Truth Social Shakes Markets with Bold Blue-Chip Crypto ETF Bid—BTC, ETH, XRP, and SOL in the Mix

Truth Social just dropped a regulatory bombshell—filing for a crypto ETF that reads like a 'who's who' of digital assets. Bitcoin, Ethereum, XRP, and Solana all make the cut in a move that could force Wall Street to finally take meme-stock energy seriously.

The ETF Arms Race Heats Up

While traditional finance still debates whether crypto is 'real,' Trump-linked Truth Social is bypassing the talking heads altogether. Their proposed fund bundles four of the most contentious—and liquid—tokens into a single tradable package.

Regulatory Roulette

The SEC's inbox just got more interesting. XRP's inclusion is particularly spicy given its legal gray area—apparently Truth Social enjoys living dangerously. Meanwhile, Solana's presence suggests someone's betting hard on the 'Ethereum killer' narrative.

Wall Street's Worst Nightmare

Nothing terrifies traditional asset managers more than retail investors getting easy access to crypto's volatility. This ETF—if approved—would let Main Street trade blue-chip tokens as easily as Apple stock. Cue the institutional sweating.

Truth Social's filing proves one thing: in the race for crypto relevance, even partisan platforms know where the real money moves—whether regulators like it or not.

Source: Sec.gov

Source: Sec.gov

Truth Social ETF Portfolio Structure and Crypto.com partnership

The ETF portfolio will maintain a composition of approximately,,,, andby value.

Upon approval, the ETF will be listed and traded on NYSE Arca, though the fund’s ticker symbol remains undisclosed.

"the Trust’s allocation of its assets to the Portfolio Assets (the “allocation ratio”) is initially expected to approximate percentages by value of 70% bitcoin, 15% ether, 8% SOL, 5% CRO and 2% XRP."

— Eric Balchunas (@EricBalchunas) July 8, 2025The proposed ETF is expected to function as a passive investment vehicle, tracking the market prices of its underlying cryptocurrencies without employing leverage, derivatives, or speculative trading strategies.

The fund will also engage in staking for assets such as Ethereum, Solana, and Cronos, allowing it to generate staking rewards.

Truth Social previously filed for a spot Bitcoin ETF in June, followed by a submission for a Bitcoin and ethereum combination ETF.

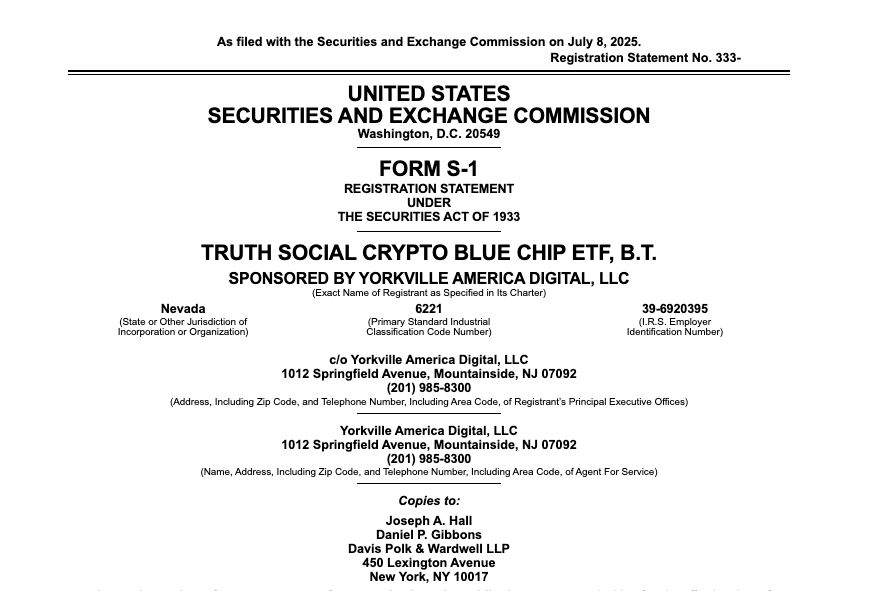

Similar to those registration statements, the “Truth Social crypto Blue Chip ETF” is sponsored by Yorkville America Digital, while Foris DAX Trust Company will be serving as custodian for digital assets, according to the filing.

Additionally, Crypto.com will act as the ETF’s exclusive Bitcoin custodian, prime execution agent, and liquidity provider.

Earlier reports indicated a TMTG partnership with Singapore-based Crypto.com to launch “Made-in-America” ETFs.

The media platform signed a non-binding agreement to offer a series of exchange-traded products (ETPs) and funds (ETFs) on the Cronos blockchain-owned exchange.

The inclusion of CRO in the investable ETFs appears to confirm Crypto.com’s involvement in the venture.

Notably, the news of the recent filing had a notably greater impact on CRO than on other Truth Social blue-chip cryptocurrencies.

The asset surged more than 20% to a monthly high of $0.09886, while Bitcoin, Ethereum, XRP, and solana only experienced gains between 1.08% and 3.6% during the same period.

TMTG’s Broader Digital Asset Strategy Amid President Trump’s Growing Crypto Fortune

The SEC’s potential approval follows the confirmation by Truth Social’s parent company of its digital asset strategy, which includes a bitcoin treasury plan.

On May 30, the company announced it had raised $2.44 billion through a private placement involving nearly 50 institutional investors.

![]() The SEC has approved TRUMP Media and Technology Group’s (TMTG) registration statement linked to a $2.3 billion Bitcoin treasury initiative. #Trump #TruthSocialhttps://t.co/ybidUAZtqb

The SEC has approved TRUMP Media and Technology Group’s (TMTG) registration statement linked to a $2.3 billion Bitcoin treasury initiative. #Trump #TruthSocialhttps://t.co/ybidUAZtqb

The funding round included 55.9 million shares at $25.72 and $1 billion in zero-coupon convertible notes, with proceeds designated for Bitcoin acquisition and general operations.

In a May 27 announcement, TMTG President and CEO Devin Nunes described Bitcoin as “an apex instrument of financial freedom,” stating that it WOULD become a core component of the company’s asset base.

On the same day, Arkham Intelligence posted on X: “Donald Trump’s company, Trump Media, will buy $2.5 BILLION of Bitcoin. Is Trump about to go Saylor Mode?”, referencing MicroStrategy’s executive chairman and his aggressive Bitcoin strategy.

Moreover, President Trump appears to be benefiting significantly from these cryptocurrency ventures.

A July 2 Bloomberg report revealed that Trump and his family have reportedly earned over $620 million from recent cryptocurrency ventures, with Trump’s exclusive crypto holdings now comprising around 9% of his estimated $6 billion fortune as of June.

![]() The Trump family has seen crypto holdings rise to $620M+, driven by memecoin, token sales, and a 20% Bitcoin stake. #Cryptocurrency #TrumpMediahttps://t.co/ReXDfVB0wT

The Trump family has seen crypto holdings rise to $620M+, driven by memecoin, token sales, and a 20% Bitcoin stake. #Cryptocurrency #TrumpMediahttps://t.co/ReXDfVB0wT

Beyond the Truth Social-affiliated ventures, the majority of this wealth is tied to his family-backed firm, World Liberty Financial, and the launch of his personal meme coin, TRUMP.