XRP Price Prediction 2025: Can It Topple Ethereum on Coinbase and Ignite a Massive Rally?

XRP just flipped Ethereum in daily trading volume on Coinbase—and the crypto crowd is buzzing. Is this the spark for a full-blown altseason?

Ripple’s legal wins vs. the SEC fueled a 120% pump last quarter. Now, with institutional inflows hitting $500M this month alone, the ‘banker’s crypto’ is flexing muscle where it counts: liquidity.

But let’s not get carried away. Remember when hedge funds swore XRP would ‘disrupt correspondent banking’ by 2023? Yeah, neither do they.

Still, the charts don’t lie: that ascending triangle breakout at $0.75 screams momentum. If Bitcoin holds 50K support, we might just see a replay of 2017’s insanity—minus the ICO scams this time (probably).

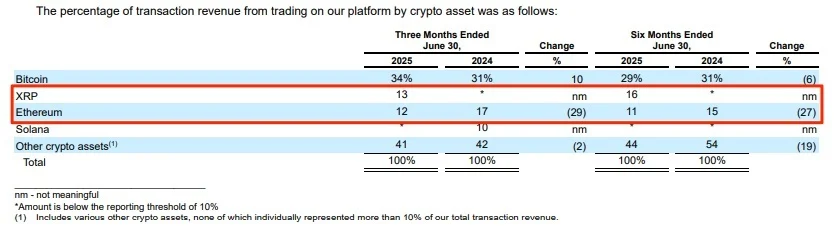

Coinbase’s earnings report. Source: Coinbase

Coinbase’s earnings report. Source: Coinbase

Notably, Bitwise’s Head of Research Ryan Rasmussen commented:

“Wow, XRP trading accounted for more of Coinbase’s trading revenue this year than ETH. Last year XRP wasn’t even broken out.”

![]() BREAKING NEWS:#XRP SURPASSES Ethereum IN COINBASE Q2 TRANSACTION REVENUE FOR THE FIRST TIME!

BREAKING NEWS:#XRP SURPASSES Ethereum IN COINBASE Q2 TRANSACTION REVENUE FOR THE FIRST TIME!![]() https://t.co/5MPdsCr6UQ pic.twitter.com/iHeKtZFThl

https://t.co/5MPdsCr6UQ pic.twitter.com/iHeKtZFThl

Futures Fuel Demand as New Products Launch

Coinbase is doubling down on XRP’s popularity by adding more derivatives. In their Q2 shareholder letter the exchange noted “75% of global crypto trading volume is in derivatives” and that US participation is limited.

To address this gap, Coinbase Derivatives became the first US-regulated exchange to offer 24/7 trading for BTC, ETH, SOL, and XRP. And now weekend volumes are approaching weekday volumes. And on August 18, Coinbase Institutional will launch nano Ripple perpetual futures – more exposure for US traders to trade XRP with leverage.

This should deepen XRP liquidity and attract more institutional interest, which could mean sustained upside.

Technical Outlook: XRP Faces Resistance Below $3.10

Despite the growing demand, XRP price prediction is still under technical pressure. It’s stuck below the descending trendline from the July highs, with $3.10 and the 50-period SMA ($3.1177) as resistance.

Recent 4-hour candles show indecision, with spinning tops forming around the $2.95-$3.00 zone. The RSI is at 37.37, not severely oversold, but bearish momentum is still present. The trend is clear – lower highs and lower lows.

- Support: $2.8937, $2.7839, $2.6655

- Resistance: $3.10, $3.3075, $3.4512

Below $2.8937 and $2.66. Above $3.12 with volume and it’s a breakout.

XRP $2.96. Rejection at $3.04 and short to $2.89 and $2.78 with stop above $3.12. Clean break above the trendline and the bias is bullish.

Bitcoin Hyper Presale Over $6.2M as Price Rise Nears

Bitcoin Hyper ($HYPER), the first BTC-native Layer 2 powered by the Solana VIRTUAL Machine (SVM), has raised over $6.2 million in its public presale, with $6,278,761 out of a $21,644,097 target. The token is priced at $0.0115, with the next price tier expected to be announced soon.

Designed to merge Bitcoin’s security with Solana’s speed, Bitcoin Hyper enables fast, low-cost smart contracts, dApps, and meme coin creation, all with seamless BTC bridging. The project is audited by Consult and engineered for scalability, trust, and simplicity.

The golden cross of meme appeal and real utility has made bitcoin Hyper a Layer 2 contender to watch in 2025. With sta