SocialFi’s Billion-User Breakthrough: How to Avoid Repeating Crypto’s Hype Cycles

SocialFi's at a crossroads—mass adoption or another vaporware graveyard?

The network effect gamble

Platforms promise creator payouts and community ownership, but most still run on hopium and half-baked tokenomics. Remember when every DeFi project had 'farm' in its name?

Traction vs. speculation

Real adoption means grandma posting cat memes earns more than degens farming airdrops. We're not there yet—but the infrastructure's improving faster than Wall Street's CBDC panic attacks.

The bubble watch

When VC-funded 'Web3 Twitter clones' start boasting about their 'total value locked' instead of active users, grab your exit liquidity. The space needs less financial engineering and more actual engineering.

SocialFi won't moon until it solves one thing: making crypto invisible while keeping its benefits. Until then? Enjoy the speculative fireworks—just don't confuse them for progress.

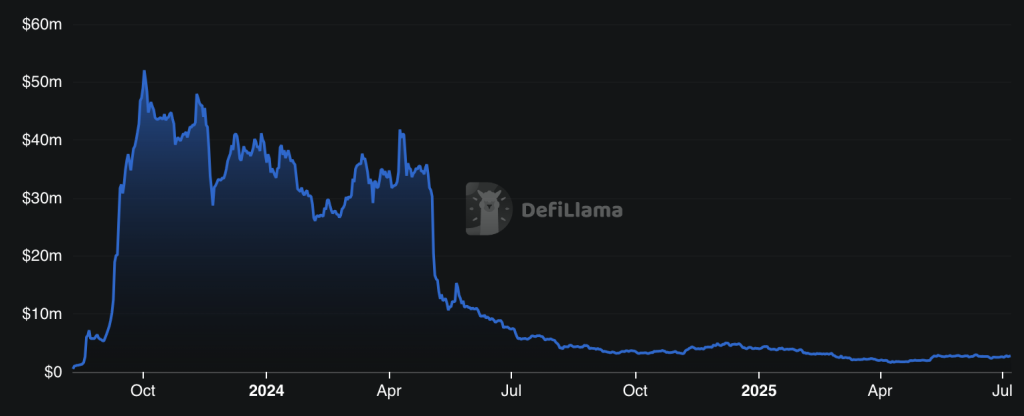

Friend.tech TVL. Source: DeFiLlama

Friend.tech TVL. Source: DeFiLlama

The case felt familiar — euphoria, vertical charts, then the hush that follows a burst bubble.

Today, a second wave of projects is trying to prove that SocialFi can be more than a quick flip. So, are they solving real problems and bringing genuine value, or just rebooting the HYPE machine? Let’s see where the evidence points.

Hype Has a Shelf-Life

If you scan the market, you may discover that tokens tagged “SocialFi” are worth about $1 billion today. Put that next to the $3.07 trillion total crypto market cap and the roughly $104 billion now locked in DeFi protocols, and the niche begins to look tiny. In such a relatively small market, a single week of enthusiasm or hesitation can double the chart (or cut it in half) before most people even notice.

What are the reasons for this whiplash? Crypto is famous for being prone to what is called market reflexivity. It’s a loop where rising prices fuel belief, that belief draws in more buyers, and the cycle intensifies — until it eventually breaks. So, it shows how rising prices can change focus from actual fundamentals to just keeping the story alive.

Take the earlier-mentioned “friend.tech” app as an example. In August 2023, it turned literally every social connection into a “key,” and the bonding curve behind those keys made early entries feel like free money. Then, six-figure sign-ups and eight-figure deposits poured in almost overnight.

But the curve turned out to be a double-edged sword. The moment growth stalled, keys got dumped, liquidity drained, and most of the capital quietly slipped away. Why? Because the boom had been driven by the reflexive bet that someone else WOULD pay more, and the floor fell out as soon as that narrative cracked.

The takeaway is simple: SocialFi needs something more resistant than reflexive price loops if it hopes to outgrow its trading-only phase. The good news? Some teams are building SocialFi models where price isn’t the main product.

Testing a Token-Light Path

Even though DeFi activity dipped in Q1 2025, the “Social” category saw 2.8 million daily unique wallets — up 10% quarter-on-quarter. It’s still a niche, but it suggests some users aren’t just chasing rewards. That’s a signal worth paying attention to. SocialFi can now take a different route, one that doesn’t lean on yield, tokens, or airdrops. And a few projects are quietly showing that it’s possible.

Some platforms are experimenting with paid access. Instead of offering rewards, they charge users a small annual fee to post. The idea is to make spam expensive and keep the lights on without launching a token. By doing this, they flip the usual script asking users to pay for a cleaner, more stable network instead of dangling rewards. This approach has gained some ground so far, but one big question remains: will people keep paying when most social apps are free?

Others focus on portability. In these models, every post and follow is minted as an NFT, letting creators take their audience across apps. It’s an attempt to build user-owned identity rather than lock-in — a compelling idea. But wallet sign-ins and gas fees still create friction, and although they may have a decent user base, the experience hasn’t yet broken out of crypto-native circles.

A third category avoids tokenization altogether — at least for now. These projects entirely delay it, run on a non-transferable points system, and skip introducing a liquid asset. That may dampen hype, but it also avoids the reflexive cycles that derailed previous “social” experiments. Whether that patience pays off (or just delays hard decisions) is still up in the air.

That said, token-light models aren’t without trade-offs, including slower growth, limited liquidity, and fundraising troubles. And taken together, none of these models offer a definitive answer, but they do show one thing: SocialFi can be explored without defaulting to speculation.

Rethinking the Core Loop

The way I see it, in 2025, SocialFi won’t break out by tweaking bonding curves or handing out tokens just to get people in the door. That scheme has already run its course. What matters now is whether anyone can build something people use when there’s nothing to farm.

So, my take is: if speculation is the only thing holding attention, then attention won’t last long.

The projects we’ve explored haven’t solved scale, but they’ve shown one thing: usage without speculation is possible. That’s why the next real breakthrough will come from the protocol with the lowest outflow. One that offers wallet-free onboarding, spam resistance, portable identity, and a UX people actually want to stick with.

Disclaimer: The views and opinions expressed in this article are those of the author and do not necessarily reflect the views of Cryptonews.com. This article is for informational purposes only and should not be construed as investment or financial advice.