Shocking 2025 Data: 65% of Bitcoin Mining Still Controlled by Chinese Operations

The dragon hasn't loosened its grip—despite years of regulatory crackdowns, China's shadow still dominates Bitcoin's backbone.

Mining's great migration myth

Remember the post-2021 exodus narrative? Turns out miners just played geographical hide-and-seek. While operations scattered from Sichuan to Texas, 65% of the hashrate remains Chinese-controlled through offshore shells and proxy partnerships.

The decentralized illusion

Mining pools may flaunt their global server locations, but follow the money: equipment financing, pool ownership, and colocation deals all trace back to Chinese capital. Even ASICs rolling off new assembly lines in Malaysia? Funded by yuan-denominated VC.

Wall Street's blind spot

Institutional investors keep pouring into mining stocks without asking who really controls the hashrate—classic 'not your keys, not your coins' energy. Meanwhile, the OGs quietly stack sats through mainland-connected pools. Stay paranoid.

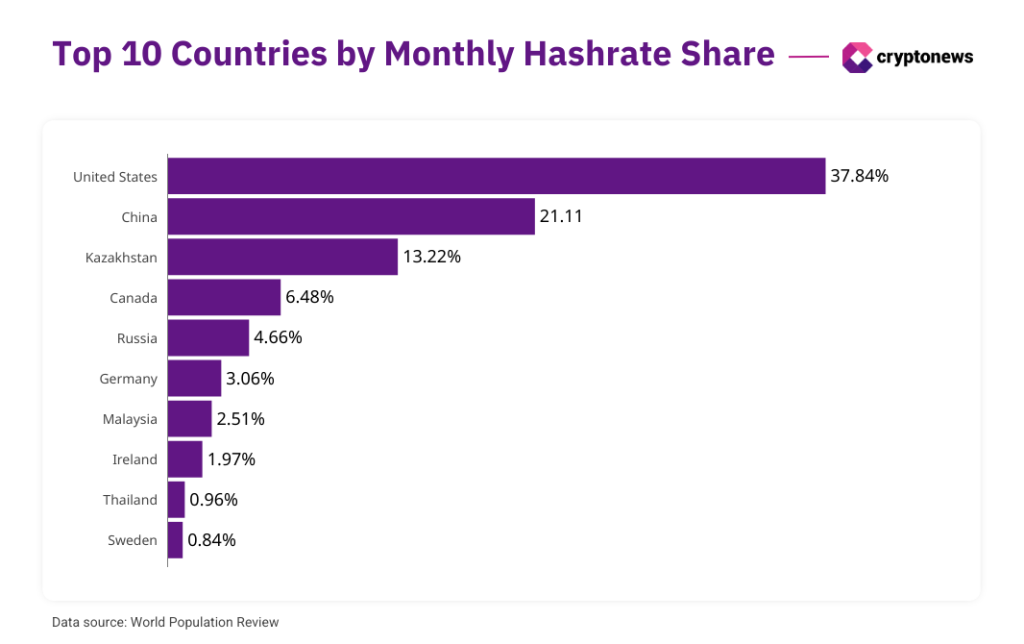

Speaking to Cryptonews, Hydyrov said while much of China’s previous hashrate has moved to countries like Russia and the U.S., many of the same “major market players” continue to shape BTC mining worldwide.

“I estimate that 55–65% of the global mining industry still has Chinese origins,” he said, noting:

“[But] I wouldn’t call it influence — it’s simply business. These companies pursue profit and have highly optimized, competitive operations.”

Hydyrov was responding to a question about whether miners with Chinese roots still effectively control the Bitcoin network’s hashrate — even when operations have moved overseas. China accounted for 74% of the Bitcoin supply before the 2021 ban.

Chinese Bitcoin Miners Expand Capacity

According to Hydyrov, many of Uminers’ Chinese partners who dominated in volume and scale back in 2019 have since redirected their orders from China to other countries, primarily North America and Russia.

It’s unclear how much of China’s previous Bitcoin mining capacity ended up in places like North America and Russia.

Hydyrov said he could not “provide an exact number” but estimates that all of Uminers’ former China-based customers continued operations — and in many cases, even expanded.

“All our partners who had stable mining operations in China before 2021 have continued their work — and many have even increased their capacity by 30% to 150%.”

Uminers works with some of the largest Chinese mining firms, including Bitmain and MicroBT. The company, which has been in operation since 2017, sells more than 5,000 crypto-mining rigs every month, according to its website.

Inside China, mining still goes on in less developed areas, “where policy enforcement is weak,” powered by renewable energy. Authorities tend to turn a blind eye when miners offer co-benefits like heat recovery systems for public use. As Hydyrov says:

“In such regions, mining companies can collaborate with provincial governments by providing recovered heat energy in exchange for staying off-grid. These data centers are generally small — around 1 to 10 MW.”

The larger firms moved operations abroad or to neighbouring countries. For example, BTC KZ relocated miners from Xinjiang to Ekibastuz, northeastern Kazakhstan. More recently, ASIC manufacturers have started to establish bases in the United States.

Bitmain, the biggest hardware Maker with a market share of 82%, started U.S. production of mining rigs in December 2024, one month following Trump’s election victory, according to Reuters.

MicroBT, the second biggest with 15% market share, is reported as “actively implementing a localization strategy in the U.S.” to “avoid the impact of tariffs”.

Canaan (2.1% market share) began trial production in the U.S. to avoid Trump’s so-called Liberation Day tariffs, announced on April 2. TRUMP imposed tariffs of up to 50% on Chinese imports. The figure was cut from a high of 145%.

The dominance of the three Chinese companies has long been a topic of debate, raising questions about market power and the potential for disruption.

Bitcoin Mining as Economic Leverage

However, the firmware market — specialized software that controls and optimizes the operation of mining hardware — is more fragmented, according to the latest study by the Cambridge Centre for Alternative Finance (CCAF).

Third-party firmware providers, including Vnish (Russia), Braiins OS (Czech Republic), LuxOS (UK), and ePIC (USA), now account for a combined 38% of the distribution. A growing number (17.6%) of mining firms prefer to develop custom firmware tailored to their specific operational needs, per the report.

Experts say understanding the landscape and scale of Chinese Bitcoin mining capacity could help explain President Trump’s “deep involvement” in the broader battle over Bitcoin mining hashrate.

In recent months, Trump has pushed to make Bitcoin an important pillar of U.S. economic strategy, positioning the top cryptocurrency as a tool to help reduce America’s $36 trillion national debt.

The Republican President has proposed policies to support local mining, with pro-Bitcoin Senator Cynthia Lummis calling for an end to the “unfair treatment” of Bitcoin miners in taxation issues.

For years, miners and stakers have been taxed TWICE. Once when they receive block rewards, and again when they sell it.

It’s time to stop this unfair tax treatment and ensure America is the world’s Bitcoin and Crypto Superpower.![]()

Trump’s two eldest sons, Eric and Donald Jr, have also cofounded a new mining outfit called American Bitcoin — part of the U.S. President’s pledge to make America a global leader in the crypto industry.

On July 1, American Bitcoin announced it had raised $220 million. The company, launched in March, plans to use the new capital to buy Bitcoin and more ASIC miners. The crypto venture has Eric Trump as its chief strategy officer.

Can the US Decouple from Chinese Tech?

Analysts have framed Trump’s focus on Bitcoin as part of the ongoing economic rivalry between the U.S. and China. But can the U.S. realistically achieve hashrate dominance without relying on Chinese technology?

“Not easily — and certainly not in the short term,” Hydyrov, the Uminer founder and CEO, tells Cryptonews, adding:

“Building facilities comparable to Bitmain or MicroBT requires not only substantial investment and advanced chip design expertise but also years of research and development and supply chain development.”

Most large-scale miners around the world, including those in the U.S., like Riot Platforms and Core Scientific, still rely on ASIC miners manufactured by Chinese firms. Mining management software and trouble-solving in the data centers often involve Chinese consultants, said Hydyrov.

“The key issue is people,” he stressed. “Developing local specialists will take time. While the U.S. may be taking steps to train such experts, this process is still in its early stages.”

Hydyrov says the U.S. is moving in this direction, “but reaching absolute independence…will require coordinated efforts of government, industry, and academia.” Full self-sufficiency WOULD take at least three years, he added.