Solana Price Prediction 2025: Stocks Migrate to SOL – Is $1,000 Imminent?

Solana's blockchain just became Wall Street's favorite playground. Traditional equities are jumping ship—and SOL might be the life raft.

Why $1,000 SOL isn't a meme anymore

The network's speed and low fees are vacuuming up stock tokenization projects. Forget 'if'—the question is how high SOL goes when legacy finance fully docks.

Risks? Sure. The SEC still hates fun, and validators occasionally nap during peak traffic. But with institutions piling in, even crypto cynics are recalculating their exit strategies.

One hedge fund manager sniffed: 'We'll tokenize everything—even your grandma's bonds.' Welcome to the future, where your stock portfolio lives on-chain and regulators permanently have heartburn.

Solana’s xStocks Hits “Major Milestone for DeFi” With Kamino

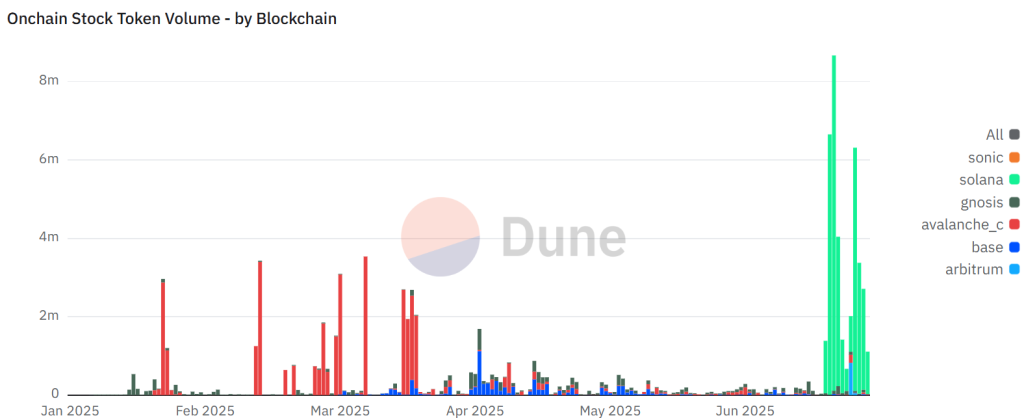

xStocks has gained rapid traction since launch, rising to a majority market share as the only blockchain product to consistently post million-dollar daily transaction volumes.

Its strongest daily performance saw the Solana ecosystem command a 95% share with $9 million in trading volume, according to a Dune Analytics dashboard.

Kamino Finance, Solana’s largest money market, holds nearly $3 billion in total value locked across lending, leverage, and liquidity management.

This partnership, dubbed a “milestone for DeFi,” expands the reach of xStocks and adds merit to the tokenised equity market as a key pillar of the Solana ecosystem going forward.

xStocks Kamino

We're live on @KaminoFinance, allowing users to use tokenized stocks as collateral or swap on @solana. Kamino is the newest member of the xStocks Alliance, joining us to shape the future of capital markets.

Designed for everyone, onchain and DeFi-ready. pic.twitter.com/Elbu0iAhvU

“xStocks is a major step in bridging DeFi and TradFi,” Kamino said in Friday’s press release. “With xStocks live on Kamino, on-chain credit is now possible for a trillion-dollar asset class.”

The feature will launch with a tokenized representation of SPY, QQQ, GOOGL, APPL, NVDA, TSLA, MSTR, HOOD, and will gradually expand.

Solana Price Analysis: Is SOL Equipped for $1000 in 2025?

In the current institution-driven market cycle, growing exposure to TradFi through RWA tokenization and ETFs could position Solana as a top performer.

Even with these unrealised fundamental catalysts, the technical outlook still eyes a surge, supported by a brewing four-year cup-and-handle pattern.

Following its mid-June rebound, Solana appears to be building a solid support trendline, forming a confluence zone with the handle’s upper resistance that could fuel a breakout.

Momentum indicators are also flashing early strength. The RSI holds firm above 50, signaling easing sell-side pressure and underlying bullish momentum.

More so, the MACD has narrowly avoided a death cross, now continuing to widen its lead above the signal line. On the weekly chart, this typically signals a longer-term uptrend taking root.

There is indeed a strong technical backing for growth. If this holds, a breakout sets a target around $430—a 167% advance on current prices in line with the 3.618 Fibbonnaci extension.

This setup suggests strong technical grounds for growth.

A confirmed breakout could lift SOL toward $430, aligning with the 3.618 Fibonacci extension and marking a 167% gain from current levels.

But with the demand of TradFi investors still untapped, the rally may extend deeper into a discovery phase, placing $1,000 as the next key upside target.

For now, traders should watch the $188 zone. It remains a key resistance level as a top marker of recent bullish moves.

A $1000 Solana Remains Distant – Here’s How to Make Faster Gains

When it comes to large altcoins like SOL, gains are limited. Explosive breakouts take years to build, and pan out in a fraction of that time—holder spend most of their time waiting.

Meanwhile, newer coins making the rounds like Aura are posting 46x gains in a single day.

That’s where Snorter ($SNORT) steps in. Its purpose-built trading bot is engineered to spot early momentum, helping investors get in before the crowd, where the real gains are made.

While Trading Bots are not a new concept, Snorter has been designed specifically for sniping with limit orders, MEV-resistant token swaps, copy trading, and even rug-pull protection.

It’s one thing to get in first, it’s another thing to know when to sell—Snorter Bot can help.

The project is off to a strong start—$SNORT has already raised over $1.6 million in its initial presale weeks, likely driven by its high 205% APY on staking to rewards early investors.

You can keep up with Snorter on X, Instagram, or join the presale on the Snorter website.