Bitcoin’s Liquidity Stress Test: Why the Profit Party Isn’t Over for the Majority

Bitcoin just faced its latest liquidity gauntlet—and came out grinning. Despite market tremors, most holders are still sitting pretty in the green. Here's why the bulls aren't sweating.

The dip that didn't sink the ship

Volatility? Just another Tuesday. While paper hands panicked, long-term investors barely flinched. The 'super majority' of wallets remain profitable—proving once again that crypto's real gains go to those who stomach the rollercoaster.

Liquidity isn't vanishing—it's evolving

Exchanges may be bleeding reserves, but OTC desks and lightning networks are picking up the slack. (Wall Street would call this 'innovation' if they weren't too busy shorting their own clients.)

The bottom line? Bitcoin's proving it doesn't need perfect conditions to keep holders rich—just enough time for weak hands to fold.

Source: Glassnode

Source: Glassnode

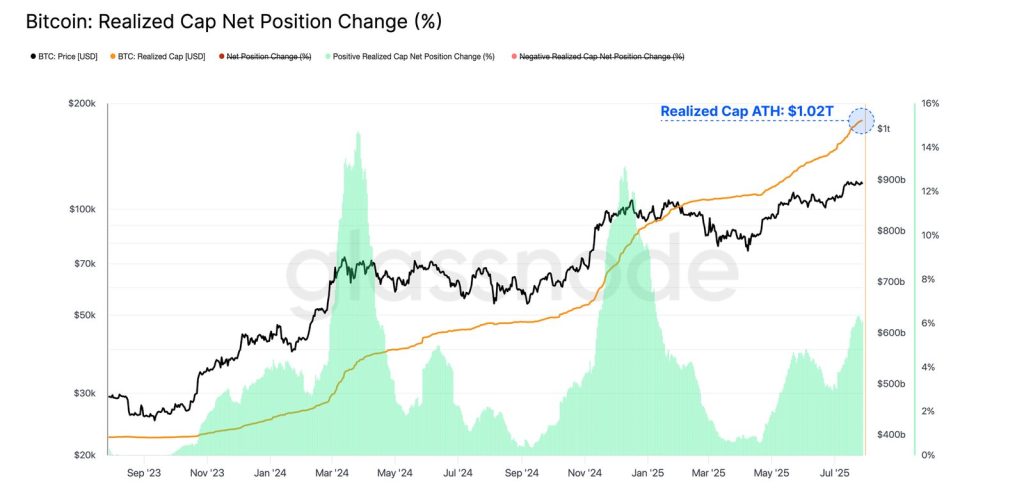

Moreover, the event caused a major spike in the Net Realized Profit/Loss metric, which hit an ATH of $3.7 billion. The spike “preceded the weekend sell-off and reflected the movement of coins in advance of the final distribution.”

Meanwhile, the Bitcoin market has “remained remarkably stable,” even with the sell-side pressure and profit-taking by long-term investors. Therefore, a “supermajority” of investors still hold their BTC “at a meaningful unrealized profit, with over 97% of the circulating supply still held, despite spot prices trading above their original acquisition price.”

Unrealized profits, or the total dollar value of paper gains across all market participants, recently hit an ATH of its own of $1.4 trillion in aggregate.

These metrics underscore “how the majority of investors are sitting on substantial paper gains, and set up an environment of potential future sell-side pressure should prices continue to rise further”, the report notes.

You may also like: BTC’s Upwards Trajectory is Unshaken, But Few Altcoins Will Perform Well – Coinbase and Glassnode Despite potential risks, Bitcoin (BTC) is likely to continue rising this year, though the same can’t be said for the vast majority of altcoins, according to the latest Charting crypto report, a joint publication of Coinbase Institutional and Glassnode, reflecting data until 30 June, 2025. Companies are increasingly investing in crypto for their treasuries, particularly in BTC. This creates “a meaningful new source of demand.” Leveraged funding of crypto purchases could present risks...Bitcoin May Move to $141,000 if It Breaks Above Current Range

The resulting sell-side pressure from the whale’s exit pushed the price down to $115,000. It then stabilized at $119,000, just below the latest all-time high, despite the scale of the transaction.

“This episode illustrates Bitcoin’s ability to absorb large sell-side volumes, even during typically thinner weekend trading hours, reinforcing the market’s structural robustness,” the report argues.

Meanwhile, BTC currently trades at $118,363. It’s unchanged in a day and in a week. It’s up 10% in a month and 77% in a year.

BTC hit its ATH of $122,838 on 14 July, decreasing 3.7% since.

Per several on-chain valuation models, Bitcoin remains range-bound between $105,000 and $125,000. A decisive breakout above this range could “shift market dynamics” and make way for a MOVE toward $141,000. The latter is an area where “profit-taking could sharply intensify.” It’s likely to see increased sell-side pressure due to the high unrealized profit expected there.

On the other hand, “a light volume zone sits just below the current price between $110,000-$115,000.” This is “a critical area to monitor should a market pullback occur.”

Meanwhile, the Long-Term Holder Net Realized Profit/Loss jumped to a new ATH of $2.5 billion, compared to the previous high of $1.6 billion.

Also, the researchers compared the ratio between Long and Short-Term Holder supply, noting a recurring pattern across all three ATH formations this cycle. There’s an initial phase of accumulation, followed by a sharp pivot into aggressive distribution, they write.

The distribution phase is underway, and the LTH/STH supply ratio continues to contract.

Additionally, the Unrealized Profit metric indicated that many investors are still “quite positive about market conditions, acting as a tailwind for sentiment, but also a growing incentive to cash in on the road ahead.”

You may also like: Why Is Crypto Down Today? – July 30, 2025 The crypto market is down today, with 92 of the top 100 coins per market in the red. The cryptocurrency market capitalization has dropped by another 4.8% over the past 24 hours to $3.95 trillion. At the same time, the total crypto trading volume is at $146 billion. Crypto Winners & Losers Over the past 24 hours, only two of the top 10 coins per market capitalization have seen their prices rise. Bitcoin (BTC) decreased by 0.7% in a day, now trading at $118,159. This is the second...