BitMine’s $2.2B ETH Power Move: 190,500 Ethereum Weekly Haul Cements Treasury Dominance

BitMine just pulled off the largest institutional Ethereum accumulation in history—while traditional finance was busy rebalancing paper portfolios.

The $2.2 Billion Power Grab

190,500 ETH flowed into BitMine's treasury this week alone, catapulting them to the undisputed number one spot in Ethereum holdings. This isn't just dipping toes in the water—it's a full-scale strategic invasion of digital asset territory.

While legacy institutions debate yield curves and inflation hedges, crypto-native players are building actual treasure chests. The move signals overwhelming confidence in Ethereum's infrastructure role—betting big on the network's transition to proof-of-stake and layer-2 scaling solutions.

Treasuries don't lie. While Wall Street funds pay analysts to write reports about 'digital gold,' real players are busy accumulating the actual asset. Maybe someone should tell them ETH isn't going to mine itself—oh wait, it actually does now.

This massive accumulation reshapes the entire Ethereum ecosystem. When one player holds this much network weight, every protocol upgrade and governance decision suddenly gets more interesting. Watch for ripple effects across DeFi, staking, and network security.

Let's see traditional finance try to short this.

BitMine Expands ETH Treasury, Ranks Second in Global Crypto Reserves

According to the announcement, the company added more than 190,500 ETH in a single week, building on an already aggressive buying campaign launched in late June.

As of August 24, BitMine holds 1,713,899 ETH valued at $4,808 each, alongside 192 Bitcoin and $562 million in unencumbered cash.

The company now leads all corporate Ethereum treasuries by a wide margin and ranks second among global crypto treasuries overall, trailing only Michael Saylor’s Strategy Inc., which controls 629,376 BTC worth $71 billion.

Tom Lee's Ethereum Treasury Company Bitmine $BMNR now holds more than $8.8 Billion worth of ETH + Cash up from the $6.6B last week

BMNR now owns 1.71 Million ETH and 192 BTC pic.twitter.com/rbayqJENZ1

Chairman Thomas “Tom” Lee of Fundstrat said the pace of acquisitions reflects the company’s ambition to secure roughly 5% of Ethereum’s total supply, around six million ETH, a goal that WOULD require about $22 billion at current prices.

“In the past week alone, BitMine raised capital from institutional investors at unprecedented speed,” Lee said. “We remain convinced Ethereum represents one of the biggest macro trades of the next decade. As Wall Street and artificial intelligence MOVE on-chain, Ethereum will be the foundation for transforming today’s financial system.”

The company’s rapid expansion has coincided with regulatory shifts that Lee likened to historic financial turning points. He cited the recently enacted GENIUS Act and the SEC’s “Project Crypto” initiative as catalysts comparable to the U.S. abandoning the Gold standard in 1971, a moment that reshaped Wall Street for generations.

BitMine’s aggressive Ethereum strategy has also made its stock one of the most actively traded names in the U.S. market. According to Fundstrat, BitMine shares averaged $2.8 billion in daily trading volume over the past week, placing it 20th among all U.S.-listed equities.

That level of activity puts the company ahead of banking giant JPMorgan and cybersecurity heavyweight Palo Alto Networks, underscoring investor appetite for exposure to its Ethereum-heavy balance sheet.

Fueling its ambitious strategy, BitMine has been rapidly expanding its equity offering program. On August 12, the company filed with the SEC to boost its at-the-market stock sale capacity to $24.5 billion, up from an initial $2 billion authorization in July.

While the funds may be used for bitcoin purchases or mining operations, BitMine has made clear Ethereum remains its primary target.

Corporate Ethereum Holdings Jump 127% in July, Led by BitMine and SharpLink

BitMine’s rapid rise has also reignited competition among Ethereum-focused corporate treasuries. Rival SharpLink Gaming reported holding 728,804 ETH as of June 30, nearly all of it staked to generate yield as the company pivots into a full-scale Ethereum treasury vehicle.

SharpLink has already raised more than $3 billion in capital through direct offerings and private investment vehicles, with co-CEO Joseph Chalom, a former BlackRock executive, arguing that treasury strategies could deliver “multiples of the value of the underlying” for shareholders.

Both BitMine and SharpLink are aggressively staking their reserves, with SharpLink confirming it has earned over 1,300 ETH in rewards to date.

The growing competition was on display last week in Manhattan, where major Ethereum treasury firms pitched Wall Street on the asset’s role as the foundation for a new financial system.

According to Bloomberg, the movement aims to lock away vast amounts of Ethereum’s supply, creating scarcity while positioning corporate players at the center of decentralized finance infrastructure.

The strategy is already having an impact. July marked the largest monthly increase in corporate ETH holdings on record, soaring 127% to 2.7 million ETH worth $11.6 billion.

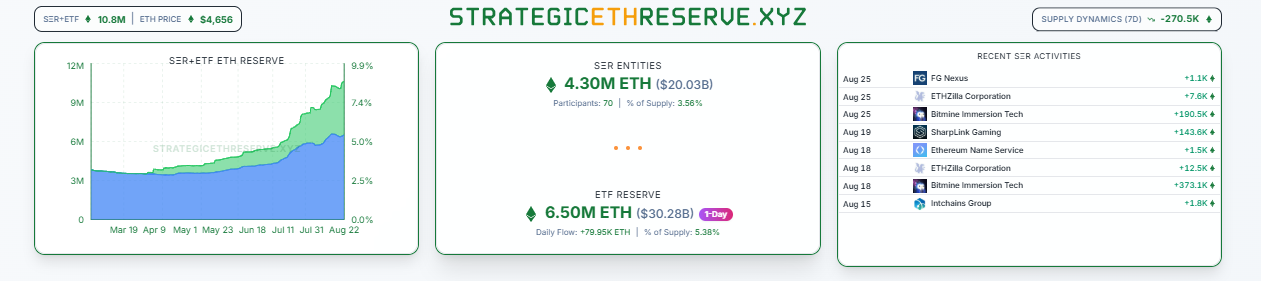

Data from SER shows that 70 entities now hold a combined 4.3 million ETH, roughly 3.6% of the total supply, while ETFs account for another 6.5 million ETH. Together, that represents nearly 9% of all circulating Ether.

BitMine remains the single largest holder with 1.7 million ETH, representing about 40% of corporate reserves, while SharpLink follows with 741,000 ETH, representing 17%.

ETFs, meanwhile, have emerged as an even larger force, now amassing 6.5 million ETH with daily inflows approaching 80,000 ETH.

Globally, the race mirrors developments in Bitcoin. Michael Saylor’s Strategy Inc. expanded its reserves this week, purchasing 3,081 BTC to bring its total to 632,457 BTC worth $71 billion, keeping Bitcoin and Ethereum locked in parallel battles for institutional dominance.

Whales Drive Ethereum Toward $5K as Institutional Flows Favor ETH Over BTC

Notably, whale demand for Ether has surged in the past month, driving a NEAR 25% rally that outpaced Bitcoin’s 5.3% monthly decline. Ethereum is now trading at $4,644.54, down 2.3% on the day but still up 7.1% over the week.

A CryptoQuant report highlighted that institutional flows are favoring ETH over BTC. Data from the Chicago Mercantile Exchange (CME) shows Ethereum futures open interest rising alongside price gains, suggesting strong liquidity inflows.

In contrast, Bitcoin’s recent highs have not been matched by similar open interest recovery, signaling weaker institutional participation.

Analysts note this divergence positions Ethereum as the stronger asset in the short to medium term. Adding to the momentum, retail traders have yet to enter in large numbers, typically a late-stage market indicator, making ETH’s rally appear more sustainable for now.

Meanwhile, Bitcoin dominance has fallen to 57.4%, its lowest level since June, reflecting ETH’s growing share of the market. Binance data further shows whales steadily accumulating Ether since July through spot and futures orders.

Binance Whales Keep Buying ETH

“This strong accumulation thus supports the upward movement and will likely provide enough momentum to push ETH toward the $5,000 level.” – By @Darkfost_Coc

Link![]() https://t.co/fXROsgi9p7 pic.twitter.com/hKwsxGNs3b

https://t.co/fXROsgi9p7 pic.twitter.com/hKwsxGNs3b

Their activity, often following confirmed trends, is reinforcing ETH’s move toward the $5,000 mark, with whale accumulation likely to provide the fuel for further gains.