Metaplanet’s Bold $1.45B Bitcoin Bet: Holdings Soar to $2.25B in Historic Crypto Move

Metaplanet just dropped a billion-dollar bombshell—and the crypto markets are buzzing.

Massive Capital Shift

The company finalized a staggering $1.45 billion share sale, channeling every penny into Bitcoin acquisitions. This isn't just dipping toes in the water—it's a full-scale plunge into digital assets.

Portfolio Transformation

Their Bitcoin holdings now sit at $2.25 billion, positioning Metaplanet among the corporate giants betting big on cryptocurrency's future. That's not just diversification—it's a fundamental rewrite of their balance sheet strategy.

Because nothing says 'confidence in traditional finance' like dumping over a billion dollars into an asset class that gives Wall Street analysts nightmares. The move signals a radical departure from conventional corporate treasury management—and could spark a wave of imitation across the sector.

Asian Corporate Treasury Revolution Accelerates

Nakamoto Holdings committed $30 million to participate in Metaplanet’s global equity offering, marking its largest investment and first stake in an Asian Bitcoin-focused public company.

KindlyMD’s subsidiary stock surged 77.2% on Nasdaq following the announcement despite recent monthly declines.

Similarly, Sora Ventures recently launched a dedicated $1 billion Bitcoin treasury fund backed by $200 million in regional commitments, targeting rapid accumulation within six months.

Just today, QMMM Holdings reported 1,736% stock gains after announcing $100 million crypto treasury plans targeting Bitcoin, Ethereum, and Solana.

The Hong Kong-based digital media firm’s shares soared 2,300% before closing higher at $207 on Nasdaq.

Japan leads corporate Bitcoin adoption with multiple Tokyo-listed firms announcing treasury strategies.

Government policy changes support corporate crypto adoption, with proposed tax reforms potentially reducing capital gains rates from 55% to 20%.

The Flywheel Effect Faces Premium Compression Challenges

Metaplanet’s financing strategy relies on “moving strike warrants” issued to Evo Fund, creating a capital generation flywheel for Bitcoin purchases.

CEO Simon Gerovich designed the mechanism to raise funds at low costs during stock price appreciation.

The model showed signs of strain as shares declined 54% since mid-June peaks despite Bitcoin gaining 2% during the same period.

Accumulation rates slowed from 160% growth through June to less than 50% since.

Bitcoin premium compression threatens the strategy’s sustainability. The company’s market capitalization multiple versus Bitcoin holdings narrowed from eight times reserves in June to approximately two times currently.

As a result, analysts warn that further premium compression could limit accumulation capacity.

However, Gerovich called preferred share issuances a “defensive mechanism” protecting common shareholders from dilution during price convergence.

![]() Japanese BTC investor Metaplanet has announced a fresh purchase of 136 BTC, boosting its BTC Yield to 487% YTD 2025.#Metaplanet #BTCAccumulation #BTCYieldhttps://t.co/Q5VbxzEH03

Japanese BTC investor Metaplanet has announced a fresh purchase of 136 BTC, boosting its BTC Yield to 487% YTD 2025.#Metaplanet #BTCAccumulation #BTCYieldhttps://t.co/Q5VbxzEH03

As of September 8, Metaplanet reported a 487% Bitcoin yield year-to-date through aggressive accumulation from 12,000 BTC at June-end to current levels.

Stock performance, however, lagged Bitcoin gains with shares trading NEAR four-month lows despite reaching 20,000 BTC milestones.

Revenue Generation Through Options Strategy

The company allocated ¥20.4 billion from the offering proceeds to the Bitcoin Income Generation Business, expanding options trading operations.

Metaplanet generated ¥1.9 billion in sales revenue from Bitcoin options during Q2 2025.

The options strategy addresses Bitcoin’s yield-free nature by generating income through covered call writing and volatility trading.

Management targets full-year operating profitability through accumulated options premiums.

![]() Japan's @Metaplanet_JP Q2 financial report shows a 468% Bitcoin yield, becoming the 4th largest global holder with 18,113 BTC worth $2.1B, targeting 210,000 BTC by 2027.#Japan #Bitcoinhttps://t.co/n5xJXwpgW7

Japan's @Metaplanet_JP Q2 financial report shows a 468% Bitcoin yield, becoming the 4th largest global holder with 18,113 BTC worth $2.1B, targeting 210,000 BTC by 2027.#Japan #Bitcoinhttps://t.co/n5xJXwpgW7

Q2 financial results showed ¥816 million operating profit on ¥1.2 billion revenue, largely driven by ¥1.1 billion in Bitcoin option underwriting income.

The business model provides recurring revenue streams beyond price appreciation speculation.

Shareholder base expanded over 1,000% to 128,000 individuals as the Bitcoin strategy gained international attention.

The company transformed from a struggling hotel operator to Asia’s most prominent corporate Bitcoin holder.

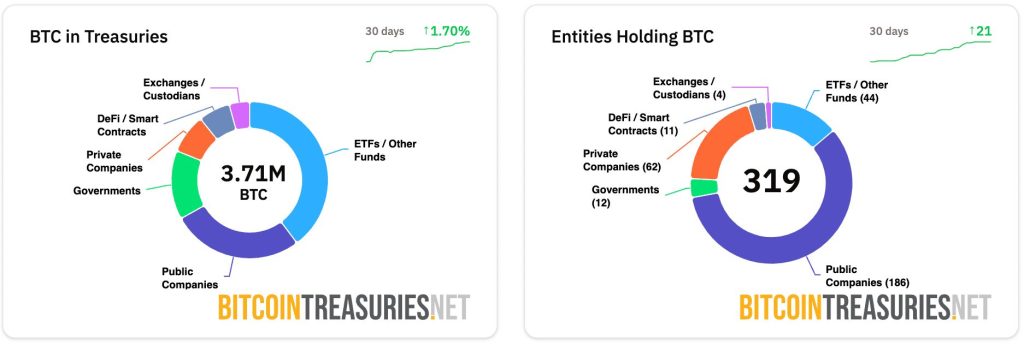

Global corporate Bitcoin movement spans 31 entities controlling over $413 billion in holdings.

However, Sentora research has recently warned that most participants won’t survive credit cycles due to structural vulnerabilities in rising-rate environments.

Institutional critics argue that idle Bitcoin holdings lack scalability in rising-rate environments without yield generation capabilities.

Corporate treasuries increasingly face sustainability questions regarding mark-to-market dependency.

For Metaplanet, the international offering price reflected a 9.93% discount to the September 9 reference price of ¥614, ensuring attractive entry points for overseas institutional investors.

The settlement proceeds will be immediately used for Bitcoin purchases.

Payment completion is set for September 16, with delivery the following day. The timing positions Metaplanet for strategic Bitcoin accumulation through October 2025.