KULR’s Bitcoin Bet Pays Off: 1,021 BTC Holdings Now Yield a Staggering 291% Return

KULR just doubled down on crypto—and it's printing money.

The firm now holds 1,021 BTC, with its Bitcoin strategy delivering a jaw-dropping 291% yield. While Wall Street hedgies fiddle with bond ladders, KULR's playing digital gold roulette—and winning.

No fancy derivatives, no over-leveraged nonsense. Just cold, hard Satoshis stacking at hyperspeed. The yield? Almost triple Bitcoin's own 2025 price surge. Someone's doing more than just HODLing.

Of course, in crypto, today's genius is tomorrow's liquidation event. But for now? The numbers speak for themselves.

BTC Yield Emerges as Key Performance Indicator

A Core component of KULR’s strategy is its proprietary metric: BTC Yield. This figure, which reached 291.2% year to date, measures the percentage increase in the ratio of bitcoin holdings to Assumed Fully Diluted Shares Outstanding.

According to the firm it is intended to reflect the effectiveness of the company’s bitcoin acquisition tactics. Complementary metrics include BTC Gain (633 BTC), BTC Dollar Gain ($70.3 million), and a multiple of Net Asset Value (mNAV) currently at 2.24.

KULR notes these metrics are designed to capture the value-accretive nature of its treasury operations, rather than serve as traditional financial indicators.

Cautions on Interpreting BTC Metrics

While BTC Yield offers insight into KULR’s Bitcoin-centric strategy, the company cautions that it should not be considered a proxy for earnings performance or liquidity. It excludes liabilities and does not reflect overall financial health.

KULR said that its stock price is influenced by a broader set of variables beyond bitcoin holdings. Investors are advised to use BTC Yield as a supplemental tool and refer to the company’s full financial statements and SEC filings for a comprehensive view of its position.

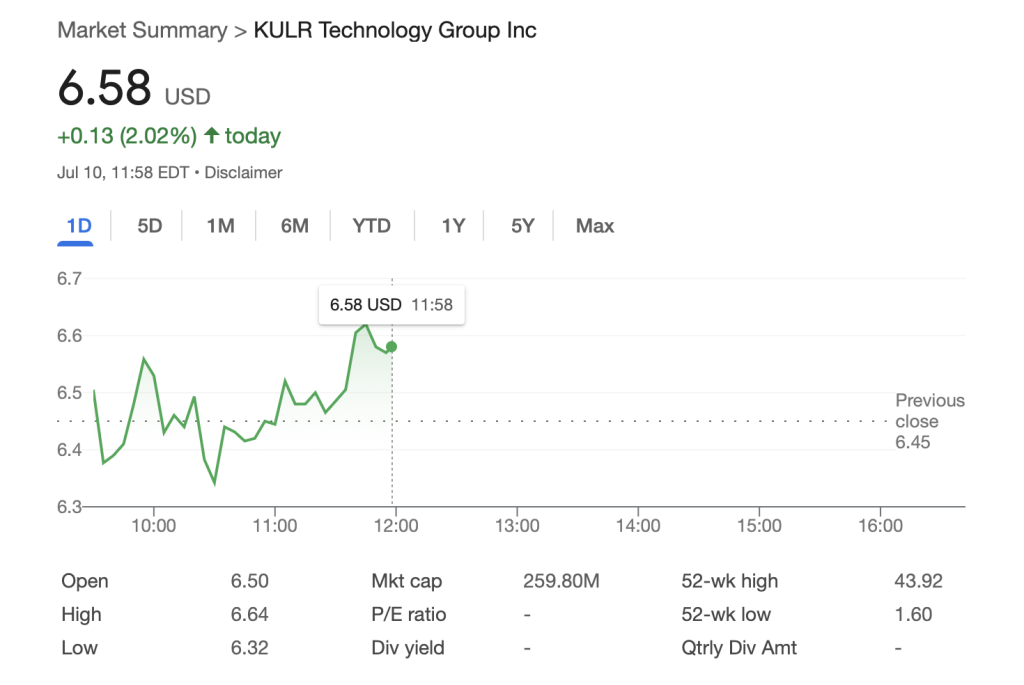

KULR Price Action – Modest Gain

KULR Technology is trading at $6.58 today, up 2%, reflecting modest intraday gains.

KULR continues to show investor confidence, supported by its Bitcoin-driven narrative and endorsements by analysts. That said, it remains a volatile, technically uncertain stock.

KULR Boosts Mining Capacity with New Deployment in Paraguay

This month KULR said it has also deployed 3,570 Bitmain S19 XP 140T Bitcoin mining machines in Asuncion, Paraguay, raising its total mining capacity to 750 PH/s across multiple sites.

$KULR Technology recently announced our deployment of 3570 Bitmain Miners, located in Paraguay.

For more information check out our recent press release.https://t.co/nLT41EbHuc#KULR #bitcoin #bitcoinmining pic.twitter.com/CTLTC2HGtD

This expansion highlights KULR’s strategic dual approach—mining Bitcoin and purchasing it on the open market—allowing the company to flexibly and efficiently grow its BTC treasury.

The “buy-or-mine” model is designed to optimize accumulation based on market conditions and operational advantages.