Bitcoin’s Irony: How Its Dominance Could Become Its Greatest Liability

Bitcoin's throne wobbles as its own legacy backfires—liquidity surges, innovation stagnates, and Wall Street's wolves circle.

The King's Burden

Market dominance now works against BTC as lightning-fast altcoins eat its lunch. Network congestion turns 'digital gold' into digital molasses—fees spike while competitors streamline.

Institutional Capture

BlackRock's ETF success ironically cemented Bitcoin as the boomer crypto. Real yield chasers pivot to DeFi 2.0 protocols offering actual utility (and juicier APYs).

Codebase Claustrophobia

Core developers guard Bitcoin's 'purity' like museum curators—meanwhile, Ethereum's L2s process transactions at 1/100th the cost. The OG blockchain risks becoming a relic.

Closing thought: Nothing makes TradFi smirk harder than watching crypto's revolutionary poster child turn into... just another asset class. The ultimate victory—or defeat?

Image: Bitwise

Image: Bitwise

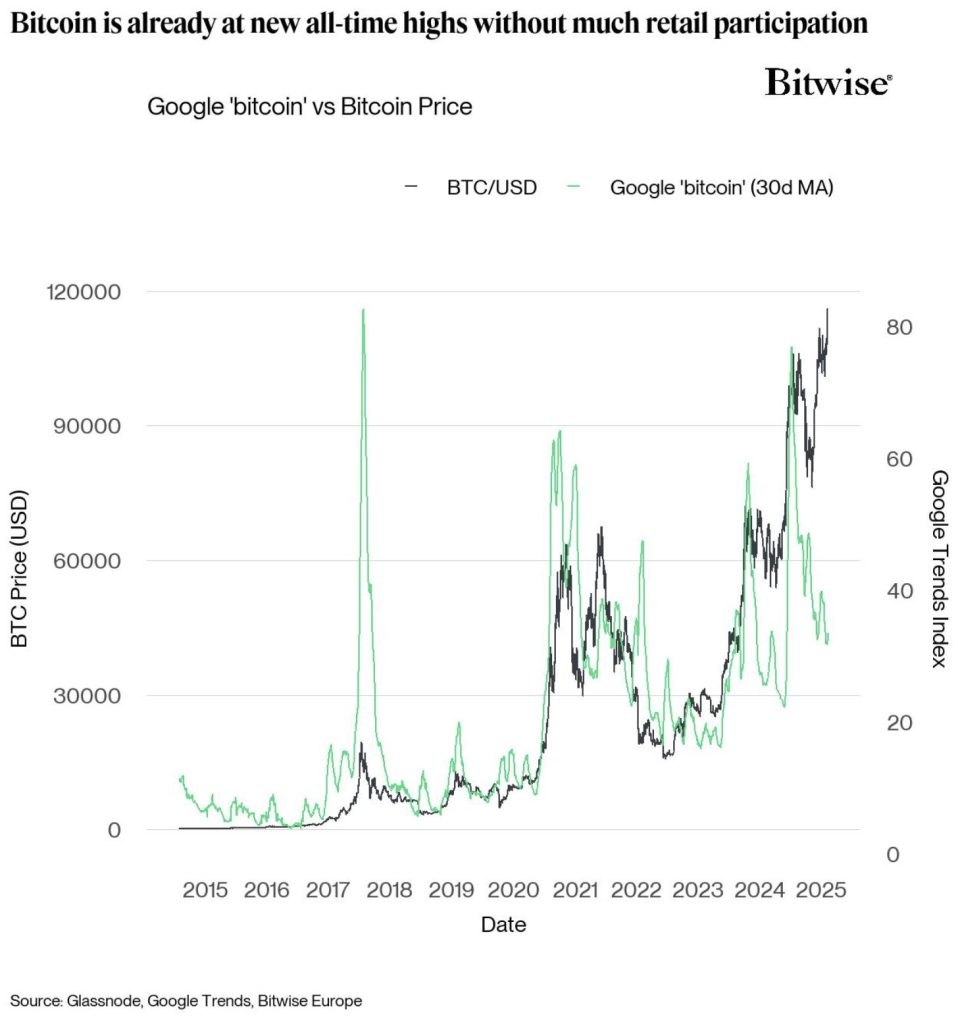

The Google line, in green, jumps sharply higher in late 2017 and early 2018, coinciding with when BTC hit $20,000 for the very first time. Fast forward to now though, and the opposite is happening. Even as Bitcoin’s value reaches unprecedented levels, as shown by the black line, search interest is plunging.

Before we delve into what’s going on, there’s one important caveat worth making here. The rise of artificial intelligence — allowing curious internet users to get customized answers to their questions in a matter of moments — means Google isn’t as popular as it once was. For all we know, a large chunk of this traffic could be flowing into the likes of ChatGPT instead — something we can’t verify because OpenAI doesn’t release information about what’s trending on its platform.

But there’s no denying that, at least for now, everyday investors just aren’t gravitating to Bitcoin like they used to. So… why might this be?

For one, some consumers might be feeling a little cautious. Those with long memories will know that buying around an all-time high can be risky. Anyone who snapped up BTC when it first hit $20,000 in 2017 ended up in the red for three years — with the value of their coins plunging by 67.5% in just six months.

And the same was true back in November 2021, when bitcoin broke $69,000. Prices had crashed by more than 75% within 12 months, and wouldn’t return to this level for two years or so.

Many anecdotes on X suggest this isn’t what’s happening here — instead, they argue that many retail investors just simply aren’t aware of BTC’s surge. There’s a famous saying: “When the taxi driver starts telling you to buy Bitcoin, it’s time to sell.” Right now though, it doesn’t seem like anyone’s talking about the crypto markets. Established analysts on X say they’ve had no questions about what’s happening from their friends and family.

There’s another theory, too — people do know that Bitcoin is rallying, but they fear that, at $120,000, it’s now just too expensive to buy. This has led to calls for an education drive to inform the public that BTC doesn’t need to be bought whole, and can be purchased in smaller fractions.

One idea that’s been put forward is for the industry to get into the habit of discussing Bitcoin in the form of satoshis — the smallest denomination of BTC. One sat is equivalent to one-hundred-millionth of a coin, worth about $0.0012 in dollar terms at the time of writing. That means $1.20 WOULD get you 1,000 sats.

Back in April, a Bitcoin Improvement Proposal was put forward calling for BTC’s base unit to be redefined — a pretty radical proposal that would mean a single satoshi would be referred to as one Bitcoin. In other words, 10,000 sats would now become 10,000 BTC. Supporters say this would eliminate “unit bias,” and have the same impact as a stock split — making this cryptocurrency seem more affordable.

Retail or no retail, Bitcoiners are now setting their sights on the next big milestone: $1 million. That remains some way off — and may take a few bull cycles to achieve… if it’s ever reached at all. The likes of JAN3’s Samson Mow point to this target as evidence that we’re still early, and plenty of opportunity for retail investors remains.