Rich Dad Poor Dad Author Sounds Alarm: "1929-Style Crash Coming!" – Goes All-In on Bitcoin, Gold & Silver

Wall Street's favorite contrarian is back—and this time, he's betting against the system.

Robert Kiyosaki, author of the finance classic 'Rich Dad Poor Dad,' just dropped a bombshell prediction: a 1929-level market crash is imminent. His survival strategy? Ditch traditional assets and pile into Bitcoin, gold, and silver.

Why the Doomsday Portfolio?

Kiyosaki's move screams distrust in central banks and fiat currencies. While mainstream investors cling to stocks, he's hedging with the ultimate inflation trio: decentralized crypto and precious metals.

The Cynic's Take:

Another wealthy investor preaching apocalypse while quietly enjoying his diversified portfolio. But hey—if you're going to panic, might as well do it with assets that actually survive hyperinflation.

One thing's clear: when the guy who built his brand predicting financial crises goes full crypto-goldbug, even Wall Street dinosaurs might want to check their pulse.

Robert Kiyosaki Warns of ‘Another Great Depression’ as U.S. Debt Hits $36.6 Trillion

The bestselling author pointed to the moves of investment icons Warren Buffett and Jim Rogers, noting both have trimmed their exposure to stocks and bonds. “They are both in cash or silver,” Kiyosaki wrote.

“If you do not know why Buffett and Rogers have sold their stocks and bonds, you may want to find out.”

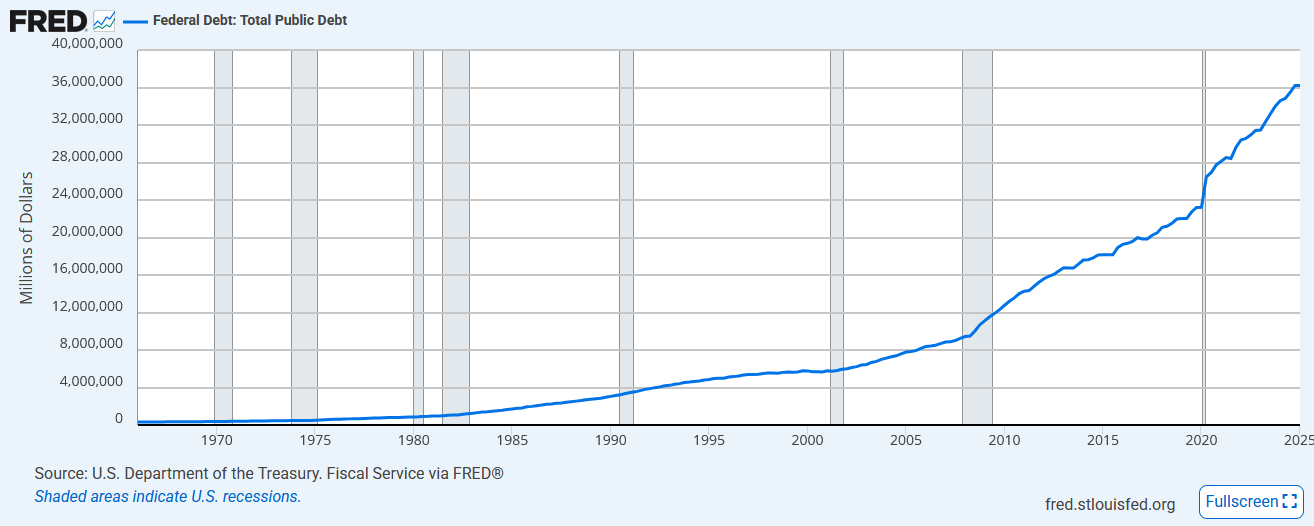

In the same post, he warned of “another Great Depression” and described America’s mounting debt as unsustainable. “You can only print money to pay your bills… for so long,” he added.

Kiyosaki’s comments come as the U.S. national debt hits historic levels. This month alone, debt ROSE by $367 billion, reaching $36.6 trillion, an all-time high. The jump followed President Trump’s approval of a sweeping spending bill that raised the debt ceiling by $5 trillion.

The increase is expected to carry the government through to 2027 without a default.

The ballooning debt is placing growing pressure on federal finances. Interest payments already consume 13% of the national budget and are projected to top $1 trillion annually by 2033. That trajectory, analysts say, risks forcing future cuts to Social Security, Medicare, and defense spending, even as global tensions escalate.

Analysts are also pointing to early signs of economic stress. According to Kurt S. Altrichter of Ivory Hill Wealth, the U.S. housing market is flashing recession signals. Inventory for new single-family homes has swelled to nearly 10 months’ worth of supply, a level historically seen just before or during economic downturns.

The months’ supply of new single-family homes is now at 9.8.

Historically, levels this high have only occurred during or right before recessions. Builders aren’t just fighting high rates, they’re fighting demand evaporation.

The housing market is weak. pic.twitter.com/XEXjgNKBwk

Jack Mallers, CEO of Strike, also weighed in. In a post on X, he said the U.S. Treasury has no real option left other than to expand the monetary base, which effectively means more money printing.

Kiyosaki Reaffirms Support for Bitcoin as U.S. Inflation and Debt Worsen

Bitcoin, often seen as a hedge against inflation, dipped to an intraday low of $117,914 on the day Kiyosaki made his comments. The drop followed $47.5 million in liquidations as Leveraged long positions were flushed out.

Despite this, Bitcoin remains up more than 60% from its April lows, and market participants still see its long-term structure as bullish.

Short-term volatility has intensified, especially NEAR the $118K to $120K range, where large clusters of leveraged bets have built up. Each push toward $119K has faced sharp resistance, often triggering automated sell-offs.

Despite the market’s turbulence, Kiyosaki continues to emphasize Bitcoin’s role as a SAFE haven, stating that “I sit tight with gold, silver & Bitcoin,” he reaffirmed.

Kiyosaki’s warnings, though severe, echo concerns voiced by a growing number of investors and analysts. As economic pressures mount and trust in traditional financial systems erodes, bitcoin and other scarce assets are increasingly being positioned as a response to long-term fiscal instability.

While critics argue that such alarmist views may exaggerate the risks, Kiyosaki’s message is clear. “Please take care,” he wrote. “And do your own research.”