Binance Dominates 2025 Mid-Year Crypto Race: Exchange Titan Crushes Competition (CryptoQuant Data)

Binance isn't just winning—it's rewriting the rules of crypto dominance. Fresh 2025 mid-year metrics reveal the exchange giant accelerating while rivals eat dust.

The unkillable titan

Liquidity? Locked down. Trading volume? Absurd. Regulatory hurdles? Barely a speed bump. Binance's ecosystem now operates like a financial black hole—sucking in users, tokens, and market share with terrifying efficiency.

Meanwhile, legacy platforms scramble to explain shrinking order books to nervous investors. (Pro tip: When your 'decentralized' exchange needs bailout rumors to stay relevant, maybe revisit your business model.)

One question remains: At what point does market leadership become monopoly—and when do regulators finally wake up?

Exchange Leaders: Binance and Coinbase

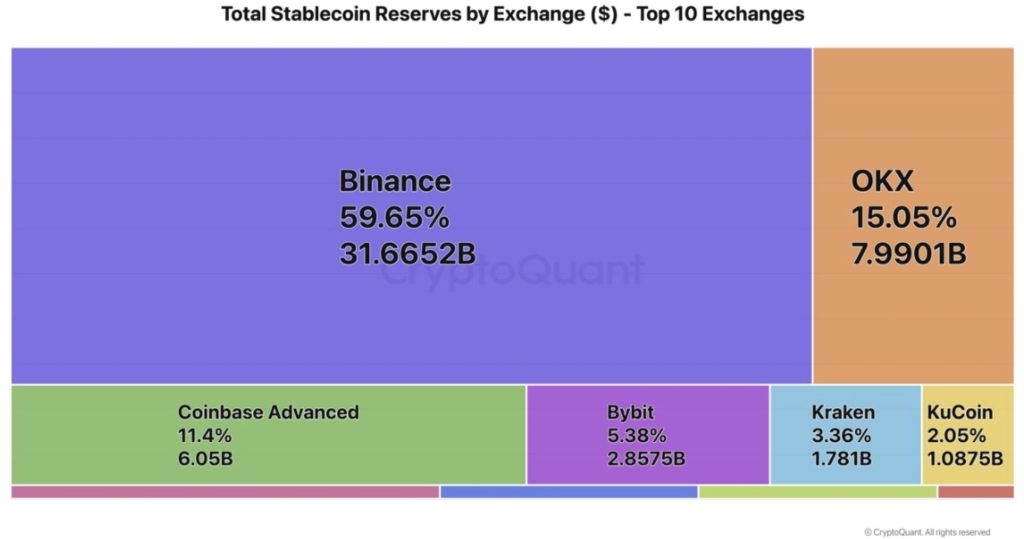

CryptoQuant’s analysis identifies Binance and Coinbase as the top-performing exchanges in their respective categories. Binance leads in spot volume, futures trading, stablecoin reserves, capital inflows, and on-chain user activity. It is the only platform showing consistent strength across all verticals.

In contrast, Coinbase retains its edge as a primary institutional exchange, especially notable in reserve holdings and usage on the ethereum network. However, Coinbase’s trading activity and market breadth remain more conservative compared to Binance and some mid-tier exchanges.

Mid-tier players such as Bybit, OKX, and Bitget maintain competitive momentum in the derivatives space and Ethereum-based stablecoin flows. Their overall capital inflows, reserve growth, and on-chain user activity remain significantly below those of Binance and Coinbase.

On-Chain Metrics Reinforce Binance’s User Preference

The report highlights that on-chain behavior is increasingly favoring Binance, especially during high-volatility periods. Binance recorded the highest altcoin deposit and withdrawal activity, a signal of active user rotation and engagement during market rallies.

On the TRON network, Binance also led in USDT transaction volume, reflecting the platform’s stronghold in low-fee, high-frequency stablecoin trading — a critical function for both retail users and market makers in 2025.

While platforms like OKX and Bybit show steady growth in user traffic and niche asset trading, they have not matched Binance’s scale in terms of on-chain dominance or reserve inflow volume.

As of mid-2025, Binance’s multi-layered dominance — spanning spot, futures, stablecoins, and on-chain metrics — positions it as the central force in the global crypto exchange landscape, according to CryptoQuant’s dashboard analysis.

Coinbase remains a well-capitalized and stable alternative, especially for institutional participants, while other exchanges remain in competitive pursuit but with notable gaps in scale and user engagement.