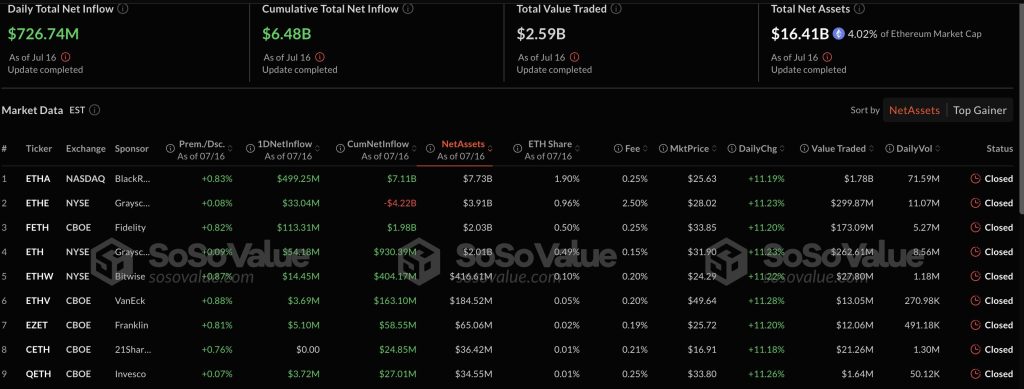

🚀 Ethereum ETFs Shatter Expectations: $727M Floods In—Bull Run Incoming?

Wall Street's crypto love affair hits new highs as Ethereum ETFs see a historic $727 million single-day cash injection. Forget 'slow money'—this is institutional FOMO on steroids.

The ETH ETF Gold Rush

Traders are piling into Ethereum-backed funds like it's 2021 all over again. The $727M surge smashes previous records, signaling that big players are finally waking up to ETH's utility beyond speculative trades.

Why This Isn’t Just Deja Vu

Unlike Bitcoin's ETF debut, this inflow comes as Ethereum's ecosystem matures—DeFi, staking yields, and real-world asset tokenization are now part of the pitch. Funny how yields suddenly matter when traditional finance can access them.

The Cynic’s Corner

Let’s see how fast these inflows reverse when the SEC inevitably starts probing 'yield-bearing' ETF structures. Until then: enjoy the leveraged hype cycle, courtesy of your friendly neighborhood financialization engine.

Source: SoSoValue

Source: SoSoValue

Ethereum Tops $3,200, Outpaces Bitcoin and Solana in Daily Gains

The surge came as Ethereum crossed the key $3,200 threshold, rising more than 6.8% on the day to trade near $3,347. It outpaced both Bitcoin and Solana, reflecting growing institutional interest in the asset. Daily volumes soared, and total value traded across ETH spot ETFs reached $2.59 billion.

Open interest in ETH futures has also reached a new peak of $45b, up 60% since late June. This surge in derivatives activity points to increased institutional positioning and heightened expectations of further price momentum.

ETH Gains Attributed to Staking Yields, Deflation and Long-Term Utility

Bitget Wallet CMO Jamie Elkaleh said Ethereum’s current momentum signals more than short-term bullishness. “Ethereum is emerging as the yield-generating infrastructure play,” he said, citing staking yields of 4% to 6% and deflationary supply mechanics post-EIP-1559.

“BlackRock’s accumulation of ETH is not just about price upside—it’s a strategic position in what many see as the backbone of future onchain finance,” he added.

ETH ETFs are now seen as a bridge between crypto-native strategies and traditional finance. BlackRock’s accumulation, for instance, is widely viewed as a long-term bet on Ethereum’s growing role in powering decentralized finance, NFTs and Web3 infrastructure.

Investor Confidence Returns as Redemption Pressure Fades

These record inflows are especially notable considering that many ETFs struggled with outflows during their early months, largely due to Grayscale trust redemptions. The July reversal suggests renewed investor confidence, now that redemption-driven selling has waned.

Despite the bullish narrative, risks persist. Regulatory ambiguity around whether ETH qualifies as a security continues to hang over the market. Meanwhile, competition from high-speed alternatives like solana and Layer 2 scaling solutions could splinter Ethereum’s dominance.

Still, Ethereum’s appeal lies in its dual identity, as both a yield-bearing financial instrument and the backbone of onchain innovation.