Michael Saylor Doubles Down: MicroStrategy Snags 155 Additional Bitcoin – A Bullish Signal for Crypto Markets

MicroStrategy's founder just dropped another $10M+ into Bitcoin—because apparently, traditional finance wasn't volatile enough for his taste.

The move signals institutional confidence despite recent market turbulence. Saylor's now sitting on a stash worth billions, proving once again that crypto's biggest whales wear suits.

Meanwhile, Wall Street analysts clutch their pearls.

A Record-Breaking Bitcoin Balance Sheet

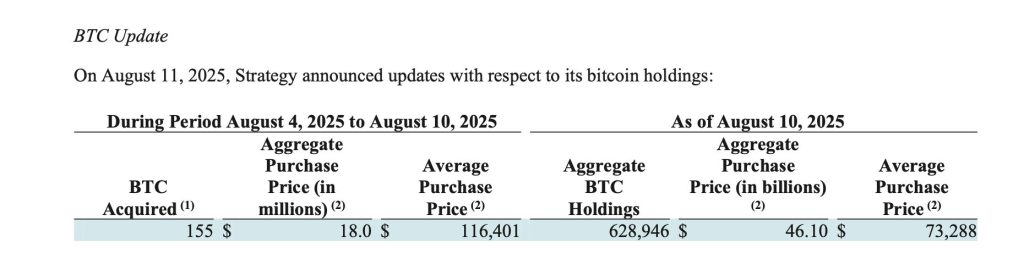

Following this latest purchase, Strategy’s total Bitcoin holdings now stand at 628,946 BTC. The company’s cumulative investment in Bitcoin amounts to roughly $46.10 billion, translating to an average purchase price of $73,288 per bitcoin.

These figures cement Strategy’s position as the largest publicly traded corporate holder of Bitcoin by a wide margin. The company’s Bitcoin yield for the year-to-date in 2025 is an impressive 25%, reflecting significant gains in the asset’s market value this year.

Why This Acquisition Stands Out

The timing of this acquisition is notable. Bitcoin prices have surged in 2025, driven by institutional adoption, increased integration into traditional financial markets, and macroeconomic factors such as persistent inflation and currency debasement fears. Buying at over $116,000 per bitcoin shows Strategy’s confidence in further upside potential.

Saylor has repeatedly stated that Bitcoin represents “digital gold” and a superior form of money. His strategy has been to convert a large portion of Strategy’s balance sheet into Bitcoin, financing some purchases through debt and equity offerings. This latest MOVE suggests that Saylor sees continued strength in the market, despite already substantial gains this year.

Market Implications and Investor Reactions

Strategy’s Bitcoin accumulation has made its stock a proxy for Bitcoin exposure among traditional equity investors. Following previous purchase announcements, MSTR shares have often mirrored Bitcoin’s price movements, rising as sentiment around the cryptocurrency improves.

Investors and analysts will be watching closely to see how this additional purchase affects both the company’s market valuation and its future financial results. With over $46 billion in Bitcoin now on its books, Strategy’s fortunes are increasingly tied to the performance of the world’s largest cryptocurrency.