Pepe Price Prediction: Crypto Titan Arthur Hayes Dumps PEPE – Bull Market Doom or Buying Opportunity?

Crypto heavyweight Arthur Hayes just made waves by offloading his PEPE holdings—sparking panic across meme coin markets. Was this a canary in the coal mine for the bull run?

The sell-off comes as PEPE struggles to reclaim its all-time highs, leaving traders questioning whether the frog-themed token has hopped its last rally. Meme coins live and die by whale movements—and when a billionaire exits stage left, retail investors scramble for the doors.

But here’s the twist: every market needs a villain. Hayes’ departure could be the shakeout PEPE needs before its next leg up. After all, nothing pumps a crypto like a ‘smart money exits, dumb money panics’ narrative.

Pro tip: Watch the derivatives data. If open interest collapses alongside price, even the degens might finally admit this frog’s been boiled. Until then—buy the dip, sell the rip, and remember: in crypto, ‘fundamentals’ is just Wall Street slang for ‘bagholder cope’.

Arthur Hayes Moves Away From Pepe – Will Others Follow?

Blockchain analytics platform Lookonchain initially reported that Hayes sold an estimated $13 million in crypto assets on August 2, including $414,000 in PEPE.

Arthur Hayes(@CryptoHayes) sold 2,373 $ETH($8.32M), 7.76M $ENA($4.62M) and 38.86B $PEPE($414.7K) in the past 6 hours.https://t.co/1HymJRPhcj pic.twitter.com/MoJNKUjJaQ

— Lookonchain (@lookonchain) August 2, 2025Explaining his rationale in response to Lookonchain, Hayes cited the deteriorating U.S. macro backdrop, pointing to the effects of tariffs now surfacing in Q3 jobs data.

With inflation fears discouraging interest rate cuts globally, he argues that no major economy is expanding credit fast enough to drive nominal GDP growth.

Hayes expects a potential market repricing, setting the stage for capital to rotate out of volatile assets like cryptocurrencies.

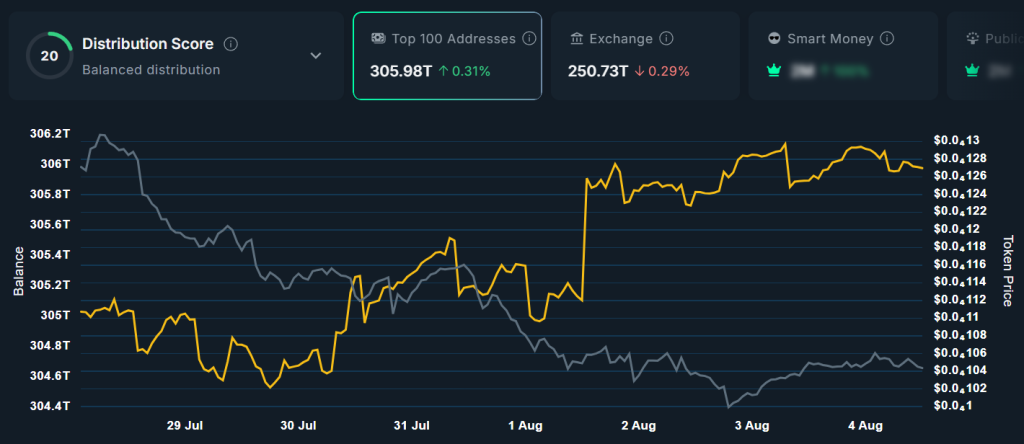

However, it seems Hayes may be alone in his exit. Whales appear to be taking the Pepe Price decline as a buy the dip opportunity according to Nanasen data.

The top 100 wallets continue to accumulate, increasing their holdings by a slowed, but steady 0.31% over the past week to NEAR a total $306 trillion PEPE tokens.

Pepe Price Analysis: Did Hayse Sell Too Early?

While there is merit to the argument that the macro narrative will cast a shadow over the mid-term PEPE price outlook, the recent correction appears to have found a bottom.

With the breakdown momentum of a head and shoulders pattern forming from the mid-July market top now realised, a 2-month symmetrical triangle is back in focus.

ChatGPT said:

The new week has seenfind support at, affirming the lower boundary of its triangle pattern and signaling that a potential reversal may be forming.

If momentum builds, thecould reclaim theneckline of its recent head and shoulders formation, opening the way to key resistance levels atand.

A break abovewould confirm a clean breakout from the triangle, setting the stage for an extended rally. This could push PEPE from aup to a potential, with a breakout target of.

However, momentum indicators remain shaky.

Thebriefly bounced from oversold levels but quickly turned back down, showing a lack of strong follow-through from bulls.

Theline has also flattened just above the signal line — an early sign of potential upside, but without the conviction needed to kick off a sustained uptrend.

This leaves the door open for another retest of thelevel. If that level holds, it could act as a springboard for a stronger second bounce, potentially forming areversal pattern.

But ifbreaks, the bullish scenario is likely invalidated. A breakdown WOULD target lower support around, signaling the end of the current bull run.

Bear Markets Still Hold Gains – Here’s How to Find Them

As “reciprocal” tariffs return, the markets are fearing a repeat of the mid-2025 bear market—holders might be playing the waiting game again.

While large cap coins now consolidate under weak buy pressure as HODLing becomes the new strategy, low-cap plays like TROLL are posting 2x gains in a single day.

That’s where Snorter ($SNORT) steps in. Its purpose-built trading bot is engineered to spot early momentum, helping investors get in before the crowd—where the real gains are made.

While Trading Bots are not a new concept, Snorter has been designed specifically for sniping with limit orders, MEV-resistant token swaps, copy trading, and even rug-pull protection.

It’s one thing to get in first, it’s another thing to know when to sell—Snorter Bot can help.

The project is off to a strong start—$SNORT has already raised almost $2.4 million in its early-stage presale, likely driven by its high 157% APY on staking to rewards early investors.

You can keep up with Snorter on X, Instagram, or join the presale on the Snorter website.

Click Here to Participate in the Presale