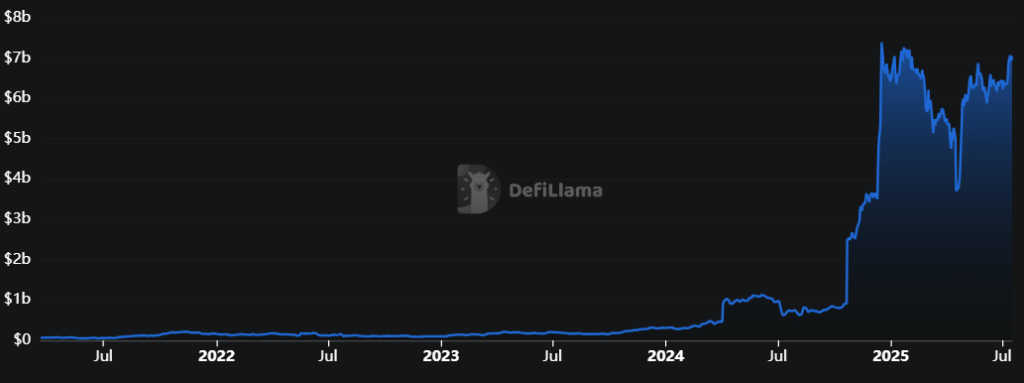

🚀 Bitcoin DeFi TVL Rockets 20X: From $307M to $6.4B in Just 18 Months

Bitcoin's DeFi ecosystem just pulled off a gravity-defying act—turning $307 million into a $6.4 billion behemoth since early 2024. TradFi banks take notes: this is how you grow without charging $35 overdraft fees.

The Lazarus Protocol Effect

Anonymous devs, yield farms that actually yield, and a stack of Ordinals-fueled liquidity pushed Bitcoin DeFi past 'niche' status. No VC money required—just code that works.

Wen Lightning Network?

Scaling solutions finally caught up with demand, slicing through congestion like a hot knife through… well, Bitcoin blocks. Miners are oddly quiet about fee revenue.

One hedge fund quant muttered: 'It's not a bubble if it keeps growing—wait, that's exactly what bubbles do.' Meanwhile, BTC maximalists are quietly dusting off their 'Number Go Up' memes.

Source: DeFiLlama

Source: DeFiLlama

The report noted that the surge was fueled by several key factors. These include protocol launches, novel token standards, growing institutional inflows, a rally pushing BTC to an all-time high, and the rise of liquid restaking.

Moreover,has been the undisputed DeFi leader for years now, thanks to smart contracts and a strong developer ecosystem. Yet, “the narrative is evolving,” Arch Network claims. “A new wave of builders is bringing DeFi to Bitcoin.”

These developers are attracted by Bitcoin’s security, untapped liquidity, institutional interest, and increasing user demand for composable financial tools. Furthermore, LAYER 1 innovations and protocols are unlocking Bitcoin’s native programmability.

“Many view bitcoin as the next DeFi frontier, set to even outpace Ethereum,” it claims. “As this momentum grows, Bitcoin’s role as a foundational layer for DeFi is becoming increasingly undeniable.”

According to Arch Network CEO and co-founder, Matt Mudano, “Bitcoin’s true potential lies beyond being a passive store of value. As a $2 trillion asset, unlocking its liquidity to build a truly open and permissionless financial system on its base layer is the next frontier. Bitcoin DeFi is the greatest opportunity not only for crypto, but for financial innovation as a whole.”

You may also like: Matt Mudano, CEO of Arch, on Bitcoin Momentum, Programmability on Bitcoin, and the Future of Bitcoin DeFi | Ep. 443 Matt Mudano, CEO and Co-founder of Arch, joined the Cryptonews Spotlight podcast to explain how Bitcoin can evolve from a static reserve asset into the backbone of a global financial system. From on-chain smart contracts to miner incentives and real-world DeFi, Mudano outlines a vision of Bitcoin that’s more than “digital gold” - it’s programmable capital. Bitcoin Is Becoming a Strategic Reserve Asset “Bitcoin is becoming the most successful ETF launch in human history…...36% of Respondents Keep BTC in Cold Storage, Favoring Self-Custody Over Yield and Bitcoin DeFi

Among many findings in the report, Arch noted that 36% of respondents hold BTC in cold storage. 33% trade on CEXs, and 31% use it for payments. Also, 29% use BTC as DeFi collateral, 22% for bridging, 20% in Bitcoin-native DeFi, and 28% as liquidity provision. 7% aren’t actively using their coins.

Moreover, among those who don’t use BTC in DeFi, 36% cited lack of trust, and 25% said risk and fear of loss. Other reasons include technical barriers (poor tooling and low liquidity), UX, and regulation.

Also, 16% simply prefer to HODL. The same amount waits for better infrastructure. “Only 11% don’t see clear benefits, suggesting that most concerns can be addressed rather than indicating a lack of interest in leveraging Bitcoin more actively,” the report argues.

Meanwhile, among those who use Bitcoin DeFi, there are both veterans and newcomers, the researchers found. The majority of respondents are in Asia (61%) and Africa (17%).

55% of respondents are involved in lending and borrowing protocols, while 51% are in decentralized exchanges (DEXs) and 40% in stablecoins.

Most builders (44%) chose Bitcoin DeFi for its security and decentralization, and 27% are in it for growing liquidity and ecosystem expansion.

Other reasons include Bitcoin’s long-term vision and community (26%), the opportunity for Layer 2 innovation (20%), ecosystem growth (17%), censorship resistance (12%), and privacy (8%).

However, despite its advantages, Bitcoin wasn’t built for complex smart contracts, the report notes. For 43% of the respondents, this is the main challenge. Lack of developer tools (22), poor documentation (15%), low composability (16%), and liquidity (12%) are other reasons. These show “that Bitcoin DeFi is still early.”

As solutions to many of these issues, respondents named better infrastructure (45%) and broader L2 adoption (43%).

Many developers also work on ethereum (63%),(47%), and(44%), with 60% preferring other chains for smart contract flexibility and 33% for developer tools.

That said, 49% of responding developers working on other chains plan to switch fully to Bitcoin. 39% will stay multichain, and 12% haven’t decided yet.

You may also like: Bitcoin DeFi Explodes: Bull Run Locks 2,000 BTC – Is $115K Next? Bitcoin (BTC) is on a bullish trajectory. The cryptocurrency hit a new all-time high of $111,970 on May 22 before quickly retracting to $110,700. The price of BTC is currently hovering around $108,000, yet metrics suggest that Bitcoin is on an upward trend. Bitcoin bulls predict that the price of BTC may soon rally to $115,000. Bull Run Advances Bitcoin DeFi While investors eagerly await another BTC all-time high, industry experts point out that this bull run is different from...