Crypto Carnage: $1.05B Liquidation Tsunami Hits Bulls After Hot US Inflation Data – Is the Rally Dead?

Crypto markets just got sucker-punched. A brutal $1.05 billion liquidation wave crushed bullish positions within hours—all thanks to hotter-than-expected US inflation numbers. Leveraged longs got vaporized as Bitcoin and altcoins nosedived.

Was this the knockout blow for the bull run? Or just a painful correction shaking out weak hands? The charts look bloody, but crypto’s never been one to follow traditional logic. Remember: Wall Street analysts still can’t decide if Bitcoin’s a currency, an asset, or a collective delusion—but they’ll charge you 2% to manage it either way.

Key question now: Will institutional buyers treat this as a fire sale or a warning sign? Grab your popcorn—the next 48 hours will separate the diamond hands from the margin-called ghosts.

$1.05B Liquidation Massacre Indicates Pause in the Crypto Bull Run

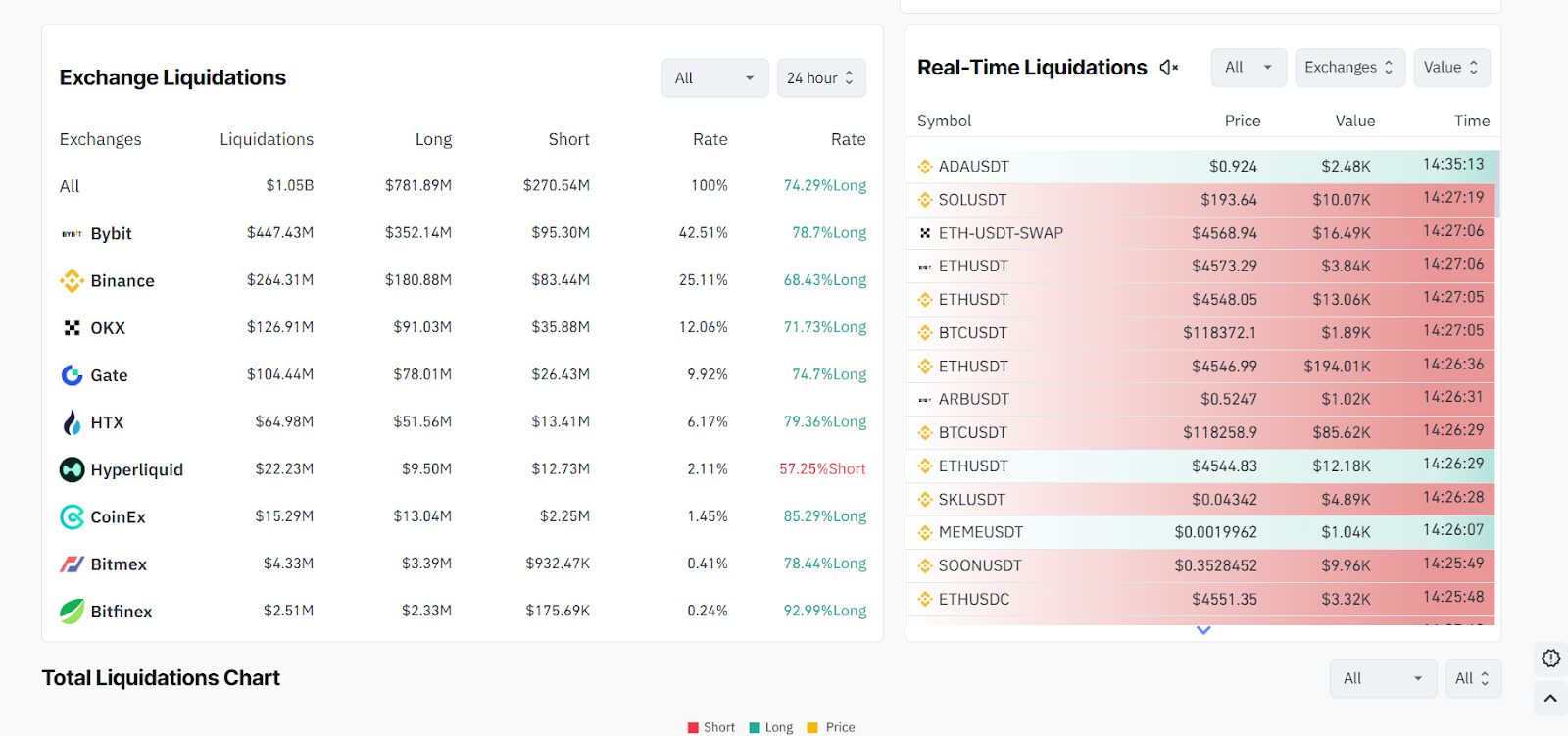

Data from Coinglass reveals the extent of the massacre, showing that over the past 24 hours, more than $781 million in long positions were obliterated while over $270 million in shorts were simultaneously wiped out.

Bybit bore the heaviest casualties, accounting for over 42% of liquidations with approximately $447 million in Leveraged positions destroyed. Other major centralized exchanges, including Binance, OKX, and Gate.io, recorded combined liquidations totaling $495 million.

Examining asset performance, ethereum (ETH) suffered the most severe damage, falling 3.78%, with over $229 million in long positions and $80.22 million in short positions annihilated.

Bitcoin (BTC) declined 2.98%, erasing over $253 million in leveraged positions. Other major casualties included SOL (-5.12%), XRP (-6.63%), Doge (-8.90%), and SUI (-6.73%).

Only Cardano (ADA) managed to stay in positive territory among the top 20 cryptocurrencies, gaining 3.96%.

The liquidation frenzy claimed notable victims, including popular trader AguilaTrades, who lost 18,323 ETH ($83.56 million), leaving only $330,000 in their account.

Caught in the market crash, AguilaTrades(@AguilaTrades) was liquidated for 18,323 $ETH($83.56M) again.

His total losses exceeded $37M, leaving him with only $330K in his account.https://t.co/LeSb2QO0PX pic.twitter.com/wNf4JNwemb

The massive sell-off comes as a shocking reversal, given that Bitcoin just achieved a new all-time high of $124,457 in the early hours of August 14.

Ethereum was merely $120 away from setting its own record, while solana appeared set to challenge previous peaks after breaking above $208.

The trio now trades at drastically reduced levels, with Bitcoin at $118,089, Ethereum at $4,586.76, and Solana at $194.18.

Treasury Secretary Crushes Crypto Bull Run Dreams

Adding fuel to the bearish fire, Treasury Secretary Scott Bessent declared on FOX Business Live that “THE U.S. WILL NOT BE BUYING ANY BITCOIN.”

He clarified that the government will only retain the $15-$20 billion in bitcoin currently held and any additional assets obtained through confiscation.

JUST IN:![]() Treasury Secretary Bessent says the US Government is "not going to be buying" Bitcoin. pic.twitter.com/vL79P531CP

Treasury Secretary Bessent says the US Government is "not going to be buying" Bitcoin. pic.twitter.com/vL79P531CP

This statement directly contradicts previous promises regarding a U.S. Bitcoin stockpile and a Strategic Bitcoin Reserve, dealing another blow to market sentiment.

While Bessent indicated the government WOULD cease selling its Bitcoin holdings, the gloomy revelation has propagated the “market has topped” narrative, prompting many investors to exit positions at losses or breakeven points.

Market psychology has undergone a dramatic transformation, reflected in the crypto Fear and Greed Index, which currently stands at 66.

This represents a major journey from the extreme fear level of 15 recorded in March.

Just one week ago, the index registered a neutral 51, but Ethereum’s impressive rally and Bitcoin’s overlapping surge rekindled hopes of a generational bull run.

The sudden liquidation event has crushed these aspirations, leaving market participants in a state of exhaustion.

Crypto analyst “TradeWithThanos” warns that a bear market may be imminent and advises extreme caution, particularly ahead of the next FOMC meeting in September.

However, prominent key opinion leader Ansem maintains optimism, asserting that 2025 and 2026 will prove most rewarding for crypto assets, suggesting the market top has not yet been reached.

sentiment on altcoins is at all time lows with $BTC & $ETH @ all time highs and the most attention *ever* on the space from outsiders

my bet is 2025 & 2026 will be the most fruitful for cryptoassets, and will be driven by innovative protocols gaining meaningful traction https://t.co/uj1dqh5CYS

Bitcoin Technical Analysis Points to Further Downside

From a technical perspective, the BTC/USD daily chart indicates that the price recently swept liquidity into a rejection block and failed to break higher, indicating a potential reversal zone.

The current level of around $119,000 has established itself as a formidable resistance, with the price rejecting after tapping into a fair value gap (FVG).

Chart analysis suggests that if this rejection persists, Bitcoin could retrace toward the mid-$110,000 region.

The unfilled gap around $108,000–$110,000 presents a strong price magnet, aligning with the last unfilled gap from the recent rally.

Should this support level fail, deeper purple support zones could face testing.

Overall, the technical bias favors a corrective downward movement before any renewed attempt to reclaim recent highs.