Why Crypto Mortgages Are a Ticking Time Bomb—And How to Avoid the Fallout

Crypto meets real estate—what could go wrong? The latest trend of using digital assets to secure home loans is flashing more red flags than a bull market correction. Here’s why mixing volatile assets with 30-year debt might be the riskiest trade of 2025.

The Volatility Trap

Imagine your down payment evaporating overnight because Bitcoin decided to take a 20% nosedive before closing. Crypto’s wild price swings turn mortgage approvals into a high-stakes casino game—where the house always wins.

Regulatory Roulette

Banks hate uncertainty, and crypto mortgages come with enough unknowns to give any compliance officer nightmares. From AML headaches to tax reporting chaos, lenders are scrambling to retrofit legacy systems for this Frankenstein financial product.

Liquidity Illusions

That ‘instant settlement’ promise? Doesn’t apply when you need to liquidate your NFT collateral during a market crash. Traditional mortgages move slow for a reason—crypto’s 24/7 markets meet real estate’s glacial pace creates a perfect storm of mismatched timelines.

The Bottom Line

Until stablecoins get FDIC insurance and ETH stops moving 10% before breakfast, crypto mortgages remain a speculative plaything for degens—not your average homebuyer. But hey, at least it’s more exciting than watching your bank’s 0.01% savings account ‘grow.’

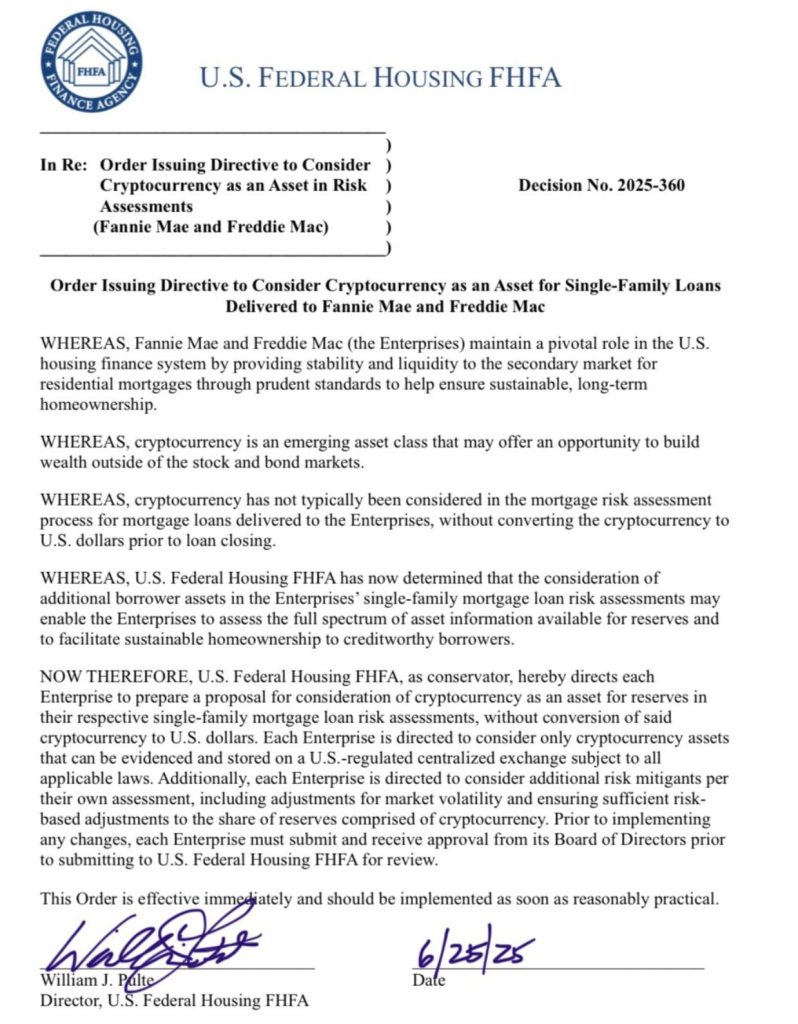

But at this point, it’s worth taking a huge step back — and considering the potential ramifications that this policy could have on homeowners and the economy.

We all know how volatile Bitcoin can be. It’s accelerated from $61,000 to $107,000 over the past 12 months. Such dramatic price movements also work both ways, with a devastating plunge from $68,000 to $16,000 back in 2022.

Embracing BTC as collateral WOULD mean enthusiasts no longer need to convert their coins back into dollars, but can retain them in the hope of future price rises. On the flipside though, there is a real risk that a homeowner’s crypto stash could be liquidated in the event of a sudden downturn. Put another way, it would mean slavishly monitoring prices to prevent a devastating margin call.

Digital assets are also a pretty impractical source of funding for a house purchase. When fiat is used, applicants may only need a 5% to 10% cash deposit — meaning they can borrow the rest and make monthly repayments. By contrast, most crypto mortgage providers require 100% collateralization. In other words, if you’ve got your heart set on a $300,000 house, you’d need to pledge $300,000 of coins. It’s also worth noting that lenders typically only accept BTC and ETH, meaning that your Doge bags wouldn’t get you very far in the application process.

Critics are already sharing fears that injecting crypto into the housing market could contribute to a 2008-like financial crisis, where a slew of high-risk mortgages defaulted and sparked a global recession. Given the U.S. government implicitly guarantees home loans issued by Fannie and Freddie Mac, there’s also a real danger that an implosion in Bitcoin’s value could end up costing taxpayers.

Are There Any Benefits?

In the interests of balance, it’s important to acknowledge the pain points that crypto investors currently face as they try to get on the property ladder — a substantial challenge as house prices continue to spiral out of control.

For one, lenders in some countries actually penalize applicants if transactions involving crypto exchanges appear on their statements. That’s grossly unfair, and an outdated mindset that urgently needs to change.

Many banks are also incredibly inflexible when considering income sources — especially when it comes to the self-employed. Someone working as a sole trader with an income of $100,000 could end up being able to borrow substantially less than a full-time employee with an identical salary.

A few years ago, data from Redfin also revealed that about 12% of first-time buyers were selling crypto in order to finance their downpayment. Given how Bitcoin’s value has risen markedly since then, this means they will have missed out on a substantial amount of profit.

Josip Rupena, CEO of the crypto mortgage firm Milo, recently told Mortgage Professional America:

“There’s a lot of clients that have amassed bitcoin wealth from over 10 years ago, when Bitcoin was trading at $100. Now, Bitcoin trading is at $85,000. It’s become a significant portion of their net worth, and they don’t want to sell it.”

It’s unacceptable for crypto investors to be treated like pariahs by lenders. Everyone needs a home. But these guidelines put forward by the FHFA actually have the potential to endanger these Bitcoin holders, and put the economy at risk by tying the fates of digital assets and traditional finance even closer together.

Bitcoin’s looking rosy right now — and pushing $108,000. But what will happen in the next bear market, when there’s a real chance of an 80% crash, and what would it mean for the homeowners who have a roof over their heads because of their crypto stash?

Disclaimer: The opinions in this article are the writer’s own and do not necessarily represent the views of Cryptonews.com. This article is meant to provide a broad perspective on its topic and should not be taken as professional advice.