another rugged Tuesday in DeFi—where the only thing more volatile than the tokens is the quality control.

How it All Started

The root cause traces to January 2025, when a developer submitted code containing unaudited features to MoveBit auditors.

The developer failed to highlight new additions while mixing previously audited fixes with unreviewed functionality.

MoveBit issued its final audit report based on incomplete information. The same developer then deployed contract version 0xcf34 using single-signature address 0xf55c rather than the audit-confirmed hash, bypassing internal review processes.

Asymptotic team identified the critical C-2 vulnerability in August, warning that some functions could modify code without permission.

The developer dismissed the severity and failed to implement necessary fixes despite available support.

Attack execution began at 16:00 UTC on September 7 with hackers leveraging the flash loan function and the get_sy_amount_in_for_exact_py_out query vulnerability.

The team detected anomalies thirty minutes later when YT yields displayed over 30x returns.

On August 11, we reported a Critical vulnerability (C-2) to Nemo regarding unauthorized manipulation of py_index_stored, an index variable which affects all interest, yield, and conversion calculations. We warned of potential "incorrect payouts, market disruption, and loss of… https://t.co/RCgiloT7fE

— Asymptotic (@AsymptoticTech) September 11, 2025The Developer’s Secret Code Deployment

In late 2024, initial audit submissions correctly configured flash_loan as an internal non-callable function while development teams iterated on features.

The developer drew inspiration from Aave and Uniswap protocols to maximize composability through flash loan capabilities.

However, the implementation critically underestimated security risks and incorrectly used public methods rather than internal functions.

The earlier-mentioned function, intended to enhance swap quoting mechanisms, contained implementation errors.

Functions designed for read-only purposes were coded with write capabilities, creating the primary attack vector.

On January 5, 2025, the developer integrated unaudited features into the final codebase after receiving MoveBit’s initial audit report.

The mixed version contained both fixed issues and new unaudited features without explicit scope highlighting.

The developer communicated directly with the MoveBit team on January 6, obtaining final audit reports through modification of previous versions.

Instead of using confirmation hashes from audit reports, separate upgrades and deployments occurred without the internal team’s knowledge.

Single-signature deployment address enabled unauthorized contract version activation. This version remained in the active code until exploit occurrence despite subsequent security procedure implementations.

April’s transition to multi-signature upgrade protocols failed to address the fundamental issue.

The developer transferred only contract caps while maintaining vulnerable code rather than deploying audit-confirmed versions.

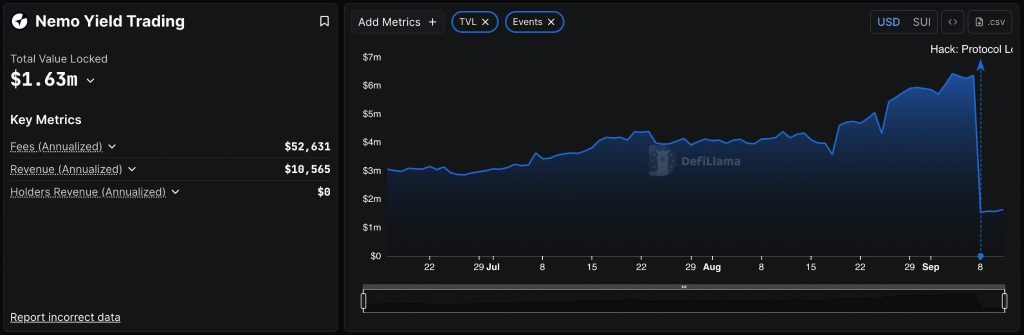

![]() Nemo Protocol loses $2.4M to hackers on sui blockchain as TVL crashes 75% from $6.3M, marking the third major DeFi hack this month alone.#Sui #Nemohttps://t.co/ZrVfJk2cZr

Nemo Protocol loses $2.4M to hackers on sui blockchain as TVL crashes 75% from $6.3M, marking the third major DeFi hack this month alone.#Sui #Nemohttps://t.co/ZrVfJk2cZr

Fund Recovery and Security Remediation Efforts

Stolen assets totaling $2.59 million were quickly moved through sophisticated laundering operations.

Primary attacker wallet initiated cross-chain transfers at 16:10 UTC via Wormhole CCTP before final aggregation on Ethereum.

However, security teams established monitoring protocols for the holding address while coordinating with centralized exchanges on asset freezing.

White-hat agreement frameworks and hacker bounty programs were also implemented to encourage fund recovery.

As for the remediation effort, emergency incremental audits were submitted to Asymptotic with plans for additional independent security firm reviews.

Manual-fix functions were also integrated into new contract patches to enable multi-signature wallet restoration of corrupted code.

As a result of the hack, the total value locked instantly collapsed from $6.3 million to $1.63 million now as users withdrew over $3.8 million worth of USDC and SUI tokens.

To compensate affected users, plans have been put in place for debt-structuring design at the tokenomics level, with community sharing scheduled upon finalization.

The protocol apologized for security failures while implementing enhanced monitoring, stricter controls, additional audit checkpoints, and expanded bug bounty programs.

The exploit contributes to the ongoing 2025’s devastating DeFi security crisis with over $2.37 billion in losses across 121 incidents in the first half alone.

So far this year, September emerged as particularly destructive with SwissBorg’s $41.5 million SOL hack, npm supply chain attacks affecting billions of downloads, and multiple protocol exploits happening almost at the same time.