🚀 Bitcoin Spot ETFs Explode: $1.18B Floods In – Near-Record Daily Haul

Wall Street’s crypto crush just got hotter. Bitcoin spot ETFs raked in a staggering $1.18 billion in a single day—edging close to all-time inflow records. Guess those 'volatile asset' warnings didn’t age well.

The institutional stampede

No slow drip here—this was a firehose of capital. TradFi’s latecomers are sprinting to catch the Bitcoin bus, wallets wide open. Funny how ‘risky’ becomes ‘must-have’ when fees start flowing.

Cynic’s corner

Let’s be real: half these fund managers couldn’t explain UTXOs if their bonuses depended on it. But when the SEC rubber-stamped these ETFs, suddenly everyone’s a ‘blockchain believer’. Welcome to finance—where conviction follows liquidity.

What’s next? If this pace holds, we’re not just flirting with records—we’re rewriting the playbook. Buckle up.

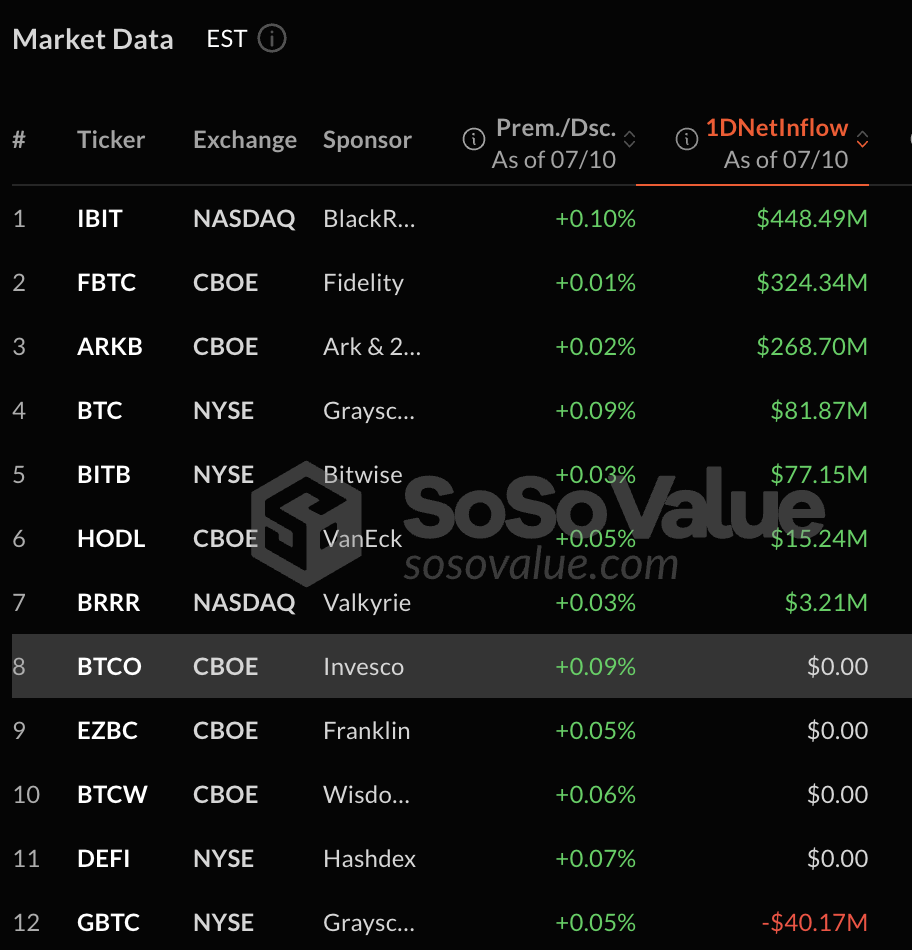

US Bitcoin spot ETFs’ daily total net inflow (Source: Sosovalue)

US Bitcoin spot ETFs’ daily total net inflow (Source: Sosovalue)

Ethereum Spot ETFs see $383M Total Net Inflows, Signals Strong Conviction

Ethereum spot ETFs also saw a total net inflow of $383 million, marking the second-highest record. Ether ETFs have $5.10 billion in cumulative net inflows so far.

Fueled by ETF demand, Ether is up 8% with a clean push beyond $3,000. “It’s showing more strength than Bitcoin this week, with fresh institutional flows and BlackRock’s ETH ETF hitting record volumes,” wrote Rachael Lucas, crypto analyst at BTC Markets. Ether is currently trading at $3,014 at the time of writing.

Ethereum’s up 7% with a clean push to US$3,000. It’s showing more strength than Bitcoin this week, with fresh institutional flows and BlackRock’s ETH ETF hitting record volumes. ETH maxis, enjoy the moment.

— Rachael (@Rachael_M_Lucas) July 11, 2025The Ether spot ETF daily net inflows of $300.93 million on July 10 is led by BlackShares iShares ethereum Trust (ETHA), followed by Grayscale’s ETHE fund.

Further, ETHA saw significant investor interest with over $1.2 billion collected since June, indicating bullish market sentiment.

Lucas noted that the Optimism marks a “defining moment” in both cryptos’ institutionalization.

“What we’re seeing is not a retail-driven frenzy, but a steady pipeline of capital from asset managers, corporate treasuries, and wealth platforms finally stepping into the market. Weeks of consistent inflows confirm that,” she added.