🚨 Crypto ETF Bloodbath: Bitcoin Bleeds $333M, Ethereum Dumps $465M in 24 Hours – Time to Panic or Buy the Dip?

Crypto markets got sucker-punched today as ETF outflows hit record highs. Bitcoin and Ethereum led the rout—but is this a healthy correction or the start of something uglier?

The Great Unwinding: Institutional players yanked capital at warp speed, with BTC and ETH seeing their worst single-day outflows since the 2024 bull run began. Classic 'sell the news' behavior after last month's ETF approvals.

Silver Linings Playbook: Veteran traders point to leveraged longs getting liquidated—a necessary purge before the next leg up. Meanwhile, crypto Twitter oscillates between 'THE END IS NIGH' and 'DISCOUNT SATOSHIS.'

Wall Street's Short Memory: The same suits who FOMO'd into ETFs at ATHs are now panic-selling into weakness. Some things never change—like hedge funds frontrunning retail yet again.

One thing's certain: volatility is back with a vengeance. Strap in.

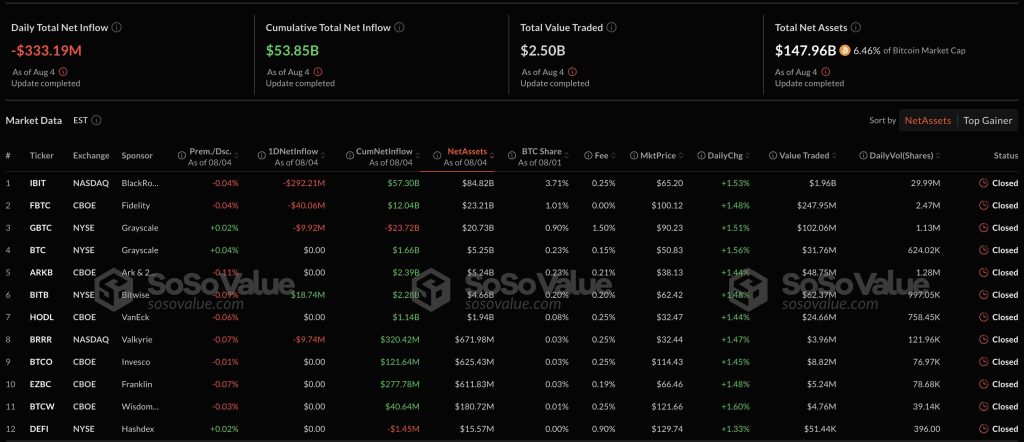

This is the first significant outflow since February. Thoughts? pic.twitter.com/IJYz30weJ2 — crypto Seth (@seth_fin) August 5, 2025

The institutional asset manager, previously known for accumulating substantial BTC and ETH positions, is now facilitating large-scale liquidations on behalf of its investors.

Crypto ETF Selloff is “PTSD from 2017 & 2021” – Bull Run Far From Over

The widespread speculation that the crypto bull run may have reached its peak appears justified as Bitcoin retreated to $111,920 lows, failing to reclaim the $116,000 level throughout August.

Similarly, Ethereum touched $3,357 support levels and continues to face resistance at the $3,700 threshold.

The selloff extended beyond BlackRock, with Fidelity and Grayscale also reporting significant outflows from their crypto Spot ETFs, approximately $49 million in bitcoin and $91 million in Ethereum over the past 24 hours.

BlackRock’s Ethereum ETF experienced its most substantial outflow since inception, with 101,975 ETH tokens valued at $375 million being liquidated, effectively ending the asset manager’s 21-day consecutive inflow streak.

ETH ETFs were bloody red today:![]() 133.1K ETH ($465M) of outflows.

133.1K ETH ($465M) of outflows.

On the bright side, ETH ended up green for the day (+6.3%). pic.twitter.com/s0fBqhjbiM

The collective Ethereum ETF outflows reached $465.1 million, marking the largest single-day net redemptions since spot Ether ETFs launched in July 2024.

Crypto investor Ted Pillows acknowledged the market’s anxiety surrounding the recent ETH ETF outflows, noting that many participants view this as a potential cycle peak indicator.

However, Pillows maintains that the current fear lacks fundamental backing, describing it as “emotional baggage” and “PTSD from previous market crashes in 2017 and 2021.”

People are scared by the $ETH ETF outflows over the past two days.

Now, some think this is the top.

But let’s be real, that fear isn’t rooted in fundamentals. It’s emotional baggage.

It’s the PTSD from getting burned in 2017 and 2021.

Just last weeks, sentiment was extremely… pic.twitter.com/otFc8gCXTE

Given that ETF participants are approximately 60% retail investors, Pillows suggests the current reaction represents profit-taking driven by fear rather than strategic positioning.

Ethereum Technical Analysis: ETH Eyes $4,050 Bullish Flag Breakout Despite ETF Selloff

From a technical perspective, Ethereum’s 4-hour chart displays a classic bullish flag formation that recently broke higher, indicating potential trend continuation.

The price surge from below $3,400 to the $3,700 zone has led to consolidation within a tight range, currently retesting the breakout area.

The measured target from this flag pattern suggests a move toward the previous swing high resistance NEAR $4,050, representing approximately 10% upside potential from the breakout level.

The MACD indicator reinforces this bullish outlook, having crossed into positive territory with the MACD line advancing above the signal line and the histogram displaying increasing bullish momentum.

Meanwhile, the RSI reading of 56.74 shows upward momentum while remaining well below overbought conditions, indicating room for additional gains before exhaustion signals emerge.

CryptoQuant analyst Abramchart shares this optimistic perspective regarding Bitcoin, stating that the BTC price remains within a bullish zone, primarily supported by Long-Term Holder (LTH) confidence and conviction.

The analyst attributes the current dip and selling pressure to short-term holders and retail participants.

Julio Moreno, Head of Research at CryptoQuant, concurs that the crypto bull market is not yet over, explaining that Bitcoin is currently experiencing its third significant profit-taking wave in the present bull cycle, leading to a consolidation and correction phase before the next upward movement.

Profit, Pause, Push: Bitcoin is undergoing its third major wave of profit-taking in the current bull market.

This leads to a period of consolidation/correction before the next leg up.

View our most recent report, published yesterday, in the post below![]() pic.twitter.com/Xu2kq035N3

pic.twitter.com/Xu2kq035N3

Bitcoin Technical Analysis: Wave V Target $126,300 As Elliott Analysis Points Higher

Bitcoin’s daily chart reveals a distinct Elliott Wave pattern, with price currently consolidating in wave iv just below recent peaks around $120,000.

This follows earlier consolidation phases in waves II and III, both of which resolved with bullish breakouts.

The RSI Divergence Indicator shows recent bearish divergences during July highs, signaling momentum deterioration and explaining the ongoing pullback.

However, the RSI currently hovers near 47.75, suggesting weakening bearish momentum, as previous bullish signals from RSI lows in March and May preceded strong rallies.

Critical horizontal support levels are positioned around $113,900 and $105,000, with the crucial support zone at $95,600 serving as the invalidation point for the bullish wave structure.

![]() #Crypto market is down today, with all top 100 coins in the red. Still, there is a 46% chance #BTC hits $150,000 by year’s end.#Bitcoin #ETH #Ethereumhttps://t.co/c2EUtgwuPT

#Crypto market is down today, with all top 100 coins in the red. Still, there is a 46% chance #BTC hits $150,000 by year’s end.#Bitcoin #ETH #Ethereumhttps://t.co/c2EUtgwuPT

Should Bitcoin maintain these support levels with buyer intervention, the chart suggests consolidation could complete wave IV and trigger a bullish breakout toward the projected wave V target at approximately $126,300.

Failure to hold support could result in a deeper correction before any potential recovery.