Trust Wallet Unleashes Tokenized Stocks and ETFs for 200M Users—Zero Brokers Needed

Trust Wallet just bulldozed Wall Street's gates—bringing traditional finance directly on-chain.

No Middlemen, No Problem

Skip the broker paperwork and dive straight into tokenized equities. The platform's latest move opens stock and ETF trading to its massive user base without a single traditional intermediary.

200 Million Users Enter the Arena

That’s right—200 million crypto natives now get exposure to mainstream assets without leaving the blockchain. It’s DeFi meets TradFi, without the usual friction—or the hefty fees.

Because who needs a broker when you’ve got a wallet?

Sure, the suits might call it disruptive—we call it inevitable. After all, if traditional finance worked perfectly, we wouldn’t need to rebuild it on-chain.

Global access. Local control. https://t.co/BoU1G7Xs4g — Trust Wallet (@TrustWallet) September 8, 2025

Trust Wallet’s 200M Users Gain Direct Access to U.S. Stocks Without Brokers

The tokens are created by third-party providers, including ONDO Finance, via smart contracts engineered to mirror the value of the underlying asset.

For trading functionality, Trust Wallet has incorporated the 1INCH Swap API DEX aggregator, which consolidates prices from decentralized exchanges across multiple blockchains, including Ethereum, BNB Chain (formerly Binance Smart Chain), Polygon, and, most recently, Solana.

In its official announcement, Trust Wallet indicated that the initiative is part of its efforts to make global finance more accessible and open to its user base of over 200 million worldwide.

Eowyn Chen, CEO of Trust Wallet, commented on the importance of the stocks and ETF integration, stating, “incorporating RWAs into self-custodial wallets represents a crucial step toward making global finance more open and efficient.“

“The broader vision involves how blockchain technology democratizes financial market access and establishes the groundwork for a more inclusive financial future,” she continued.

This integration follows earlier groundwork that Chen referenced in June during her participation in a panel discussion titled “What World is Crypto Building” at the Proof of Talk conference in Paris.

Our CEO @EowynChen joined a powerful conversation at @proofoftalk to share how FlexGas, the first major usecase of EIP-7702, is making gas more flexible.

With FlexGas, users can pay gas with tokens they already hold such as $TWT, $USDT & $USDC. pic.twitter.com/xVNCIRcul2

She mentioned that users WOULD eventually engage with RWAs within the Trust Wallet app through an enhanced “Swap flow” feature.

In a conversation with Cryptonews, Chen explained that “for millions of users, particularly in emerging markets, traditional finance access remains limited or completely unavailable.“

She noted that RWAs can provide access to financial products previously unavailable to these users, allowing them to participate without sacrificing custody or relying on centralized platforms.

During the Proof of Talk panel, Chen also revealed Trust Wallet’s ambitions to become a Web3 neobank.

“This means providing users with the essential components of a modern financial toolkit, self-custody, asset exposure, DeFi access, staking, identity management, and more, all within a single globally accessible application,” she explained.

Will Nasdaq’s SEC Filing Bring $1.3T in Tokenized Stocks by 2030?

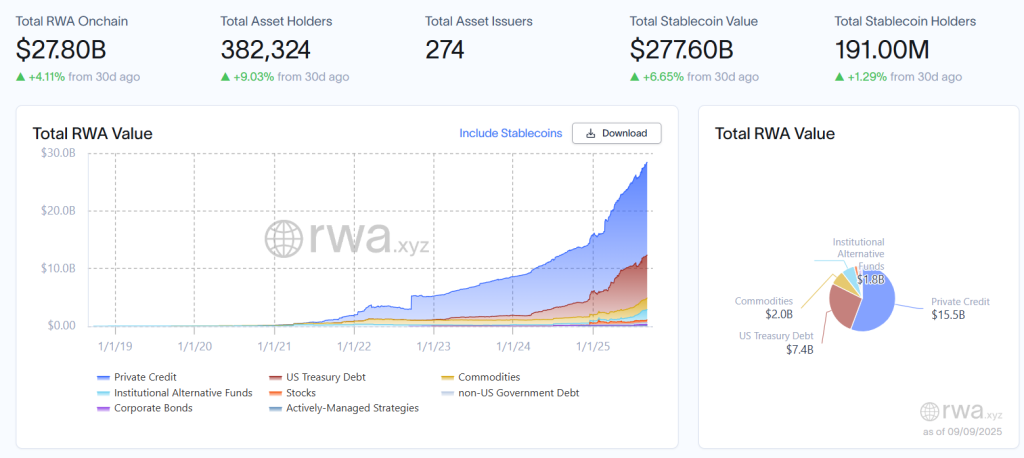

According to RWA.xyz data, the total on-chain RWA value has surpassed $27 billion, representing a 60.5% year-to-date increase, with over $420 million in stocks already tokenized.

Real Vision’s chief crypto analyst Jamie Coutts noted in an August 27 X post that if the current 2-year compound annual growth rate (CAGR) of 121% persists, tokenized traditional assets could reach approximately $1.3 trillion by 2030.

Major industry players are now entering the space to bring stocks and RWAs on-chain.

In a Monday filing, Nasdaq, the world’s second-largest stock exchange, requested that the Securities and Exchange Commission (SEC) modify existing regulations.

![]() @Nasdaq filed a request with the @SECGov for a rule change that would allow for the listing of Nasdaq tokenized stocks.#tokenization #blockchain #SEChttps://t.co/59c1LZjjyk

@Nasdaq filed a request with the @SECGov for a rule change that would allow for the listing of Nasdaq tokenized stocks.#tokenization #blockchain #SEChttps://t.co/59c1LZjjyk

The modification included the definition of securities to allow tokenized stocks to trade under identical execution and documentation requirements as traditional equities.

Similarly, in August, Japanese conglomerate SBI Holdings partnered with crypto infrastructure provider Startale Group to launch a comprehensive on-chain trading platform dedicated to tokenized stocks and real-world assets (RWAs).

According to the press release shared with Cryptonews, SBI Holdings and Startale intend to collaborate in providing round-the-clock on-chain tokenized stock and financial asset trading, along with cross-border settlement infrastructure featuring reduced fees.

Centralized exchanges such as Bybit and Kraken have already introduced tokenized versions of prominent U.S. stocks, including Apple, Nvidia, and Tesla, as well as RWAs like Gold and oil.