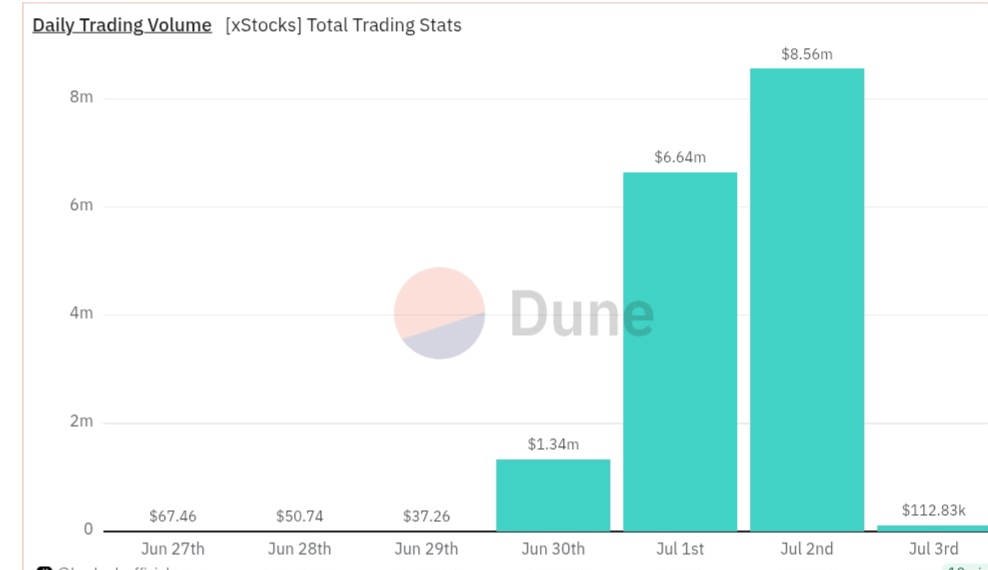

🚀 xStocks Explodes: 540% Volume Surge in 72 Hours as RWA Mania Grips Crypto

Real-world assets are eating crypto—and xStocks just served the main course.

The numbers don't lie

When trading volume rockets 540% in three days, even Wall Street interns start Googling 'RWA.' xStocks' surge mirrors the sector's frantic scramble to tokenize everything from whiskey barrels to skyscrapers.

Why institutions are drooling

Blockchain's finally delivering its original promise: slicing illiquid assets into tradable digital shares. No paperwork, no bankers taking 2% just to answer emails—just pure, unfiltered financialization.

The cynical take

Let's be real: half these 'real-world assets' will be Miami parking spots sold as NFTs. But when the music's playing, even skeptics dance.

TSLAx, which represents the Nasdaq-listed Tesla stock in token form, rose sharply, with a cumulative volume of $3.3 million.

It comes as Tesla founder Elon Musk renewed his online spat with Donald TRUMP over the U.S. President’s tax and spending bill, dubbed “big, beautiful bill.”

CRCLx, a digital representation of USDC stablecoin issuer Circle’s stock, was the third most traded token, with over $2.5 million in volume.

Circle debuted on Nasdaq on June 5 in an oversubscribed IPO. The New York-based company’s share price surged over 750% last month alone.

Other popular xShares such as MSTRx (MicroStrategy), NVDAx (Nvidia), and APPLx (Apple) also posted noticeable increases in volume.

Tokenized securities are digital versions of regular shares or ETFs, which can be traded on the blockchain. Each token reflects the price of its real-world counterpart, backed by actual shares held in custody by Backed Finance, the Swiss-based platform behind xStocks.

Investors don’t have to hold the shares directly, only tokens that represent ownership of the assets. Over 60 tokenized securities are now available on major exchanges, including Kraken, Bybit, and Solana-based DeFi protocols, via Backed.

xStocks: The Tokenized Turn

Illia Otyechnko, lead analyst at crypto exchange CEX.io, said that timing and the growing adoption of tokenized real-world assets played a key role in the xStocks trading volume spike.

The recent launch of xStocks coincided with major announcements from Robinhood and Gemini, both of which rolled out support for tokenized equities, including privately traded ones like SpaceX, he said.

“This gave xShares nearly perfect timing, allowing it to benefit from the growing buzz around tokenized equities, especially with its tokens getting listed immediately on major CEXs,” Otyechnko told Cryptonews.

Otyechnko said RWAs have moved beyond being a niche in decentralized finance (DeFi) — “they are now taking center stage.”

More than $9 billion in on-chain value has been added to the RWA sector in the first half of 2025 alone, eclipsing the total for the whole of 2024.

Notably, 63% of current real-world asset holders entered the market this year, he said, “signaling accelerating adoption.” Otyechnko explains:

“The growth comes as much of the broader DeFi space remains stagnant or in decline. The RWA surge has been driven mainly by market uncertainty due to tariff chaos and geopolitical tensions in the Middle East.”

As a result, demand for tokenized commodities and bonds has soared. Both assets have been the standout performers in the RWA sector this year, and Otyechnko says that growing Optimism is starting to spill over into tokenized stocks.

According to Shawn Young, chief analyst at MEXC Research, the rise in xStocks and RWAs reflects a broader structural shift driven by institutional interest, macroeconomics, and investor appetite for regulatory clarity.

“The convergence of TradFI and crypto is increasingly drawing investors to assets that offer not only on-chain accessibility but also real-world value and regulatory certainty,” Young told Cryptonews via Telegram.

Macro Tailwinds

Young said the appeal of xStocks lies in their promise — the ability for global users to access top real-world securities using blockchain-based tools, without the red tape often associated with old brokerage accounts.

“Tokenized equities help bridge the gap between the traditional financial markets and DeFi, enabling users to gain exposure to stocks and RWAs with fractional ownership, 24/7 liquidity, and lower barriers to entry.”

However, the rise in interest in xStocks is not happening in isolation. U.S. equity indices such as the S&P 500 and Nasdaq recently hit record highs, while the Dow Jones is also on a “strong upward trajectory”, Young added.

Eager for exposure to this upside, investors are now turning to tokenized versions like SPYx, often with lower entry points and real-time settlement. “This is meeting the long-standing demand for real-world yields using crypto-native access,” he said.

According to the RWA website, there are currently a total of $24.5 billion of real-world assets issued on-chain, with more than 265,000 asset holders. That’s a growth of 5.2% over the past 30 days, the data shows.

xStocks Are Not Tethered to Bitcoin

The increase in xStocks trading volume comes as the price of Bitcoin fell below $106,000 earlier this week as traders derisked ahead of key U.S. economic data.

On July 3, the U.S. is expected to release a slew of labor market data, including June non-farm payrolls and the unemployment rate.

Tokenized stocks appear to have bucked the broader crypto trend, and even the solana ecosystem on which many are based, according to Otyechnko, the CEX.io analyst.

Raydium, a top Solana-based DEX, remains the primary trading venue for xShares, but its overall market share has continued to decline in recent days.

“There’s little indication that xShares trading activity has connections to Bitcoin’s performance,” said Otyechnko. “Even as Solana-based tokens, xShares had minimal impact on the Solana ecosystem.”

Matteo Greco, senior associate at crypto firm Fineqia, concurred, saying he didn’t see a strong link between bitcoin and xStocks. “In the crypto space, price surges can occur at any time, driven by a wide range of factors,” Greco tells Cryptonews, adding:

“While I understand the common narrative that equities and crypto tend to move in opposite directions, in practice, the correlation between these two asset classes has increased over the past couple of years. As such, it seems unlikely that a negative price movement in Bitcoin WOULD directly contribute to growing momentum for tokenized stocks.”

But that’s not to say Bitcoin is out of the picture. MEXC’s Young sees the inverse movement between xStocks activity and BTC’s price as a “tactical portfolio rebalancing amongst investors.”

As Bitcoin declined, traders rotated capital “into fundamentally backed assets with lower volatility, like tokenized stocks.” It’s a behavior that mirrors traditional risk-off rotation strategies, he averred.