AI Giants Shift Gears: How Bitcoin Mining Became the New Cash Cow for Data Centers

Silicon Valley's latest pivot? Turning AI's hunger for power into a Bitcoin bonanza.

When the chips are down—literally—tech firms are repurposing data centers to mint digital gold. Here's why the math works (for now).

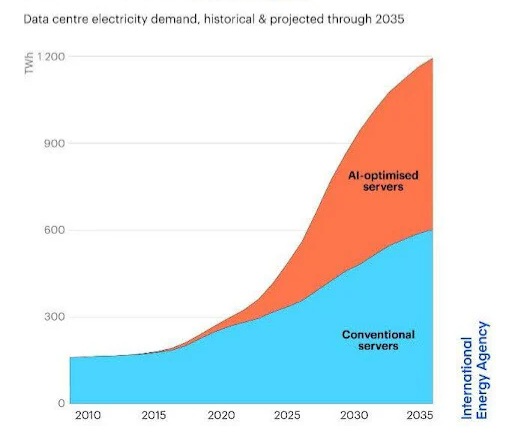

Power Play: AI's Dirty Secret Fuels Crypto Boom

Massive GPU clusters originally built for machine learning are now solving SHA-256 puzzles instead. The economics? Brutally simple: when AI contracts dry up, mining rigs print money—at least until the next difficulty adjustment.

Wall Street analysts call it 'hedging'—everyone else calls it desperation dressed up as innovation. One exec quipped: 'Our investors wanted exposure to AI, not a backdoor crypto play. Too bad the balance sheet doesn't lie.'

The Bottom Line: In the game of power arbitrage, the house always wins. Until it doesn't.

Solving the ‘Spiky’ Demand Dilemma

According to Batten, the AI/Bitcoin mining nexus is addressing long-term inefficiencies in data center power dynamics, turning excess energy into a new source of value.

For AI companies spending millions daily on compute, the ability to mine Bitcoin during off-peak hours could reduce operating costs.

Mara Holdings is an early mover in this respect. The Florida-based company’s use of AI infrastructure to mine Bitcoin not only cuts waste but also brings in new revenue while creating a responsive energy consumer for the grid.

“Meeting the demands of today’s compute infrastructure isn’t just about adding more energy, it’s about making better use of the power we have,” said Fred Thiel, CEO of Mara, in a recent press statement.

“In Mara’s flexible data centers, unused, underutilized or otherwise stranded energy resources are tapped to secure the world’s preeminent blockchain ledger, converting clean energy that WOULD otherwise go to waste into economic value,” he added.

His comments were echoed by Brian Morgenstern, head of public policy at Riot, who told a Reuters energy conference in June that “Bitcoin mining can be a first mover on sites suitable for AI data centers to build power infrastructure and monetize capacity.”

BVP Board Member @MorgensternNJ explains how Bitcoin mining companies like @RiotPlatforms help America win the global AI race by optimizing energy consumption and monetization. pic.twitter.com/ZMosoYCrQr

— Bitcoin Voter Project (@BitcoinVoter) June 25, 2025Morgenstern said Riot Platforms had invested $1 billion in energy infrastructure and energized a 400MW power plant in Corsican, Texas, that is using 40% of its capacity to mine Bitcoin.

“We’re monetizing that power…we’re buying land, [and] we’re bringing in AI data center development experts,” he said.

But the implications for models such as Mara or Riot’s extend far beyond corporate profit, says Batten. It’s the impact they have on grid stability. Artificial intelligence data centers tend to create erratic, hard-to-predict power demand.

This “spikiness” is a “nightmare” for grid operators, he said, especially as more renewable energy like solar or wind, which is by nature intermittent, comes online. Batten explained in a voice message to Cryptonews:

“Spiky power demand is really bad for the grid, particularly when grid operators are already struggling with the intermittency of variable renewable energy. If you then have an intermittent power user, it’s an absolute nightmare.”

Bitcoin Mining Stabilizes Power Grids

Batten said Bitcoin mining can stabilize unexpected spikes in AI power demand. That’s because, unlike most industrial processes, Bitcoin mining can be dialed up or down in seconds, responding to real-time grid needs.

When there’s too much energy or AI demand drops, miners can use that excess power. Likewise, they can swiftly shut off their machines when demand spikes — “making the grid operator’s job of stabilizing the grid so much more easy.”

“It means that you can put more variable renewable energy on the grid [without risking blackouts or brownouts],” says Batten. “Otherwise, they [grid operators] have to respond by just giving baseload energy.”

According to the environment analyst, “there is no modular, scalable, interruptible, load balancing technology that exists in the world today than Bitcoin mining.”

In his presentation at the Reuters energy conference, Morgenstern, the Riot head of public policy, said Bitcoin’s decentralization means mining facilities can “curtail power use when the grid needs them to.”

“It’s 100 degrees in August, no problem. We curtail when grid stress rises. At some sites, we can even sell grid stability services so the grid operator can use us like a thermo switch to balance supply and demand.”

The convergence of AI and Bitcoin, two energy-intensive sectors, is also critical for cutting carbon emissions. Experts say with better grid stability and less energy waste, renewable energy integration would be more feasible. As Batten notes:

“It’s going to be good for grid stability, and it’s going to be good for the AI data centers as well as be good for renewable energy generation.”

The big question, though, is whether the Mara model can scale.

“Absolutely,” Batten declared. “Any AI company forward-purchasing large amounts of energy, so, mid-sized to hyperscalers can benefit from this model. Pretty much everyone except for the small operators.”