Stablecoins: Treasury Arbitrage Machines, Not Financial Sabotage

Forget conspiracy theories—stablecoins aren't attacking traditional finance. They're exploiting its inefficiencies with surgical precision.

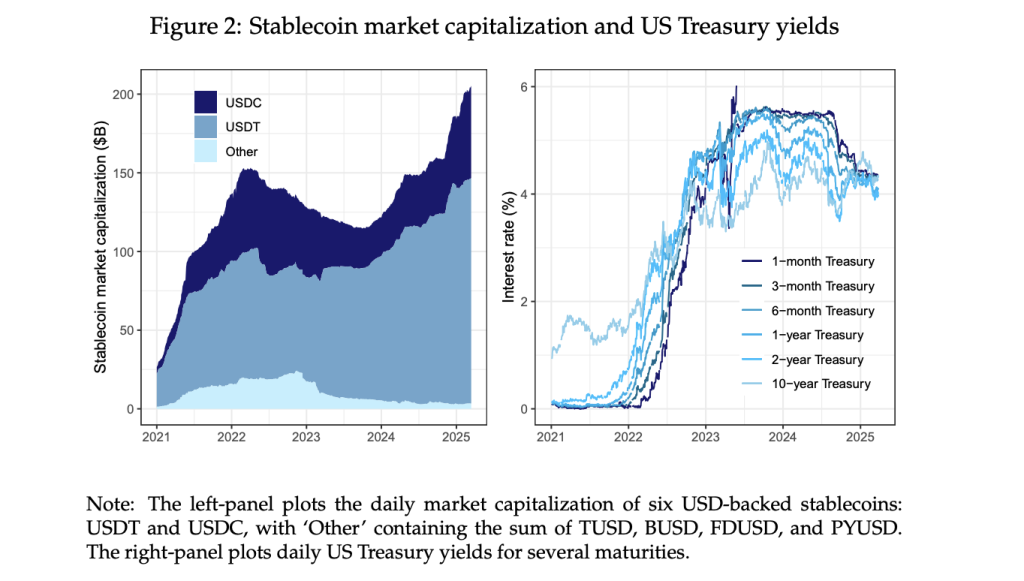

How $150B in stable assets turns yield arbitrage into a global game

When Tether's reserves hit 85% short-term Treasuries in 2023, it wasn't sabotage—it was smarter cash management than most Fortune 500 treasuries. Now Circle and competitors deploy algorithmic rebalancing that would make BlackRock's Aladdin blush.

The dirty secret? Banks hate stablecoins because they reveal how comically slow legacy settlement systems are. While SWIFT takes days, USDC moves at internet speed—with better audit trails.

Next time a central banker calls stablecoins 'dangerous,' ask why their own bond portfolios aren't this optimized. (Spoiler: because 3% management fees can't compete with code.)

Source: Stablecoins and SAFE asset prices

Source: Stablecoins and SAFE asset prices

The expanding footprint of stablecoins carries important implications for U.S. Treasury yields, monetary policy transmission, financial stability, and the future of global payments, prompting calls for greater transparency and regulatory attention, which the stablecoin issuers may themselves welcome to build trust in their businesses. Their operations are no longer confined to the crypto but have tangible connections and potential impacts on core markets like the Treasury and repo markets. The hope is that pending legislation such as the GENIUS act will help lay the groundwork necessary to properly integrate this new class of large scale treasury buyers in order to enhance our financial markets and not sabotage them.

Disclaimer: The views and opinions expressed in this article are those of the author and do not necessarily reflect the views of Cryptonews.com. This article is for informational purposes only and should not be construed as investment or financial advice.