SharpLink Makes Massive 56,533 ETH Purchase Following $360.9M Funding Round

SharpLink just dropped a bombshell—acquiring a staggering 56,533 ETH after closing a $360.9 million raise. That’s not just a bet on crypto; it’s a statement.

Big Money, Bigger Moves

The raise itself screams institutional confidence. $360.9 million doesn’t just materialize—it’s wired by players who see real value past the hype cycles and vaporware promises. SharpLink’s pivot toward Ethereum isn’t just strategic; it’s borderline aggressive.

Ethereum as a Core Holding

Stacking over 56k ETH signals more than belief—it’s a hedge against traditional finance’s slow-moving, fee-heavy machinery. While banks debate blockchain over lukewarm coffee, SharpLink’s buying actual blocks.

A Jab at the Old Guard

Let’s be real—Wall Street still thinks ‘ETH’ is a typo for ‘THE’. Meanwhile, SharpLink’s moving nine figures into a decentralized future while traditional funds rebalance their bond allocations for the third time this quarter.

Bottom line: When money talks, it sometimes yells. And $360.9 million shouting into Ethereum’s ecosystem? That’s a sound worth tuning into.

Strong Capital Position from ATM Facility

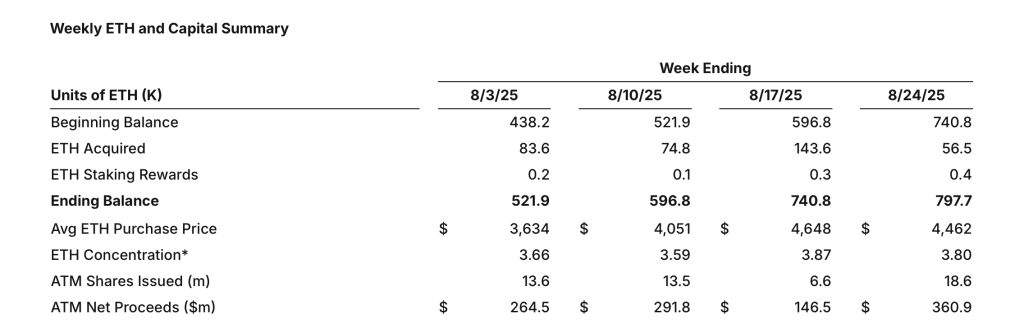

The company’s At-the-Market (ATM) facility played a central role in fueling the latest purchases. SharpLink raised $360.9 million in net proceeds during the week of August 18–22, giving the company a robust cash position. Approximately $200 million remains undeployed, earmarked for additional ETH acquisitions in the NEAR term.

This capital influx highlights institutional confidence in SharpLink’s aggressive treasury program. Since June 2, 2025, when the initiative began, the firm has consistently converted fiat proceeds into ETH, boosting its concentration ratio on a cash-converted basis above 4.00 — more than doubling in just over two months.

Growing Rewards Through ETH Staking

Alongside its purchases, SharpLink continues to benefit from Ethereum’s proof-of-stake yield. The company’s staking rewards reached 1,799 ETH since the program’s launch, adding another LAYER of revenue generation on top of its growing digital asset base.

With nearly 800,000 ETH locked, the compounding rewards could become a meaningful driver of value for shareholders.

Analysts note that SharpLink’s dual approach — aggressive acquisitions combined with staking yield — sets the company apart as one of the most committed corporate advocates of Ethereum’s ecosystem.

Shareholder Returns Bolstered by $1.5B Buyback

In addition to expanding its ETH treasury, SharpLink’s Board of Directors approved a $1.5 billion stock repurchase program on August 18, 2025. The buyback plan shows confidence in the company’s long-term financial outlook and complements its ETH-driven growth model.

By simultaneously returning capital to investors and scaling its ETH exposure, SharpLink aims to balance shareholder value with forward-looking digital asset adoption. With a strong liquidity buffer and clear strategic direction, the company positions itself at the forefront of corporate crypto treasury management.