Bitcoin’s ’Fakeout’ Fuels Bullish Frenzy – Traders Predict Imminent All-Time Highs

Bitcoin’s latest price action has traders buzzing—what looked like a bear trap might just be the launchpad for a historic rally.

The Fakeout That Fooled Everyone

Market veterans are calling Bitcoin’s recent dip a classic 'fakeout,' a deceptive move that shakes out weak hands before roaring back. Now, the smart money’s betting on a breakout—fast.

ATHs Incoming?

With volatility spiking and liquidity flooding back into crypto, analysts see parallels to past pre-bull run setups. One hedge fund manager quipped, 'Wall Street’s still trying to short this—good luck with that.'

The Cynic’s Corner

Meanwhile, traditional finance pundits insist 'this time it’s different'—just like they did before every 100% Bitcoin rally since 2013.

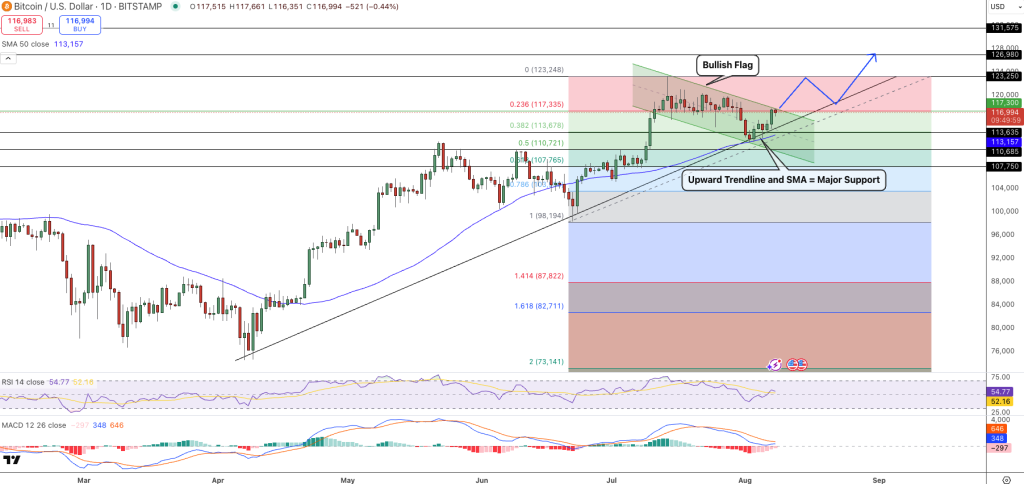

Bitcoin (BTC/USD) Technicals Signal Breakout Toward $131K

On the daily chart, Bitcoin is forming a textbook bullish flag beneath the $117,335 Fibonacci 0.236 retracement. This follows a sharp rally from the $98,000 area, anchored by a long-term ascending trendline and the 50-day SMA near $113,157 — a zone that has repeatedly triggered rebounds.

Momentum is shifting in favor of the bulls. The RSI has recovered to 54.77 from oversold conditions without entering overbought territory, and the MACD is flattening NEAR the zero line, suggesting fading bearish pressure. A close above $117,335 today could see a retest of $123,250 with the flag’s measured move targeting $126,980-$131,575.

Key levels to watch:

- Support: $113,635-$113,157; $110,685

- Resistance: $117,335; $123,250; $131,575

- Breakout Target: Low $130Ks with potential to $150K longer term

If price dips, holding above $113,000 is key to the bullish setup. A break below $110,685 would delay the breakout.

Global Trends Add to Bullish Case

Beyond the charts, macro is looking good for Bitcoin. In the US, the Fed is expected to cut rates in September with 95% probability according to CME’s FedWatch Tool. Lower rates tend to boost demand for risk assets including crypto.

Chances of a September rate cut have jumped to almost 95%.

Massive liquidity is coming.

Don't wait for the official announcement, buy the dip now

10-50x moves from here shouldn't be surprising. pic.twitter.com/1szrgTxkat

In Asia, China is pushing forward with stablecoin plans through Hong Kong to promote the Renminbi and reduce US dollar dependence in trade. This growing adoption of digital assets (even indirectly) supports Bitcoin’s long term demand story.

If the bullish flag pattern resolves as expected, current levels could be the last stop before BTC tests $131K in the coming weeks, setting the stage for renewed speculation about $150K and beyond.

New Presale Bitcoin Hyper ($HYPER) Combines Bitcoin Security With Solana Speed

Bitcoin Hyper ($HYPER) is the first Bitcoin-native Layer 2 powered by the, built to supercharge the bitcoin ecosystem with fast, low-cost smart contracts, dApps, and meme coin creation.

By mergingwith, it unlocks powerful new use cases – all with seamless BTC bridging.

The project isand built for, and.

Investor interest is surging, with the presale already surpassingand only a small allocation remaining.

, but that price is set to rise in the next 3 days.

You can buy HYPER tokens on the official Bitcoin Hyper website using crypto or a bank card.

Click Here to Participate in the Presale