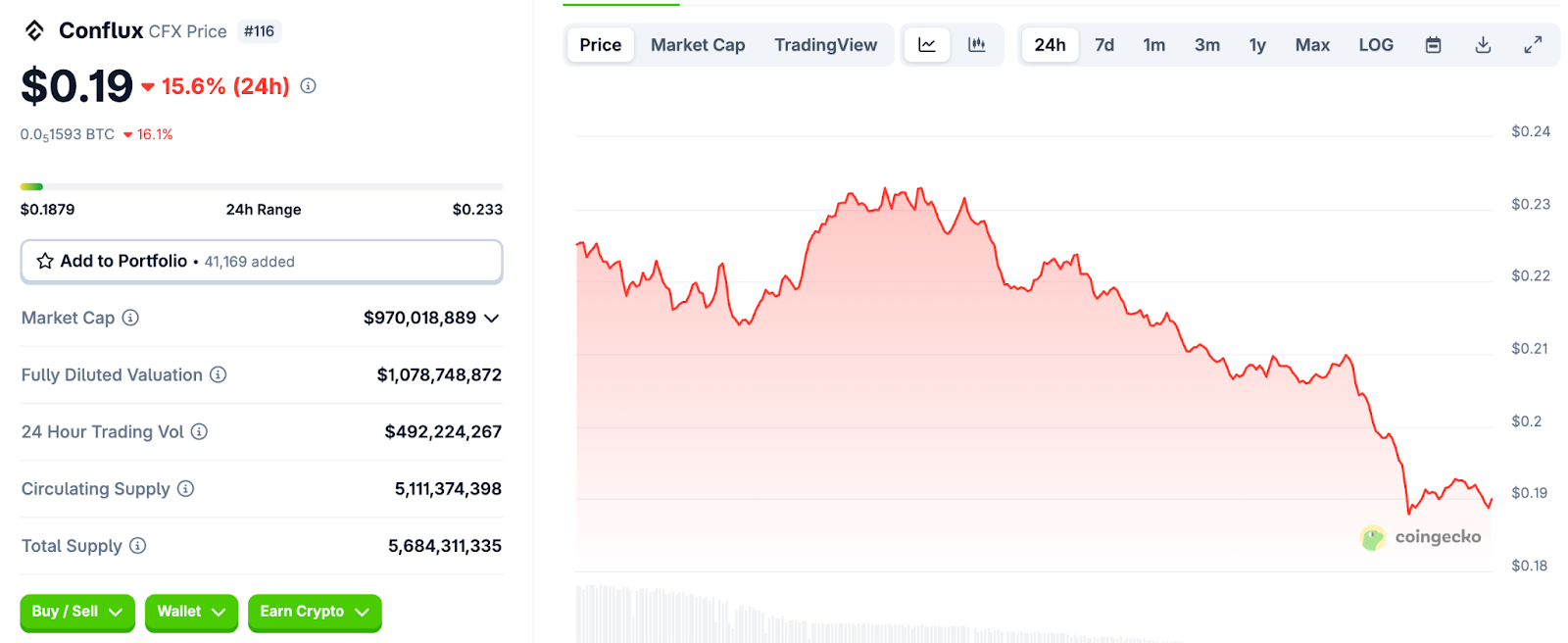

Conflux ($CFX) Plunges 15% – Oversold RSI Signals Make-or-Break Moment for Traders

Blood in the water for Conflux bulls as CFX gets hammered overnight. The 15% nosedive pushes RSI into oversold territory—now traders face the ultimate gamble: dead cat bounce or full-blown capitulation?

Technical crossroads ahead

That flashing RSI warning might tempt dip-buyers, but remember: oversold doesn't mean over. The chart could either bounce like a crypto Twitter influencer's ego or breakdown harder than a DeFi protocol's 'unhackable' smart contract.

Market psychology at play

Watch for panic selling if support cracks—nothing moves assets like fear and greed, except maybe a well-timed Elon Musk tweet. Either way, CFX holders are in for white-knuckle volatility. Just another Wednesday in crypto, where 'fundamentals' are whatever narrative pumps your bags.

Source: CoinGecko

Source: CoinGecko

Conflux Bets on Tree-Graph 3.0 and a Unique Yuan-Pegged Stablecoin

Amid the selloff, Conflux’s fundamentals remain strong with the network’s unique Tree-Graph consensus, which combines Proof-of-Work for security with a parallelized PoS overlay for finality, allowing up to 15,000 transactions per second—far above typical Layer-1 throughput.

Conflux Network is a permissionless Layer-1 blockchain founded in 2018 by Turing Award recipient Dr. Andrew Yao and his team, seeking to connect “creators, communities, and markets” across borders and protocols.

The blockchain’s strategy centers on tokenizing real-world assets, supporting cross-chain bridges, and piloting metaverse/Web3 initiatives.

Recent developments have been catalysts for both bullish runs and profit-taking.

Conflux’s Tree‑Graph 3.0 mainnet upgrade was recently announced at the Conflux Technology & Ecosystem Conference for late July and early August 2025. This major protocol upgrade will introduce parallel block processing for massive scalability, driving prices over 52% following the news.

At the same time, Tree-Graph’s AI agent support and parallel processing aim to attract developers to next-gen DeFi, gaming, and enterprise dApps.

Complementing this technical leap, Conflux has rolled out axCNH, an offshore yuan-pegged stablecoin developed in partnership with AnchorX and Eastcompeace, designed to streamline cross-border payments in Belt and Road economies.

Conflux $CFX to Support Offshore Yuan-Pegged Stablecoin#Chinese Layer 1 blockchain @Conflux_Network has partnered with AnchorX and Eastcompeace Technology to develop offshore #yuan-pegged stablecoins for use in Belt and Road Initiative (BRI) countries pic.twitter.com/qmLvmVutjd

— TOP 7 ICO | crypto News & Analytics (@top7ico) July 21, 2025Collaborations with McDonald’s China and the Shanghai government are testing digital collectibles and immersive experiences.

Great collab with @McDonalds China. #NFTs![]()

![]()

![]() https://t.co/7mgMhSyqwE

https://t.co/7mgMhSyqwE

Conflux currently secures $15.81 million in Total Value Locked across its smart contract platforms, with 24-hour DEX volume hovering around $8,700, according to DefiLlama.

$CFX Pulls Back After Testing Key Highs Near $0.248

$CFX/USDT has shifted into a corrective phase after an explosive rally that set its latest high on Sunday, July 20, at $0.248, a level it retested briefly on Monday, July 21.

That double‑test of resistance created a ceiling that sellers quickly defended, and since then, the market has printed a sequence of red hourly candles, pulling back toward the $0.188 area where it currently trades.

This slide isn’t really out of nowhere. It’s coming off a vertical run that kicked off around July 18, when the token was still under $0.13, and then continued climbing until those highs on the 20th and 21st.

On lower timeframes, the selloff shows clear volume clusters.

Footprint data shows heavy negative deltas during the early sessions on July 22, with a single hour posting a delta of –16.42 million on a total turnover of 63.59 million. These prints reflect aggressive market selling as traders locked in gains NEAR the highs, while subsequent candles show reduced but steady sell pressure.

Although there have been instances of buy‑side responses, primarily deltas of +1.43M and +1.15M in later candles, these attempts have so far failed to disrupt the prevailing downward rhythm.

Additionally, RSI slipped to the mid-30s, indicating a loss of bullish momentum, and is nearing oversold territory on shorter time frames. Meanwhile, the MACD has rolled over, with its histogram shrinking and lines now below the baseline, confirming that momentum favors sellers in the near term.

After two failed attempts to clear $0.248, buyers lost momentum, and early longs began unwinding their positions.

Unless the price can reclaim and sustain above $0.20 with fresh volume, caution remains warranted. The $0.185–$0.188 band now acts as a near‑term pivot, and if defended, it could FORM the foundation for another attempt higher once sentiment steadies.