Crypto Giants Binance, OKX, Bybit & Bitget Crush Q2 Despite Market Slowdown – TokenInsight Report

Crypto’s big four exchanges just flexed their dominance—again. While trading activity slumped industry-wide in Q2, Binance, OKX, Bybit, and Bitget tightened their grip on the market. Here’s how the titans weathered the storm.

The Unshakeable Hierarchy

No surprises here: the usual suspects still call the shots. TokenInsight’s latest data confirms these platforms ate everyone else’s lunch—even as retail traders hit the brakes. Liquidity, leverage options, and those sweet, sweet altcoin listings kept the engines humming.

Slowdown? What Slowdown?

While smaller exchanges scrambled, the top players turned Q2’s cooling demand into a branding exercise. ‘Institutional-grade’ this, ‘risk-managed’ that—meanwhile, leverage traders kept the revenue faucet dripping. Classy.

The Cynic’s Corner

Let’s be real: when trading volumes dip, the big boys just repackage old products and call it ‘innovation.’ But hey—if it keeps the VC money flowing, who’s complaining? Just don’t check the token charts.

Trading Volume Down Despite Bitcoin Surge

TokenInsight reports that the total trading volume across the top 10 crypto exchanges reached $21.6 trillion in Q2, a 6.16% decline from the previous quarter.

1/ The Top 10 exchanges total $21.58T in volume, a decrease of 6.16% compared to the previous quarter. pic.twitter.com/Ue57kdpUP0

— TokenInsight (@TokenInsight) July 16, 2025While Bitcoin rallied from $83,000 to over $111,000 before closing near $106,000, the rest of the market saw uneven performance.

Liquidity remained concentrated in a few large-cap assets, with many altcoins continuing to see low activity and sharp drops in interest.

The spot market, in particular, experienced a marked pullback: average daily spot trading volume declined from $51 billion in Q1 to $40 billion in Q2. Total spot volume across major exchanges reached $3.63 trillion, a 21.7% drop quarter-on-quarter.

Derivatives trading fared slightly better, reaching $20.2 trillion, down 3.6% from Q1. This segment remained more resilient as traders sought to hedge volatility and manage risk amid ongoing geopolitical tensions and sluggish global growth.

The average daily derivatives trading volume fell to $226 billion, compared to $233 billion in Q1, reflecting broader market caution.

Binance Leads, But Market Share is Shifting

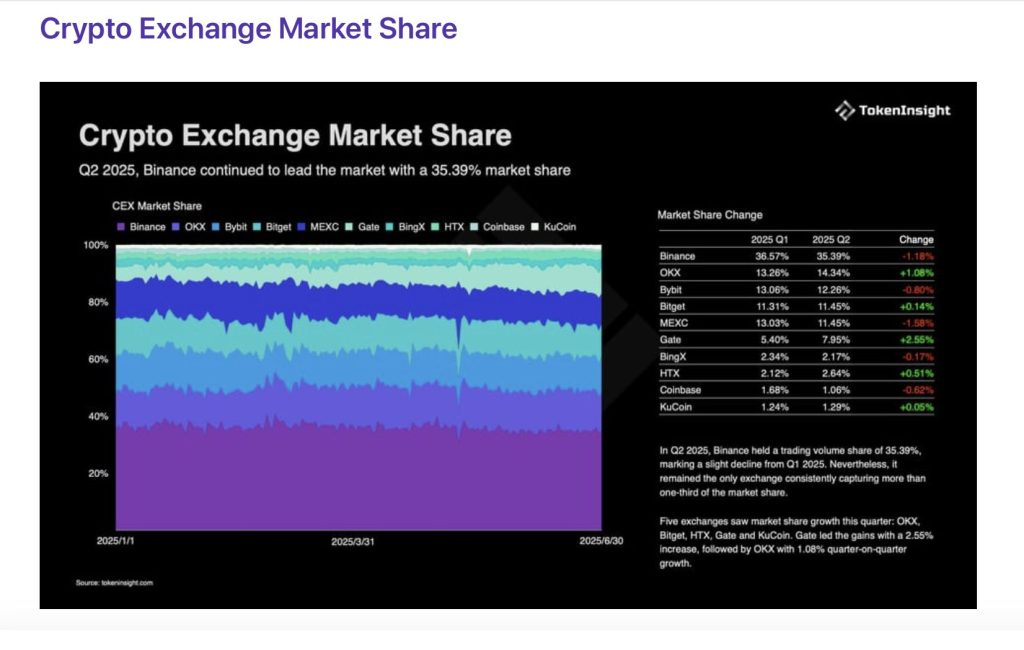

Binance retains its lead in total trading volume with a 35.39% share, though this reflected a slight decrease from Q1. Other exchanges gained ground: OKX, Bitget, HTX, Gate, and KuCoin all expanded their market shares during the quarter. Gate posted the largest gain with a 2.55% increase, followed by OKX with 1.08%.

In the open interest market, Binance strengthened its position with a 0.36% increase, reaching a 23.83% share. Bitget, OKX, and HTX also made modest gains.

The data shows a gradual diversification in user behavior, as smaller platforms continue to attract more trading volume despite the broader slowdown in market activity.

Exchange Tokens Lag Behind Bitcoin Rally

While bitcoin surged 31.62% during Q2, exchange-related tokens underperformed. BNB led the pack with an 8.91% gain, followed by modest increases in OKB, BGB, and KCS.

Most other exchange tokens posted declines, reflecting waning interest in altcoin markets. As TokenInsight notes, exchange tokens remain closely correlated with altcoin activity, which saw reduced liquidity and volume during the quarter.

With persistent macro uncertainty and uneven regulatory developments, Q3 is expected to remain challenging for exchange token performance.

TokenInsight anticipates continued divergence in this segment as market participants focus on high-cap assets and remain selective in deploying capital across the exchange sector.