🚀 Bitcoin at $119K: RSI Nosedives as Fed Rate Cut Probability Hits 92% – Make or Break Moment?

Bitcoin's teetering on the edge of its $119K support level while traders sweat over a plunging RSI and near-certain Fed rate cuts. Will the king crypto defy gravity or faceplant?

The RSI reckoning: Bitcoin's Relative Strength Index isn't just dipping—it's doing a swan dive toward oversold territory. Historically, this either signals a screaming buy opportunity... or the calm before a storm.

Fed put on steroids: With a 92% chance of rate cuts priced in, Wall Street's already popping champagne. But crypto markets? They've got trust issues—remember last time the Fed 'saved' the economy while Main Street got rekt?

Whether this is the dip before the rip or the start of something ugly depends on who you ask. Bulls see institutional FOMO at these levels. Bears see overleveraged degens about to get liquidated. Place your bets.

Macro Events Keep Traders on Edge

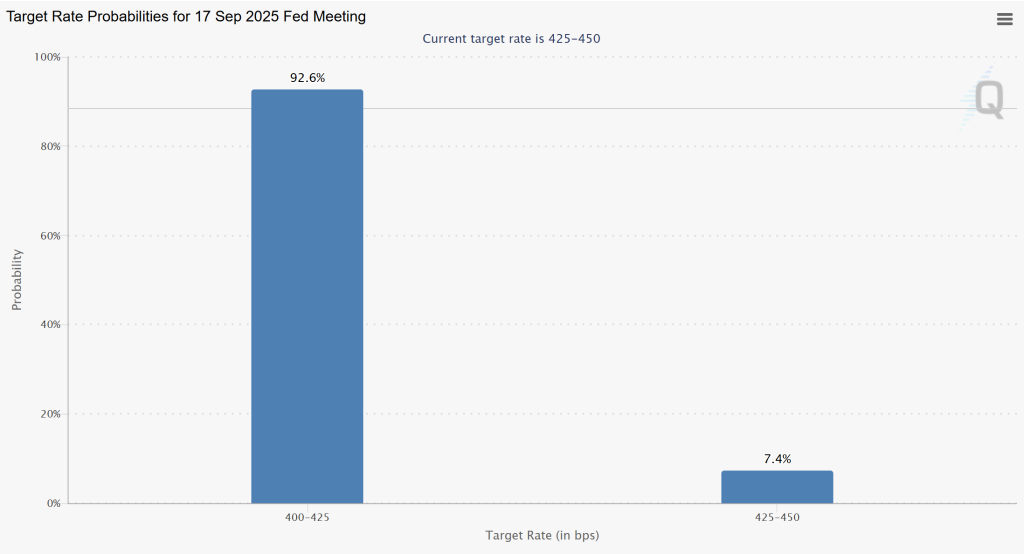

The macro backdrop is playing a critical role in shaping near-term sentiment. CME FedWatch Tool data shows traders are now pricing a 92.6% probability of the Federal Reserve cutting rates to 4.00–4.25% at its September 17 meeting, down from the current 4.25–4.50% range.

This expectation shift came after U.S. PPI data surprised to the upside at +0.9% versus the 0.2% forecast, while weekly jobless claims held steady at 224K.

Now onto Friday’s US retail sales and consumer sentiment numbers, which will tell us if the Fed will stick to the rate cut script. A soft print will boost risk appetite and give bitcoin the push it needs to clear the overhead resistance.

Bitcoin (BTC/USD) Price Prediction: Technical Route to $130K

From a structural perspective, the price action is bullish. The channel is still intact, and higher lows are reinforcing the trend. A break above $126K will trigger buying and accelerate the MOVE to $130K, which is a supply zone and psychological round number resistance.

If this break happens, the channel’s upper boundary will project to $150K in the coming quarters. On the flip side, a close below $117,300 will expose the $113,650 invalidation level, where the 100-SMA is.

Bitcoin (BTC/USD) Trade Setup

For traders, the accumulation zone between $117,300-$118,000 is a good risk-reward setup. Longs can target $123,200 first and then $126,200 with stops just below $113,650 to protect against a deeper correction.

With the technicals stable, the Fed leaning dovish, and macro catalysts coming up, Bitcoin’s next big move may happen sooner than we think. If the bulls can hold the current support and regain momentum, a move to $130K and higher is back on the table.

New Presale Bitcoin Hyper ($HYPER) Combines Bitcoin Security With Solana Speed

Bitcoin Hyper ($HYPER) is the first Bitcoin-native Layer 2 powered by the Solana VIRTUAL Machine (SVM), built to supercharge the Bitcoin ecosystem with fast, low-cost smart contracts, dApps, and meme coin creation.

By merging Bitcoin’s security with Solana’s performance, it unlocks powerful new use cases – all with seamless BTC bridging.

The project is audited by Consult and built for scalability, simplicity, and trust.

Investor interest is surging, with the presale already surpassing $9.6 million and only a small allocation remaining.

HYPER tokens are currently available at just $0.012725, but that price is set to rise soon.

You can buy HYPER tokens on the official Bitcoin Hyper website using crypto or a bank card.

Click Here to Participate in the Presale