Dogwifhat ($WIF) Shatters Expectations: 21% Surge & Solana Validator Debut Redefines Memecoin Potential

Move over, dog memes—$WIF just turned volatility into a launchpad. While Wall Street hedgies obsess over 'fundamentals,' this Solana-based memecoin ripped a 21% gain and dropped a validator like it's hot. Who needs boring old yield farming when you can have internet culture on-chain?

The Validator Play: More Than Just Bark

Solana's ecosystem gets sharper teeth as $WIF deploys its own validator node. No more begging for scraps from centralized exchanges—this dog hunts its own blocks. Validator staking could turn speculative traders into long-term pack members.

Price Action That Bites Back

That 21% pump wasn't just another meme-fueled blip. Liquidity pools deepened while perpetual traders got liquidated—proof that even joke assets develop real market structure. (Cue the 'wen institutional adoption' tweets.)

Let’s be real—this could still crash harder than a Lehman Bros. happy hour. But for now? The meme that pays keeps howling at the moon.

Source: CoinMarketCap

Source: CoinMarketCap

$WIF Expands Exchange Listings Amid Whale Moves and Validator Push

Despite lacking a whitepaper, staking mechanism, or formal utility, $WIF has captured strong retail and community support through viral marketing and speculative enthusiasm.

Recent on-chain data from Holderscan reveals that over 35% of the circulating supply remains concentrated in top wallets, amplifying the influence of whale activity.

For example, in late June, crypto influencer Ansem bought 2.97 million $WIF tokens at $0.77 each. LookOnChain spotted the trade, and prices jumped immediately afterward, proving the major influence whales have.

Wallet "Ansem" spent 2.3M $USDC to buy 2.97M $WIF at $0.77 today.https://t.co/waP2nXsTV6 pic.twitter.com/V2EHzomYcA

— Lookonchain (@lookonchain) March 3, 2025Interestingly, $WIF is taking its first step toward infrastructure utility. In partnership with DeFi Dev Corp, the dogwifhat community launched a dedicated validator node on Solana—a first for any memecoin on the network.

![]() BREAKING: @defidevcorp PARTNERS WITH @dogwifcoin TO LAUNCH DEDICATED $WIF VALIDATOR!!!

BREAKING: @defidevcorp PARTNERS WITH @dogwifcoin TO LAUNCH DEDICATED $WIF VALIDATOR!!!![]() pic.twitter.com/Sa3Vtw0R2H

pic.twitter.com/Sa3Vtw0R2H

The validator will pursue stake delegation through the Solana Foundation Delegation Program, offering shared rewards to $WIF backers and introducing a long-term incentive model.

Meanwhile, exchange activity is ramping up. On June 27, 2025, the token officially debuted on Slex Exchange via the WIF/USDT pair, joining a growing list of global trading venues.

New Listing: WIF @dogwifcoin

Spot trading is already open, the exchange has started.

Trading Pair:

WIF/USDT![]() Trade WIF:https://t.co/8XynNHtDoY

Trade WIF:https://t.co/8XynNHtDoY

Always Keep in Mind:

HOLD: https://t.co/OaPVTViTEo

DCA: https://t.co/JcGHrLPCyw

Diversification: https://t.co/lK2lI2dngk pic.twitter.com/rSRNqBl4bh

Together, these developments indicate a subtle but strong shift in $WIF’s identity—from a purely speculative memecoin to a token exploring deeper integration within Solana’s ecosystem.

Rally Fizzles as Profit-Taking Triggers 4% Pullback—Key Levels to Watch

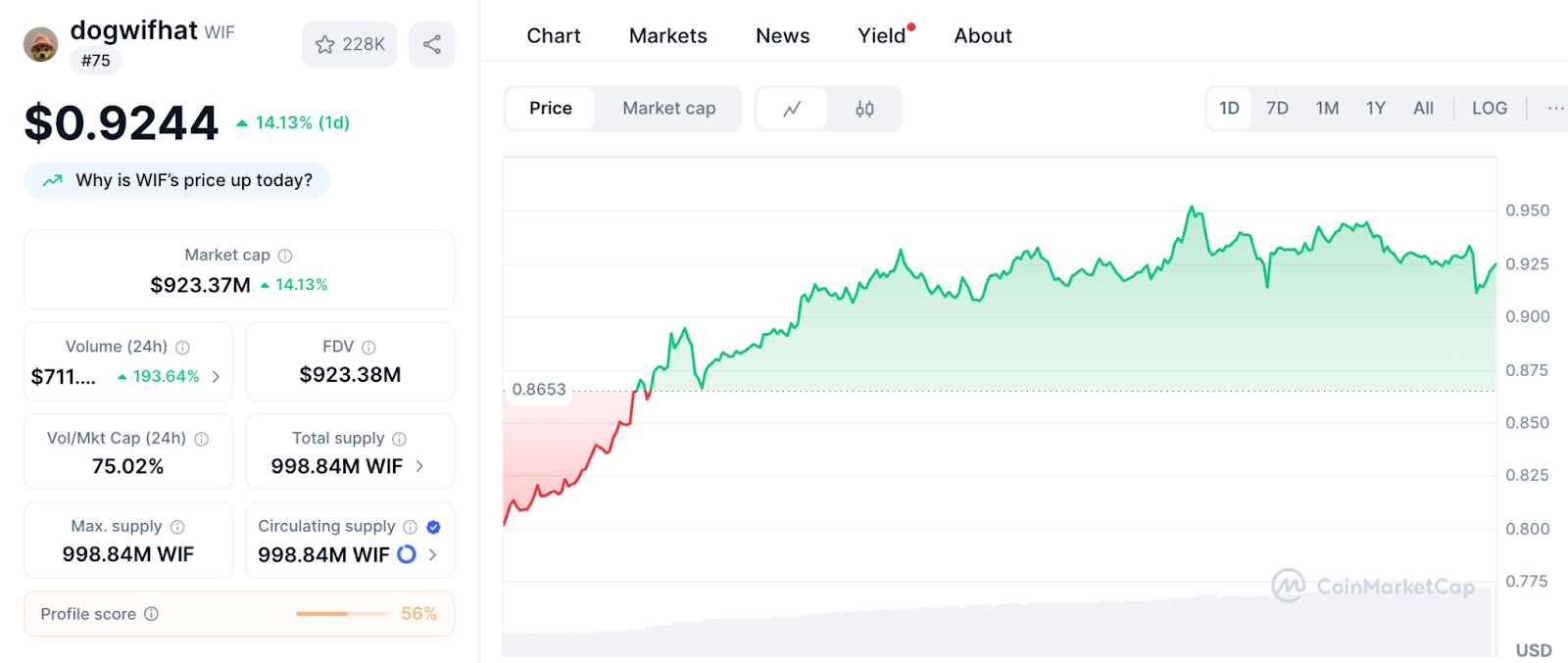

The WIF/USDT 30-minute chart shows a dramatic bullish pump on July 2, where bulls injected over $400 million in capital, triggering a vertical price breakout from $0.78 to highs NEAR $0.947, resulting in a gain of more than 21% in under 24 hours.

This explosive rally reflected strong speculative momentum and whale-driven accumulation, pushing WIF past multiple resistance levels in a single sweep.

However, the momentum was short-lived as the bullish steam cooled rapidly. Rather than consolidating near the highs, WIF has sharply reversed, dropping from $0.947 to around $0.910—a nearly 4% pullback.

The candle structure indicates a potential bearish rejection at the top, with multiple wicks testing higher levels but failing to hold. This weakness suggests that profit-taking has kicked in, and the uptrend may be stalling.

Additionally, volume peaked during the July 2 rally but has since declined substantially, which further weakens the case for sustained upside without fresh capital inflows. Traders should now watch $0.86 as a possible support zone. A breakdown below this level could accelerate the correction toward the $ 0.75–$ 0.79 range.

Until WIF reclaims $0.93 or more with conviction, the momentum appears to be shifting from euphoria to caution.