🚀 Pudgy Penguins ($PENGU) Rockets 127% in 7 Days as Meme Coin Frenzy Reignites

Meme coins are back with a vengeance—and Pudgy Penguins ($PENGU) just stole the show. Surging 127% in a week, this avian-themed token is riding the wave of speculative mania. Here’s why traders are flocking to the iceberg.

The Pump No One Saw Coming

Forget fundamentals—this rally is pure meme magic. $PENGU’s parabolic move mirrors the irrational exuberance of 2021, proving crypto’s appetite for risk never really dies. Just don’t ask about utility.

Wall Street’s Worst Nightmare

While traditional investors sweat over Fed meetings, degens are printing life-changing gains in days. The catch? Volatility cuts both ways—today’s 127% surge could be tomorrow’s rug pull. (Cue the ‘I told you so’ tweets from finance bros.)

Penguins Fly, But Can They Swim?

The real question isn’t ‘why $PENGU?’—it’s ‘why not?’ In a market where dog-themed coins once hit billion-dollar valuations, a flightless bird seems almost… logical. Almost.

Source: CoinGecko

Source: CoinGecko

Meme Coin Momentum Reinforced by ETF Buzz and Social Endorsements

The $PENGU token has rapidly transitioned from a niche NFT experiment to a multi‑faceted Web3 brand, driven by speculative ETF filings, high‑profile endorsements, and major retail partnerships.

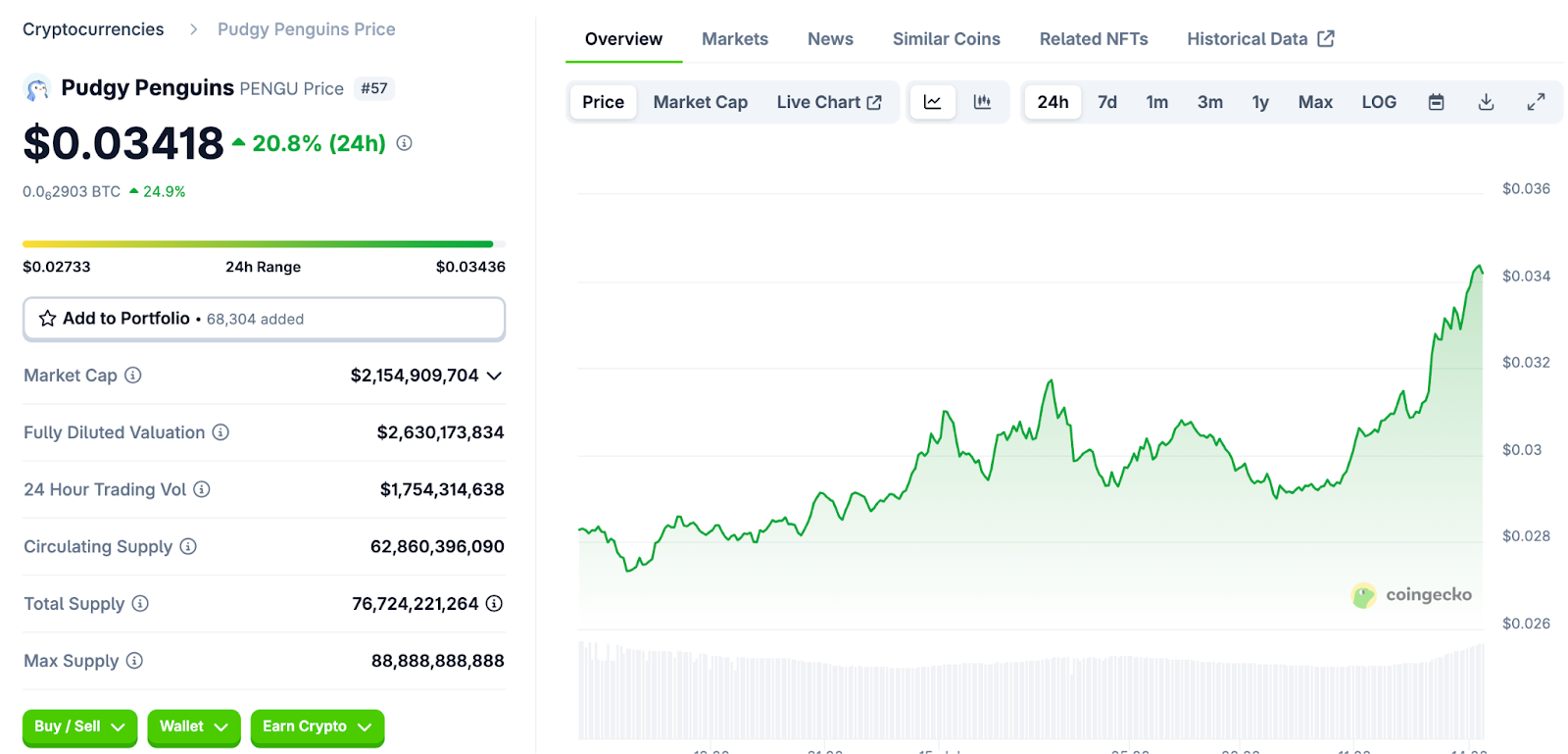

Since its solana launch in late 2024, $PENGU has seen its price double amid Coinbase’s penguin avatar stunt and ETF rumors, as observers wonder if it will become the biggest memecoin of the summer.

$PENGU’s fundamentals now rest on a tight 63 billion‑token float against a capped 88.88 billion supply, with almost 26% locked for community rewards and an airdrop that seeded hundreds of thousands of wallets last December but remains largely unspent.

That sense of scarcity quickly became a marketing asset. When Coinbase and Binance US briefly swapped their social‑media avatars for Pudgy Penguins artwork, it ignited a 60% weekly sprint that took on institutional backing once Cboe filed a FORM 19b‑4 to list the Canary PENG ETF and the SEC logged its companion S‑1.

Both filings propose allocating 95% of the fund’s holdings to PENG tokens, with the remaining 5% earmarked for Pudgy Penguin NFTs, an unprecedented structure designed to blend liquid token exposure with the rarity and collectibility of the underlying art.

canary capital filing first-ever NFT-backed ETF. 80-95% $PENGU token, 5-15% curated pudgy nfts

not just floor sweeping but rarity-based selection

Additionally, within 24 hours of Coinbase’s stunt, the loop rally strengthened as the NFT floor price leapt from about 9 ETH to 11.6 ETH, showing how the token and collection MOVE in tandem.

Liquidity followed, and the token’s revival from an April price struggle of around $0.028 to $0.0037 in July returned $PENGU to the mid‑cap league in barely three months, according to CoinMarketCap. Just five days ago, $PENGU jumped 33% alone.

I gave you all $Pengu at a 200 million dollar market cap back in April.

Today it just reclaimed a 2 billion dollar market cap.

That’s a clean 10x.

Follow me for more alpha calls. pic.twitter.com/4kA1faDCM1

Smart money seems convinced by the return, with on‑chain trackers flagging whales buying $PENGU in large volumes and even billionaires like Justin SUN endorsing the project.

$PENGU/USDT Maintains Bullish Structure as Price Approaches $0.0360 Resistance

The PENGU/USDT 4-hour chart from July 11 to 15 shows a strong uptrend. The price moved sideways between $0.012 and $0.018 for a while, but buyers took control on July 13 and pushed it higher.

On July 14, the price broke above the key $0.0300 level, confirming growing momentum. That level has now turned into solid support, holding steady through several retests. As long as this support holds, buyers remain in charge.

The rally continued into July 15, carrying $PENGU to fresh highs and is currently trading around $0.03455.

Trading activity ROSE during the breakout, reflecting strong participation, a positive indicator for sustainability. Breakouts accompanied by rising volume typically indicate genuine demand, reducing the likelihood of a false move.

The price structure has consistently formed higher highs and higher lows, a hallmark of a strong uptrend. This pattern demonstrates sustained buyer dominance across multiple sessions, reinforcing bullish conviction.

The volume footprint chart provides extra insight. A major event occurred during the 08:00 UTC 4‑hour candle on July 15. The data shows a large negative delta of –126.25 million, indicating that aggressive market sells outnumbered market buys in that candle.

However, despite this heavy selling pressure, the price did not drop. Instead, the candle remained green and continued pushing higher.

This indicates that strong buy orders were absorbing the selling pressure, allowing $PENGU to climb steadily. Such absorption shows buyers are still in control, and the trend remains supported beneath the surface.

The price now approaches a key resistance zone between $0.0350 and $0.0360, an area reinforced by recent bullish momentum. This level aligns with historical seller interest, increasing the likelihood of supply pressure.

A decisive breakout above this zone, supported by strong volume, could indicate a continuation toward higher targets. Conversely, rejection here may trigger a retracement toward the $0.0310 support level, a logical consolidation point before any renewed upside attempt.