Corporate Bitcoin Buying Frenzy: 1,755 BTC Daily Inflows Signal $125K Price Target Ahead?

Wall Street's digital gold rush accelerates as institutional adoption hits unprecedented levels.

The Accumulation Game

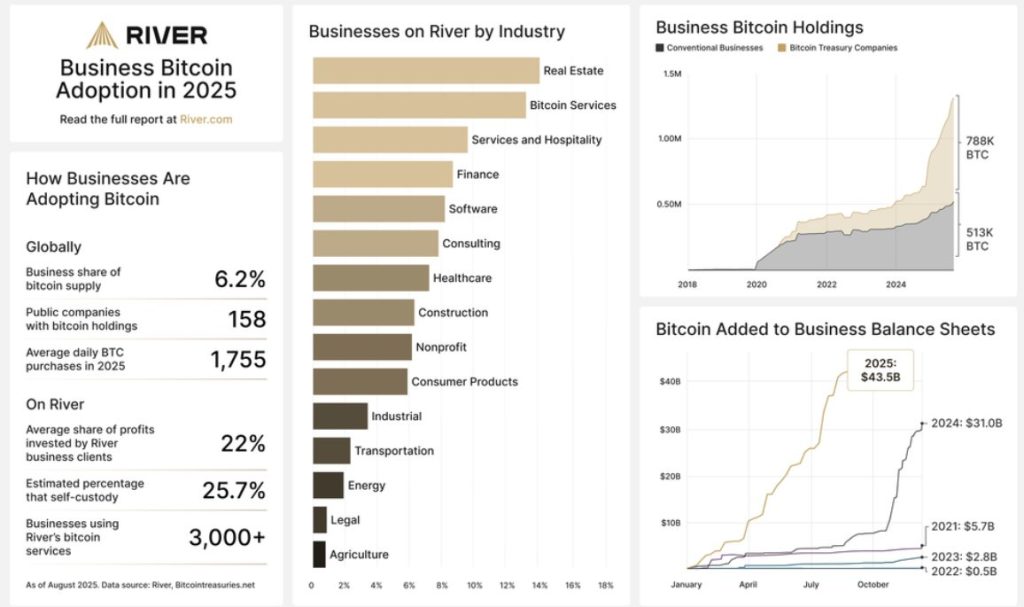

Companies aren't just dipping toes—they're diving headfirst into Bitcoin, snapping up 1,755 coins every single day. That relentless buying pressure adds up to a staggering $1.3 trillion in value over just 20 months, making traditional treasury management look like amateur hour.

Price Trajectory Heating Up

With this kind of institutional demand, the $125K threshold isn't just possible—it's becoming inevitable. While traditional finance pundits still debate Bitcoin's merit, smart money votes with cold, hard capital. Because nothing says 'store of value' like outperforming every asset class while bankers still debate its legitimacy.

The real question isn't if Bitcoin hits new highs, but when traditional finance finally admits they missed the boat—again.

22% Net Income Allocation – Businesses Go All-In on Bitcoin Strategy

Currently, businesses now control more than 6% of Bitcoin’s circulating supply, representing a twenty-one-fold expansion since January 2020.

Bitcoin Treasury Companies drive much of this growth in business adoption, accounting for 76% of all business purchases since January 2024 and 60% of publicly reported business holdings.

These stock-listed entities focus on amassing substantial Bitcoin reserves while providing shareholders who are unable to purchase Bitcoin directly with equity-based exposure to its price movements.

Michael Saylor introduced the Bitcoin treasury model when MicroStrategy (currently Strategy) executed its inaugural $250 million Bitcoin acquisition in August 2020.

Strategy’s Bitcoin portfolio now exceeds $70 billion in value. This success story has inspired the launch of over 50 comparable Bitcoin treasury enterprises.

Prior to 2024, corporate Bitcoin adoption remained confined to select private sector niches.

Mining operations were initial adopters, with crypto firms and occasional unconventional participants like Tesla from different sectors following suit.

This model transformed entirely throughout 2024.

River’s research indicates Bitcoin now delivers value across business categories and company sizes, spanning real estate, software development, consulting services, healthcare, logistics, consumer goods, media companies, and automotive sectors.

River’s findings show numerous businesses allocating well beyond a theoretical 1% to Bitcoin holdings.

Current corporate allocations average 22% of net income toward Bitcoin investments, based on July 2025 survey data, while the median allocation reaches 10%.

Among these companies, 63.6% treat Bitcoin as a permanent investment vehicle, continuously accumulating positions without immediate selling or portfolio rebalancing intentions.

BTC Above $125K Within Reach as Volatility Drops to Gold Levels

Bitcoin’s climb above $125K now seems increasingly attainable.

Previous adoption barriers, such as government “ban” fears or corporate ownership restrictions, have mostly vanished.

Multiple sovereign nations now maintain official Bitcoin investments, and March 2025 saw the United States launch its Strategic Bitcoin Reserve program.

BINANCE FOUNDER CZ SAYS MANY COUNTRIES ARE BUYING #BITCOIN FOR THEIR RESERVES

“COUNTRIES ARE FORCED TO BUY BTC” pic.twitter.com/DxYIHFoG9N

Bitcoin previously lacked sufficient liquidity for major institutional adoption. This constraint no longer exists.

But now Bitcoin currently ranks among global assets with the highest liquidity and operates continuously, contrasting with traditional treasury instruments.

Recent years have also witnessed stance reversals from prominent figures, including Federal Reserve Chair Jerome Powell, BlackRock Chief Executive Larry Fink, and President Trump, regarding Bitcoin.

Analyst Zynweb3 observes that Bitcoin historically reaches lows at the 0.382 Fibonacci retracement, occurring in Q3 2024 and Q2 2025, with potential repetition ahead.

$BTC usually bottoms at 0.382 Fibonacci level.

This happened in Q3 2024, Q2 2025 and will probably happen again.

For anyone wondering how low we can go, 0.382 Fibonacci level is currently around $100K.

So the worst case scenario is a 10% drop before a 50% rally above $150,000. pic.twitter.com/gdeLIe4RRF

Current market weakness has confined Bitcoin within the $113K-$107K range, suggesting possible further decline toward the 0.382 Fibonacci level NEAR $100K.

Nevertheless, Bitcoin maintains long-term bullish prospects, with typical 10% corrections often preceding 50% advances that could drive Bitcoin past $125K toward $150K during Q4.

Bitcoin Technical Analysis: $114K Resistance Break Could Trigger BTC Above $125K Breakout

Technically, the Bitcoin 4-hour chart shows the price has bounced strongly from the correction zone around $108,000, forming a bullish engulfing structure that signals renewed buying momentum.

The current MOVE suggests a push toward immediate resistance near $114,000, which will be the first test for bulls to confirm strength.

If Bitcoin manages to break and sustain above this level, the chart projects an extended move toward key resistance at $120,000, marking the upper boundary of the current bullish structure.

However, failure to clear $114,000 WOULD risk another pullback, potentially retesting the correction zone.