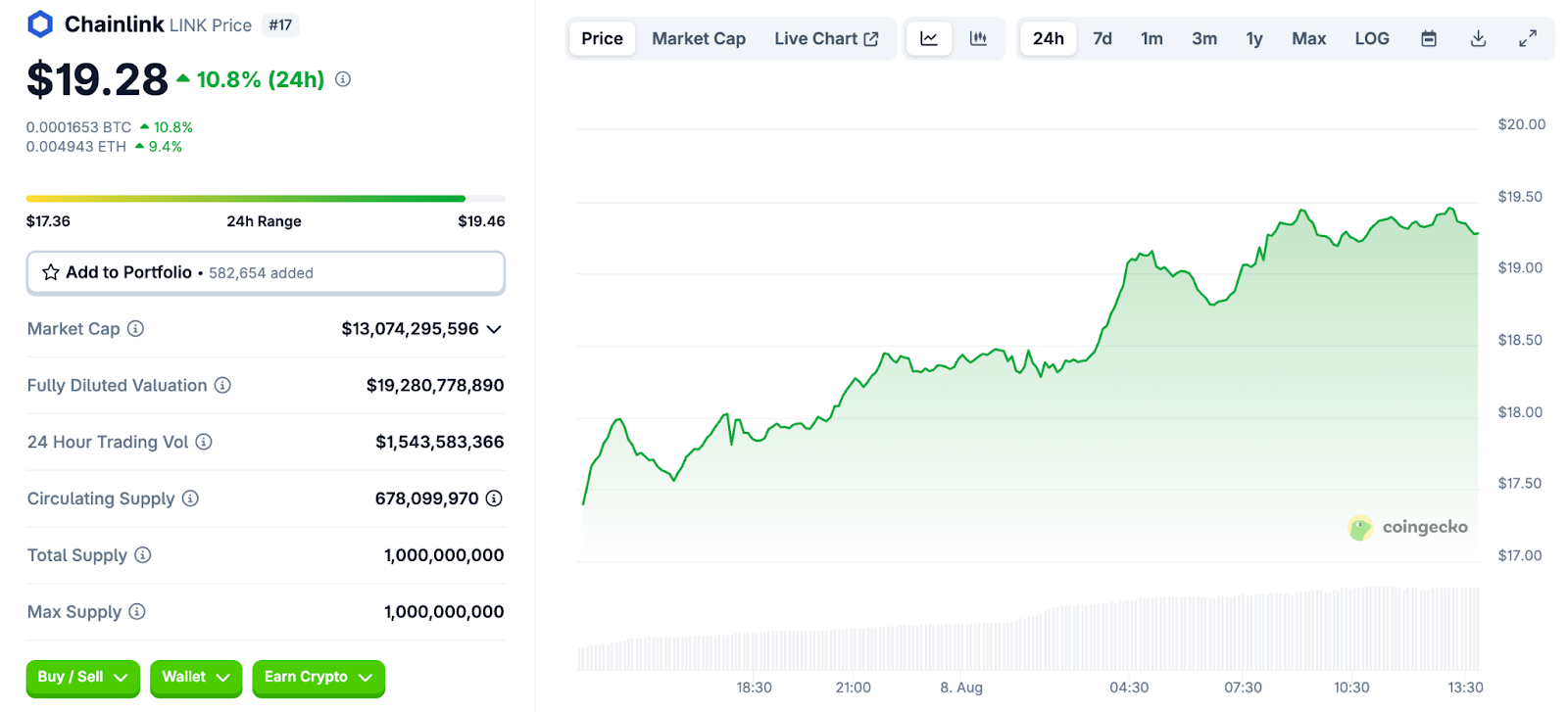

🚀 $LINK Surges 10% to $19.28 as JPMorgan & Mastercard Embrace Chainlink Integration

Wall Street meets blockchain—again. Chainlink's $LINK just ripped past $19 after legacy giants JPMorgan and Mastercard plugged into its oracle network. Cue the institutional FOMO.

Banking's awkward crypto phase continues

JPMorgan's blockchain division quietly deployed Chainlink for cross-border settlements, while Mastercard—yes, the credit card dinosaur—is testing price feeds for tokenized assets. TradFi's crawling toward decentralization like a boomer learning TikTok dances.

Oracles eating the world

Smart contracts need real-world data. Chainlink delivers it without centralized points of failure—a concept so revolutionary, even suit-and-tie finance is grudgingly adopting it. The 10% pump suggests traders think this is more than just another enterprise 'blockchain experiment.'

Bonus jab: Nothing gets crypto bros harder than institutional validation—except maybe a vague Elon tweet.

Source: Coingecko

Source: Coingecko

Driving Adoption Across DeFi, Banking, and Tokenized Assets

Chainlink is a uniquely designed decentralized oracle network that securely bridges on-chain smart contracts with real-world data, cross-chain messaging, and off-chain computation. This protocol powers Core use cases across DeFi, banking, tokenized real-world assets (RWAs), and more.

Additionally, Chainlink’s data feeds underpin risk management protocols such as Aave, Compound, and MakerDAO, while emerging applications—such as Proof of Reserve for real-asset tokenization—demonstrate broad adoption.

The $LINK token operates within a clearly defined tokenomics model, featuring a fixed supply of 1 billion tokens, with a fully diluted valuation of $19.28 billion and a current market cap of $13.07 billion.

$Link When tokenomics kick in….its game over. Chainlink has the best tokenomics of all tokens… and one day they will be turned on.

Token value necessary for sybil resistance economic incentivization proportional to value of data secured.

In addition to network service… pic.twitter.com/5JOrYE92Aw

Approximately $839.5 million worth of $LINK (6.4% of market cap) is staked to secure oracle services. At the same time, total value locked sits at zero, reflecting LINK’s function as a service-fee token rather than a locked collateral asset.

On-chain demand is demonstrated by 780,613 distinct $LINK holders, according to Etherscan, showing broad distribution across retail and institutional actors.

Unlike traditional DeFi protocols that track value through total value locked, Chainlink functions as a service-fee network, generating meaningful revenue through its various offerings.

The platform currently produces approximately $4.62 million in annualized fees derived from services, including data requests, automated contract execution through Keepers, Verifiable Random Function (VRF), and Cross-Chain Interoperability Protocol (CCIP) operations.

In addition, the platform recently unveiled the Chainlink Reserve, a smart on-chain pool funded by revenue from institutional and dApp fees that now holds over $1 million in $LINK.

By automatically converting payments in various tokens into LINK and committing to no withdrawals for years, the reserve underpins network security and indicates a long-term commitment to decentralized infrastructure.

Chainlink just made one of its most strategic moves yet:

Introducing the Chainlink Reserve, fully funded with $LINK

It’s a self-sustaining reserve designed to power the long-term growth of the Chainlink Network

Here’s what matters:

→ All service fees (paid in ETH, USDC,… pic.twitter.com/67zeb6oiUW

Chainlink’s network adoption continues to grow across both decentralized and traditional financial sectors.

Recent integrations include major legacy institutions like JPMorgan, Lloyds, and BNP Paribas utilizing Chainlink oracles for DeFi-style trade settlements, while Mastercard has implemented Chainlink technology for direct on-chain cryptocurrency purchases.

We’re excited to announce that Chainlink and @Mastercard have partnered to enable billions of cardholders to purchase crypto directly onchain.https://t.co/1pKz03jQ7t

Chainlink verifies and synchronizes key… pic.twitter.com/5jfLAAYn4D

These partnerships show Chainlink’s growing role as a bridge between conventional finance and blockchain innovation.

Chainlink Holds Gains Near $19.30 After Sustained Breakout

Chainlink ($LINK) has extended its upward trend, now consolidating NEAR $19.27 after an aggressive rally that began around August 7.

On the 30-minute chart, the structure shows a clean breakout from the $17.00–$17.20 consolidation zone, followed by a steep incline toward the $19.30 area.

The MOVE has been supported by increasing buying volume, particularly visible during the impulsive candles leading to the breakout.

The alignment of the simple moving averages underlines our bullish bias. Firstly, $LINK is trading well above the 20-day SMA at $19.21, which has acted as immediate support during minor dips in the past.

Also, the 50-day SMA at $18.56 is still way below, confirming the medium-term uptrend, while the 100-period SMA at $17.64 remains under the current trading price, suggesting that the market structure has shifted decisively in favor of buyers. The asset’s RSI has also slowed a bit.

$LINK’s RSI has settled at 60.57 after retreating from overbought territory near 70. This suggests that the market has cooled slightly without indicating a momentum breakdown. If RSI remains above 55, the uptrend’s internal strength is likely to be maintained.

The MACD also supports the bullish case, with the MACD line still above the signal line despite narrowing slightly. The histogram shows reduced positive bars, indicating that while upward momentum persists, the pace may be slowing, opening the possibility of sideways action before another leg higher.

Regarding the pattern formation in this setup, the chart resembles a bullish flag breakout that extended into a strong continuation run. The steady climb with higher lows and controlled pullbacks points toward healthy trend behavior rather than an overextended spike.

If the bulls can hold $LINK above $19.00, the probability of a retest and possible break above $19.35–$19.40 skyrockets. In contrast, failure to defend the structure at $19 could lead to a short-term pullback toward the $18.50 support area.