XRP Price Prediction: Double Bottom Pattern Signals Bull Run – Is a New ATH Imminent in 2025?

XRP traders are buzzing as a textbook double bottom pattern flashes bullish—just as the crypto market shakes off its regulatory hangover.

Technical breakout or trap? The chart setup mirrors pre-pump conditions from past cycles, but skeptics warn: 'Hope isn’t a trading strategy.'

Key levels to watch: A clean break above $0.75 could trigger FOMO, while failure risks another round of 'we told you so' from the anti-crypto brigade.

Funny how Wall Street still calls it speculative while quietly hoarding bags.

XRP Bull Run Hinges on Double Bottom Pattern

According to popular X analyst Ali Charts, a potential double bottom could see the xrp price return to $3.60, around the level that had capped its recent bull run.

$XRP could be forming a double bottom pattern! A close above $3.30 may confirm the breakout and open the door to $3.60. pic.twitter.com/4MXEmulUHF

— Ali (@ali_charts) July 31, 2025His analysis notes a key resistance at $3.30, the neckline of the double bottom, and the key threshold for a confirmed breakout towards its target. However, the market is hesitant.

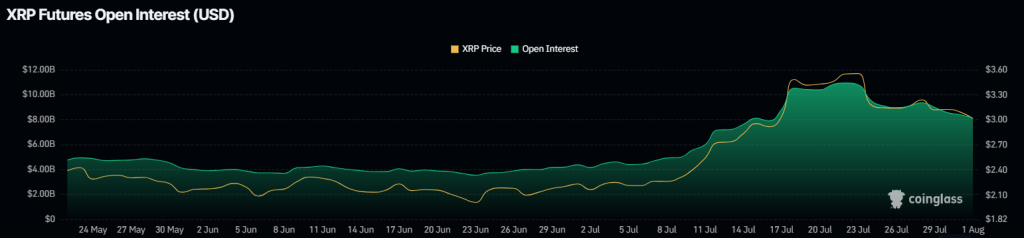

Open interest is showing signs of decline, falling 25% over the past 10 days, according to CoinGlass data—speculative interest is falling with traders wagering less on XRP price moves.

Active derivative traders do appear to be positioning for a continuation, though, with a long/short ratio of 2.59 on Binance showing over 72% of traders are still betting on price increases.

XRP Price Analysis: Is This the Setup for a New All-Time High?

The double bottom highlighted by Ali could set XRP back on the breakout path of its 9-month falling wedge pattern.

While post-breakout momentum stalled with the mid-June market top, a reversal here could refocus attention on its $4.10 target—a potential 40% MOVE to new all-time highs.

Momentum indicators support this outlook. The RSI has rebounded from oversold at 30, now sitting at 37, suggesting buyers are stepping in as sellers reach exhaustion.

Meanwhile, the MACD histogram is beginning to flatten after a death cross, often an early signal of an uptrend on the 4-hour chart as it moves back toward the signal line.

If $2.90 holds, the double bottom will need to break through its neckline at $3.30 to confirm upside toward $3.60 and beyond.

However, if $2.90 fails and macro conditions take control over investor sentiment, the XRP price could tumble to deeper support around $2.70.

Macro FUD Could Make Gains Harder To Find – This Tool Can Help

As “reciprocal” tariffs return, markets are fearing a repeat of the mid-2025 bear market—long-term holders might have to play the waiting game again.

Traders might find more success with short-term speculative plays, low-cap coins making the rounds like Ana are posting up to 1,000%+ gains in a single day.

That’s where Snorter ($SNORT) steps in. Its purpose-built trading bot is engineered to spot early momentum, helping investors get in before the crowd, where the real gains are made.

While Trading Bots are not a new concept, Snorter has been designed specifically for sniping with limit orders, MEV-resistant token swaps, copy trading, and even rug-pull protection.

It’s one thing to get in first, it’s another thing to know when to sell—Snorter Bot can help.

The project is off to a strong start—$SNORT has already raised almost $2.3 million in its initial presale weeks, likely driven by its high 161% APY on staking to rewards early investors.

You can keep up with Snorter on X, Instagram, or join the presale on the Snorter website.