🚀 $RAY Soars 33% in a Week as Solana DeFi Ignites with $200M Buyback Frenzy

Solana's DeFi ecosystem just got a jet-fuel injection—$RAY skyrockets as institutional money storms in.

When $200 million floods buybacks, even crypto skeptics check their portfolios twice. Here's why the bulls are charging.

• The buyback blitz: Not your average 'number go up' tech—this move redefines Solana's liquidity wars.

• DeFi on steroids: Suddenly, staking yields look like pocket change compared to $RAY's parabolic rally.

• Traders vs. HODLers: The 33% weekly pump sparks FOMO—and whispers of 'here we go again' from 2021 veterans.

Cynical take: Wall Street would call this 'efficient capital allocation'... if they understood blockchain. Meanwhile, degens count lambo colors.

Source: CoinGecko

Source: CoinGecko

How Solana’s Top DEX is Capturing DeFi Growth

Raydium is a leading decentralized exchange (DEX) and automated market Maker (AMM) on Solana.

Since its launch in 2021, Raydium has rolled out innovative features such as permissionless liquidity pools, an NFT launchpad, ecosystem farming opportunities, and concentrated liquidity market makers (CLMMs).

The recent V3 upgrade delivered a more intuitive UI, reduced-cost CPMM pools, integrated price oracles, and support for Solana Token-2022 standards.

On DeFiLlama, Raydium’s Total Value Locked (TVL) stands at approximately $2.33 billion, with daily DEX volume surpassing $1.16 billion. This TVL is a modest figure compared to powerhouses Lido ($40.8B) and AAVE, with over $35B in value locked in the protocol.

Nevertheless, the protocol generates about $196K in daily revenue and has returned over $654M to holders cumulatively. Around $126M in $RAY is staked, representing about 12.6% of its market cap.

$RAY holders benefit from governance rights and a share of trading fees, with 0.03% of fees distributed to token holders and 0.22% to liquidity providers. Additionally, $200M has been earmarked for programmatic buybacks, reinforcing its value-capture model.

Progress is made daily and @RaydiumProtocol is closing in on a new milestone

Nearly $200m allocated to programmatic $RAY buybacks pic.twitter.com/IYe1XCu0MT

The visibility of $RAY increased with its June 19 listing on Upbit as the $RAY/USDT and $RAY/KRW trading pairs catalyzed a price surge.

$RAY jumped between 9.5% and 18%, with prices rising from approximately $2.07 to $2.78, accompanied by strong whale activity, including $2.26 million in $RAY tokens moved to Binance, presumably for profit realization

The price of $RAY surged by nearly 25% due to its listing on Upbit.

Whale 256Eh2 deposited 906,788 $RAY($2.26M) into #Binance after the pump, possibly to sell.https://t.co/F6UVfMuEVk pic.twitter.com/x03YR48yfl

In July 2025, $RAY delivered $40 billion in trading volume and generated over $18 million in protocol revenue, supported further by $5.7 million in buybacks—a clear sign of deepening user engagement and liquidity.

Month of July Review: @RaydiumProtocol

– $40.1b in cumulative monthly volume, MoM increase of 71%

– $18.33m in protocol revenue, MoM increase of 137%

– $5.7m allocated to programmatic $RAY buybacks (2.1m RAY) + additional discretionary maker-side buyback of 1.35m RAY (3.45m… pic.twitter.com/TTAIe5pmVG

With solid liquidity, active governance, and a leading position in Solana DeFi, Raydium is positioned for continued relevance in the multi-chain trading ecosystem.

Raydium Rebounds from Local Support But Faces Overhead Supply Risk

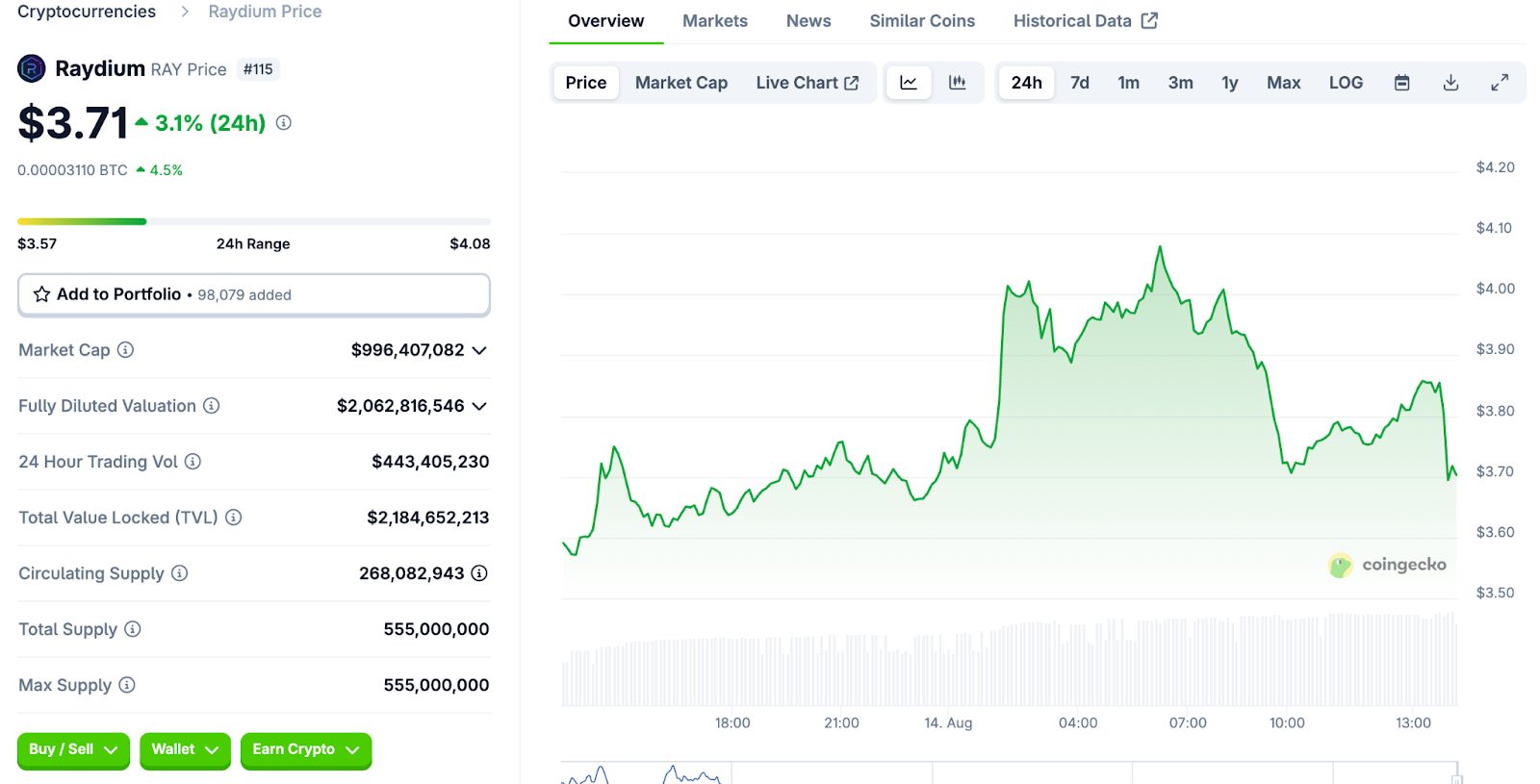

The recent performance of $RAY reflects a technical reaction following a post-breakout rally, with the price now oscillating between key intraday zones of demand and resistance.

After breaching the local high around $4.20, the asset pulled back sharply and is now hovering NEAR the $3.65 region, just above the 100-period SMA on the 30-minute chart—an area that has functioned as soft support during the last two sessions.

On the price chart, we observe a bullish structure forming between August 12 and August 13, which finally created the breakout that was supported by the 20-period SMA flipping above the 100-SMA. However, the rally began losing steam near $4.20, and a textbook lower high has since formed on the 30-minute timeframe.

The volume footprint also detailed the losing momentum in this rally. The 13:00 candle reflected a spike in net selling pressure, with a massive negative delta of 78.89K, the highest in the observed session.

Sellers aggressively lifted offers into a thin bid stack, as evidenced by clusters of red imbalances and block trades between $3.58 and $3.62. The footprint also reveals multiple failed attempts to hold above $3.75, with sell imbalances repeatedly overpowering buying efforts despite fair total volume (662K).

Cumulatively, the volume delta shows sellers have consistently controlled the initiative from the $3.90 zone downward. For buyers, reclaiming this zone is key to neutralizing the bearish shift. Until then, the bias and structure lean bearish, especially with the thin liquidity below $3.60 and the next major support closer to $3.50.