Pepe Coin Price Prediction – $500M Volume Explosion Sparks Frenzy: What’s Driving the Madness?

Memecoin mania is back—and Pepe’s leading the charge. A $500M trading volume surge has crypto degens and institutional sharks circling. Here’s why.

### The Froth Factor: Speculation or Substance?

When a frog-themed token outpaces blue chips, even Wall Street’s algo-traders start sweating. Liquidity’s flooding in, but the ‘utility’ remains… creatively undefined.

### Whale Watching: Who’s Really Pumping the Chart?

Binance order books show 20% swings in under an hour. Retail FOMO meets OTC desk shenanigans—classic crypto theater.

### The Cynic’s Take: Another ‘Narrative’ for Bagholders

Fundamentals? Try ‘number go up’ meets influencer leverage. Just don’t mention the 90% crash last time traders ‘ape’d in’ at ATHs.

$500 Million Surge Reverses Immediately: What’s Going on?

With the sudden pump having since reversed back to the $0.0000095 launchpad that triggered it, these bullish pressures are in question.

The weekend saw a sharp rise in the 4-hour RSI from oversold conditions NEAR 30 to overbought levels at 70, but the move lacked follow-through, triggering a swift correction that signals weak conviction.

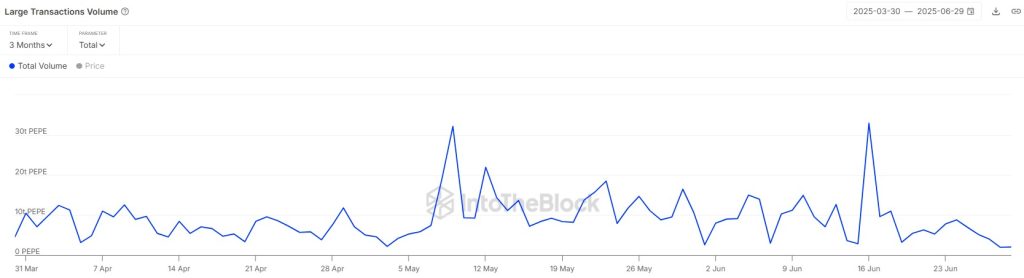

According to IntoTheBlock data, large Pepe transactions—exceeding $100,000—have declined by 93% from 32.9 trillion three weeks ago to the current 2.06 trillion.

This sharp decline in whale activity suggests major holders are hesitant to accumulate, likely waiting for further downside before re-entering the market.

This comes as the profit-to-loss ratio reaches its highest level since May, soaring to 2.55 according to Santiment data—there’s $2.55 in unrealized gains for every $1 in losses.

This heightened risk of profit-taking could explain why smart money is standing by on the PEPE price move, adding weight to the case for short-term caution.

Pepe Price Analysis: Is Pepe in for a Crash?

The ongoing retest of key support at $0.0000095 could be key the the breakout of a 6-month cup and handle pattern.

This level marks the final barrier to a newly forming uptrend, with pressure building at a confluence zone where price action meets the handle’s upper resistance trendline.

Since completing the corrective phase of a potential Elliott Wave structure, the setup favors a bullish continuation aligned with the broader trend of the pattern.

The MACD supports this outcome, building a marginal lead above the signal line after a weekend golden cross—early signs that the uptrend could persist into the short term.

More so, the RSI also finds stability in an uptrend below the neutral line, moving away from recent bearish dominance.

Should the breakout occur, the pattern projects a target near $0.000020, representing a 117% MOVE from current levels.

However, if $0.0000095 fails to hold, the next major support lies near $0.0000079—aligned with the end of the final corrective C wave of the Elliott wave formation—potentially signaling a deeper correction.

A Smarter, Safer Crypto Wallet Has Arrived – And It Could Replace MetaMask

Best Wallet ($BEST) is a next-gen crypto wallet designed to rival MetaMask and Phantom, offering faster swaps, lower fees, and support for 50+ blockchains—all without giving up control of your assets.

It also introduces tools like “” – a crypto screener that allows users to identify and invest in top ICOs while they are still flying below most investors’ radars.

This utility extends to TradFi with Best Card, replacing the traditional debit card. It allows seamless real-world transactions using stablecoins anywhere that Mastercard is accepted.

Best Wallet is already making waves, raising over $13.6 million in the presale for its new $BEST utility token. Its app is already featured on Google Play and the App Store.

To learn more about Best Wallet, follow its official X, Telegram, or visit the Best Wallet website.