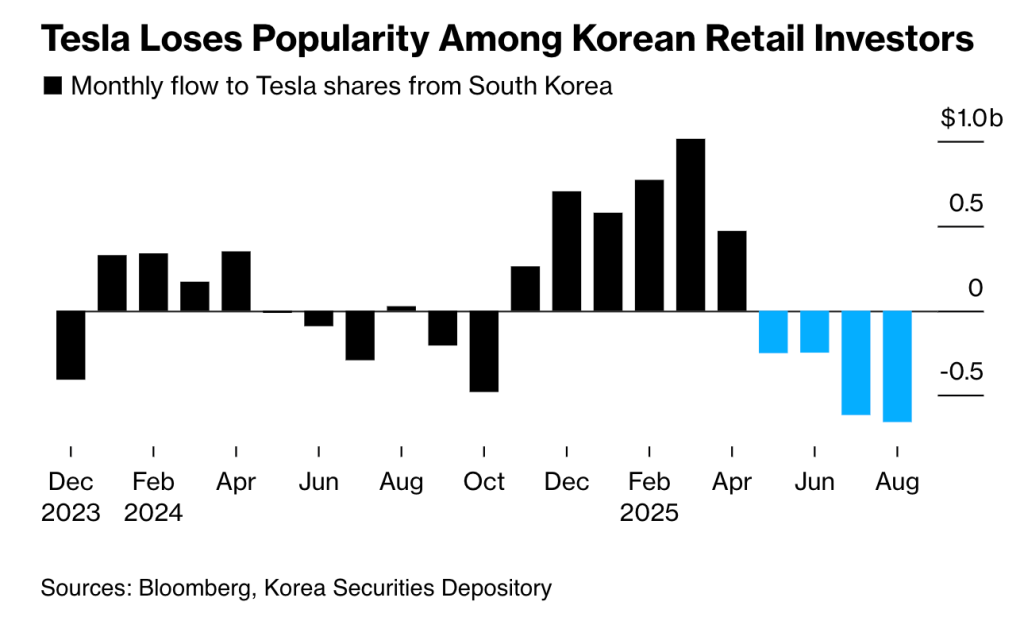

South Korean Investors Dump $657M in Tesla Stock, Chase Crypto Returns Instead

Wall Street's darling gets the cold shoulder as Asian capital pivots hard toward digital assets.

THE GREAT ROTATION

Smart money flees traditional equities—$657 million worth of Tesla shares hit the exit door. South Korea's investment class isn't just dipping toes in crypto waters anymore; they're diving headfirst into decentralized returns.

RETURN PROFILE REALITY CHECK

Why settle for Elon's volatility when you can get the real thing? Crypto's 24/7 markets don't care about Fed meetings or earnings calls. Traditional finance suddenly looks like watching paint dry—with worse returns.

Because nothing says 'financial sophistication' like chasing the asset class that gives your wealth manager night sweats.

The shift coincides with South Korea’s aggressive push toward developing the crypto market, with President Lee Jae-myung designating digital asset ecosystem construction as a “key national task” within the five-year state administration plan.

As of August, over 10,000 Korean crypto investors now hold assets exceeding 1 billion won ($750,000), with the nation’s 10.86 million active trading accounts representing roughly 20% of the population.

Tesla Loses Its Korean Retail Champion Status to Crypto Fever

Tesla remains the top foreign stock among Korean retail traders with $21.9 billion in holdings, but investor sentiment has soured considerably.

Han Jungsu, a 33-year-old investor who first bought Tesla in 2019, sold his position earlier this year, stating, “Tesla used to offer a lot of inspiring narratives but it has failed to win people’s hearts.”

The Leveraged TSLL ETF, which offers double Tesla exposure, recorded its biggest monthly outflow since early 2024, with $554 million withdrawn in August.

Korean investors criticized Tesla’s failure to establish a compelling narrative in artificial intelligence compared to emerging crypto opportunities.

Young Korean investors in their 20s lead crypto adoption, with an average holding of 2.69 billion won, despite representing the smallest demographic group among high-net-worth crypto holders.

This generation is increasingly favoring digital assets over traditional U.S. tech stocks, allocating an average of 14% of their financial assets to cryptocurrencies.

The demographic breakdown among Korea’s crypto millionaires reveals 3,994 investors in their 50s and 3,086 in their 40s, but the 137 twentysomething investors maintain the highest average balances.

Early adopters typically began with Bitcoin before diversifying into altcoins and stablecoins, with 60% of them starting their investments during the 2020 bull run.

Additionally, retail investment behavior shifted dramatically as Korean investors expressed concerns about the impact of U.S. tariffs and the strengthening of the local currency.

A similar survey data indicate that 27% of Koreans currently hold cryptocurrencies, with an average holding of 13 million won ($9,547) per investor.

Over half of South Koreans aged 20-59 have experience with crypto trading, establishing the nation as a global crypto powerhouse.

Government-Led Crypto Infrastructure Revolution Accelerates

President Lee Jae-myung’s administration has fast-tracked pro-business crypto reforms, reclassifying crypto trading firms as “venture companies” to grant them access to tax incentives, subsidies, and state-backed financing that was previously denied since 2018.

The Ministry of SMEs and Startups proposed amendments to include VIRTUAL Asset Service Providers under the status of a venture company.

![]() South Korea is moving to reclassify crypto firms as “venture companies,” which WOULD grant access to government subsidies.#SouthKorea #Cryptohttps://t.co/FucfcydMDq

South Korea is moving to reclassify crypto firms as “venture companies,” which WOULD grant access to government subsidies.#SouthKorea #Cryptohttps://t.co/FucfcydMDq

Similarly, financial regulators have lifted restrictions on institutional crypto investments while preparing approval for Korea’s first spot crypto ETFs.

The Financial Services Commission presented implementation measures for spot crypto ETFs and regulatory frameworks for won-based stablecoins, scheduled for implementation in late 2025.

Major banks established dedicated crypto teams, anticipating legislative approval.

Woori Bank launched a nine-member Digital Asset Team, while Kookmin Bank created a Digital Asset Response Council covering KB Financial Group affiliates.

Shinhan Bank formed a 20-employee crypto task force as institutions prepare rapid market entry strategies.

Regional institutions, including Busan Bank, have also established blockchain teams that cover all aspects of distributed ledger technology.

As adoption of crypto grows, the Financial Intelligence Unit has begun reorganizing anti-money laundering protocols to institutionalize the use of stablecoins, conducting external research to compile guidelines for operators and issuers in December.