Pi Shatters 45-Day Downtrend with 15% Surge as Chainlink Integration Ignites Rally — $1 Target Now in Sight

Pi Network's native token just woke up from its six-week coma with a violent 15% green candle. The catalyst? A surprise Chainlink oracle integration that's got degens whispering 'narrative shift.'

Market Mechanics: How Smart Contracts Fueled the Breakout

Chainlink's price feeds are now piping real-world data into Pi's ecosystem—finally giving developers something to build with besides hopium. The integration triggered a classic 'buy the rumor' squeeze as traders piled into the first legit use case for Pi since its ICO.

Road to $1: Meme or Momentum?

With the token now testing key resistance levels, chartists are dusting off their Fibonacci tools. A clean break above $0.85 could confirm the bullish thesis—or set up the mother of all bull traps for retail bagholders. Meanwhile, crypto Twitter is split between 'Web3 revolution' and 'exit liquidity.'

As always in crypto: The bigger the hype, the harder the rug. But for now, Pi's proving that even zombie projects can rise from the dead when you throw enough oracle magic at them.

Source: Coingecko

Source: Coingecko

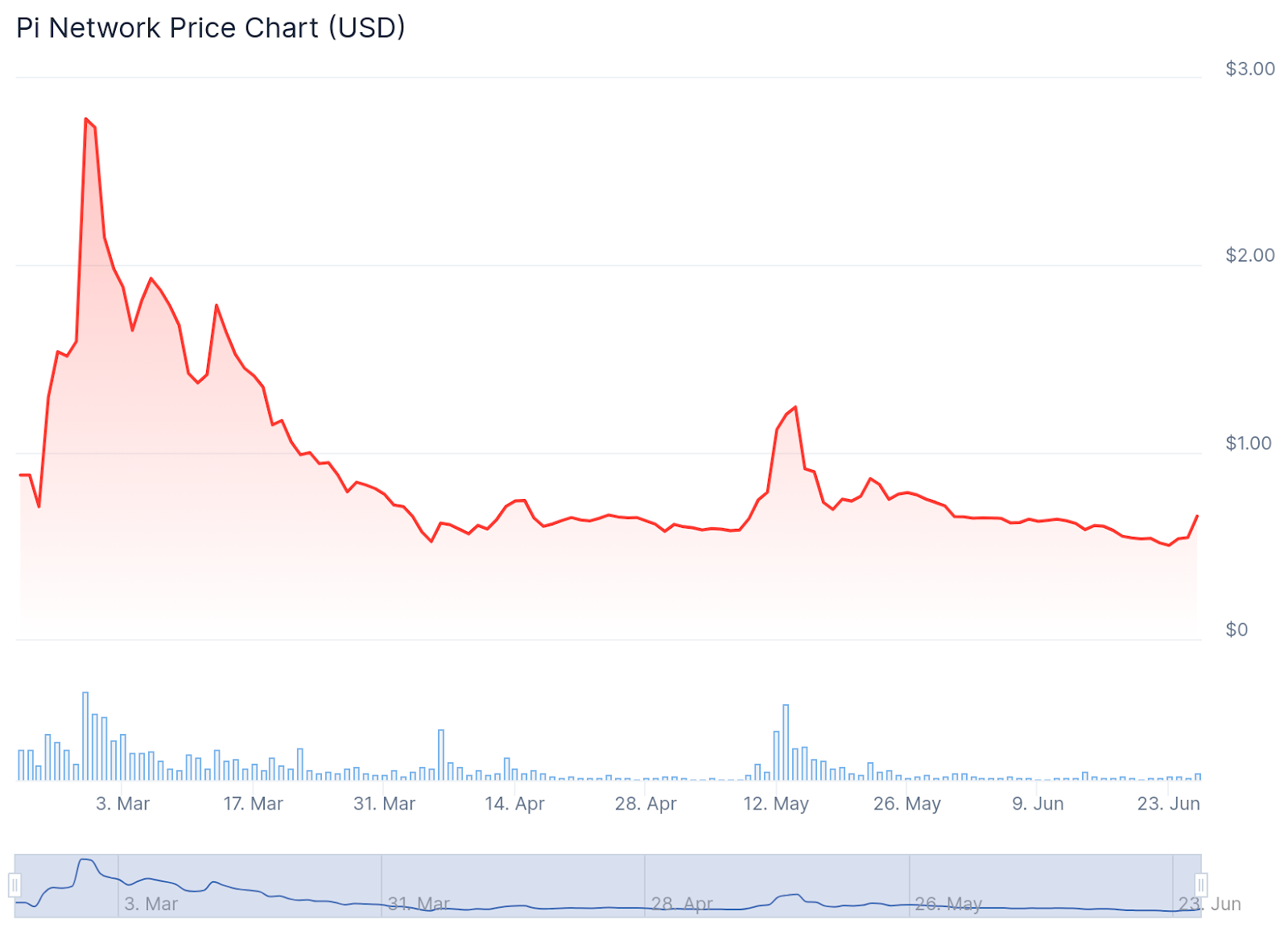

At press time, the token is consolidating at $0.623, representing a significant technical milestone for holders who endured weeks of declining prices.

Despite remaining 63% below its year-to-date peak of $2.98, Pi Network maintains its position among the cryptocurrency market’s elite, ranking among the top 30 digital assets by market capitalization.

Chainlink Integration Ignites Pi Rally As 60 million Pioneers Get DeFi Access

Market analysts have largely attributed the recent price surge to developments surrounding Chainlink’s April announcement regarding data stream expansion.

The oracle network revealed plans to integrate 22 new assets and seven additional protocols into its infrastructure standard, with PI Network securing a coveted spot among the selected projects.

Chainlink’s decentralized oracle network specializes in delivering verified, real-time information to blockchain applications, making it an essential infrastructure component for modern DeFi ecosystems.

Mastercard and chainlink partnered to enable cardholders to purchase crypto using onchain liquidity![]()

Secure fiat-to-crypto swaps powered by the Chainlink platform and the Mastercard global payments network

Bridging TradFi and DeFi, one oracle at a time

"In coming together… https://t.co/bLjr3TuY0G pic.twitter.com/crKJCYaCjl

For Pi Network, which boasts over 60 million active users, this partnership represents access to critical infrastructure that enables sophisticated decentralized finance applications.

The integration has positioned Pi Network as one of the most discussed cryptocurrency projects in recent months, contributing to its dominant social media presence across major platforms.

According to LunarCrush analytics, Pi Network currently leads cryptocurrency social media discussions with over 18% market dominance, surpassing established projects including Solana, Aave, FARTCOIN, and ONDO Finance.

Pi2Day Event Could Unleash Millions in Trading Volume As KYC Unlock Sparks $1 Pi Hopes

The heightened social engagement coincides with anticipation surrounding Pi2Day, the network’s annual mid-year celebration scheduled for June 28.

The date holds significance as it references the mathematical constant Pi (π ≈ 3.14) and its multiple (2π ≈ 6.28).

Pi2Day traditionally serves as a platform for the Core Team to showcase ecosystem developments, user growth metrics, and infrastructure achievements.

#Pi2Day is coming. $Pi up 22% in the last 24h![]()

Pi Domain auction ends in 3 days.

New AI partnership and Web3 ecosystem growth is expected.

Good times ahead![]()

![]()

![]() pic.twitter.com/qZ9PSzGNSr

pic.twitter.com/qZ9PSzGNSr

![]()

This year’s event carries particular significance as the community expects major announcements that could further accelerate adoption.

The most anticipated development involves the release of an enhanced Know Your Customer (KYC) synchronization feature.

This update will establish connectivity between the Pi Browser and the main Pi App, enabling users to consolidate identity verification data across platforms.

Through this streamlined process, millions of users currently experiencing “pending” or “tentative” KYC status may finally complete their migration to the open Mainnet.

Successful migration unlocks essential features, including wallet functionality and transferring Pi tokens to the live blockchain network.

Additionally, over 100 days have elapsed since the Open Mainnet launch, so community members anticipate announcements regarding new applications and developer tools.

Any demonstration of practical utility could shift market perception from speculative mining activity toward legitimate use case adoption.

![]() Global search interest in @PiCoreTeam has fallen to its lowest level of 2025, raising fresh questions about the project’s momentum.#Pi #PiNetworkhttps://t.co/8RI6arkBgA

Global search interest in @PiCoreTeam has fallen to its lowest level of 2025, raising fresh questions about the project’s momentum.#Pi #PiNetworkhttps://t.co/8RI6arkBgA

Descending Wedge Shattered: Analysts Eye $1.25 as Pi Bulls Take Control

The PIUSDT chart shows a strong breakout from a descending wedge pattern, a classic bullish reversal formation.

The breakout invalidates the previous bearish structure and opens the door for a sustained uptrend. Key upside targets include the $0.9624 and $1.0486 levels, both of which represent former demand zones and likely resistance.

The next significant resistance level lies NEAR the psychological $1 mark, which coincides with the top of the highlighted green supply zone.

With momentum clearly favoring bulls post-breakout, the near-term outlook remains bullish. If the price can hold above the broken wedge structure, a continuation toward the $0.90- $1.05 region appears likely.