Binance US Slashes Fees to Near-Zero as Trading Volumes Plummet to 0.20% Market Share

Binance US makes desperate move to attract traders after catastrophic market share collapse.

The exchange just announced near-zero fee trading—a clear attempt to stop the bleeding as volumes evaporate.

Market dominance crumbles

Once a major player, Binance US now holds just 0.20% of total trading volume. That's not just a dip—it's a full-scale exodus.

Fee cuts won't fix trust issues

Slashing fees might lure some bargain hunters, but it doesn't solve the regulatory cloud hanging over the exchange. Traders aren't just looking for cheap trades—they want security and stability.

Last-ditch effort or new beginning?

This aggressive pricing strategy feels more like a survival tactic than growth play. Because when your market share hits 0.20%, you're not competing—you're clinging to relevance.

Another day, another exchange trying to buy market share instead of earning it through actual compliance and innovation. Some things never change in crypto.

Trade ETH, SOL, BNB, and 20+ staking assets on select USD/USDT pairs with 0% trading fees*.

Build your conviction and trade with confidence. Only on https://t.co/AZwoBOh0gq. — Binance.US

![]()

From Zero-Fee Pioneer to Market Afterthought

The latest fee reduction marks Binance.US’s second major attempt to capture market share through aggressive pricing after initially launching zero-fee Bitcoin trading in June 2022.

That program covered four spot pairs – BTC/USD, BTC/USDT, BTC/USDC, and BTC/BUSD – and was later expanded to include ethereum pairs in December 2022.

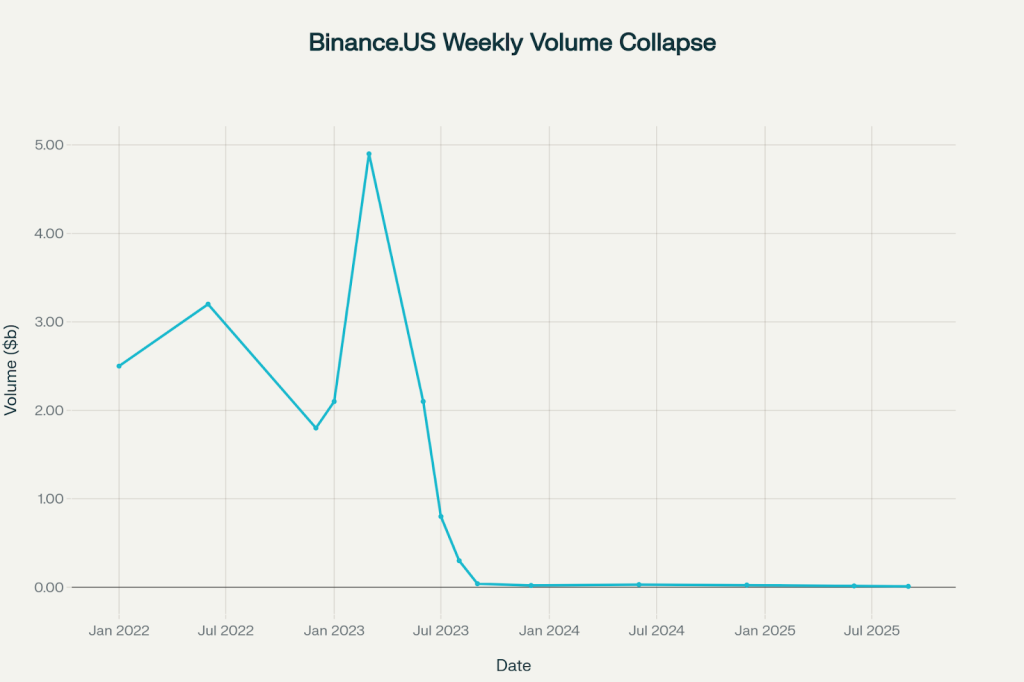

Trading volumes collapsed by 99% from nearly $5 billion weekly in March 2023 to around $40 million by September 2023 following the Securities and Exchange Commission’s lawsuit against the exchange.

The SEC filed 13 charges in June 2023 against Binance, CEO Changpeng Zhao, and Binance.US for allegedly operating an unregistered securities exchange and manipulating markets.

Within 24 hours of the lawsuit, the platform experienced $1.43 billion in net outflows as traders fled amid fears that customer funds could be frozen.

Banking partners immediately severed relationships with Binance.US, forcing the exchange to suspend USD deposits and warn customers to withdraw their dollars before services were completely halted.

The platform operated as a crypto-only exchange for 19 months until February 2025, when it restored fiat deposit and withdrawal services through ACH bank transfers.

Even after the SEC voluntarily dismissed its lawsuit with prejudice in May 2025, trading activity failed to recover meaningfully despite the removal of major legal uncertainties.

![]() @SECGov and @binance legal clash ends as U.S. regulator drops landmark lawsuit. #binance #SEChttps://t.co/Qlz11yoG4n

@SECGov and @binance legal clash ends as U.S. regulator drops landmark lawsuit. #binance #SEChttps://t.co/Qlz11yoG4n

The exchange has also added more than 20 pairs to its “Tier 0” pricing model, with all pairs now carrying a 0.01% taker fee while maintaining 0% Maker fees.

Can Pricing Alone Revive a Wounded Exchange?

The current fee structure positions Binance.US as potentially the lowest-cost venue in the U.S. market, undercutting Coinbase’s 0.40%/0.60% maker/taker fees for low-volume users and Kraken’s 0.16%/0.26% standard fees.

However, competitors have solidified their positions during Binance.US’s regulatory troubles, with Coinbase maintaining approximately 60-65% of the U.S. market share and reporting $393 billion in Q1 2025 trading volume.

Kraken has emerged as a clear second-place competitor with $186.8 billion in Q2 2025 volume and recently acquired NinjaTrader for $1.5 billion to expand its derivatives offerings.

Industry observers note that aggressive pricing alone cannot overcome the trust deficit and liquidity concerns that developed during the platform’s 19-month period without fiat services.

Institutional adoption remains minimal for Binance.US compared to rivals like Coinbase, which manages over $400 billion in assets under management and operates significant custody services.

The platform’s association with global Binance continues to create compliance questions for potential institutional clients, even after the SEC case dismissal and leadership changes.

Moreso, regulatory uncertainty has made institutional investors particularly risk-averse regarding platforms with previous enforcement actions, regardless of case outcomes.

“I strongly believe that 2025 will be a breakout year for Binance.US, and our teams are hard at work building a comeback story for the ages,” Interim CEO Norman Reed stated in December 2024.

The exchange plans to launch new features and expand its product lineup throughout 2025 as it attempts to rebuild its market position under more favorable regulatory conditions following the TRUMP administration’s pro-crypto stance.